Page 55: of Offshore Engineer Magazine (Sep/Oct 2016)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2016 Offshore Engineer Magazine

REGIONAL OVERVIEW it and only needs to be but signi? cantly complicate a coordinated and cost ef? cient barrel. An ef? cient development of the pre-salt also depends approved by congress. development of a common reservoir. on the policies of the government.

Lastly, Brazil requires a more realistic and functional local A last very important issue for Carcará is the “Unitization

This change will allow content policy. It is only fair to expect that an increasing share Round.” It is assumed that as much as 30-50% of the whole for greater involvement of the supplies for offshore developments can be and should be Carcará structure could be in open acreage and that this will and operatorship by constructed in Brazil. However, this has to happen over time be unitized with the existing Carcará license. This will make international oil compa- through strengthening of the the development of Carcará nies in the huge pre-salt local industry and building even more robust, and would opportunities.

Brazil pre-salt wells' production (Mb/d) sustainable competitive sup- reduce the breakeven oil

Secondly, the govern- by number of months from ?rst production pliers. How to ? x the transi- price even further. This could ment has to con? rm the tion to a new regime for local become a better investment continuation of current 60 content is a very delicate opportunity than the giant tax reliefs for the off- matter; however, it is crucial Libra ? eld. shore development also

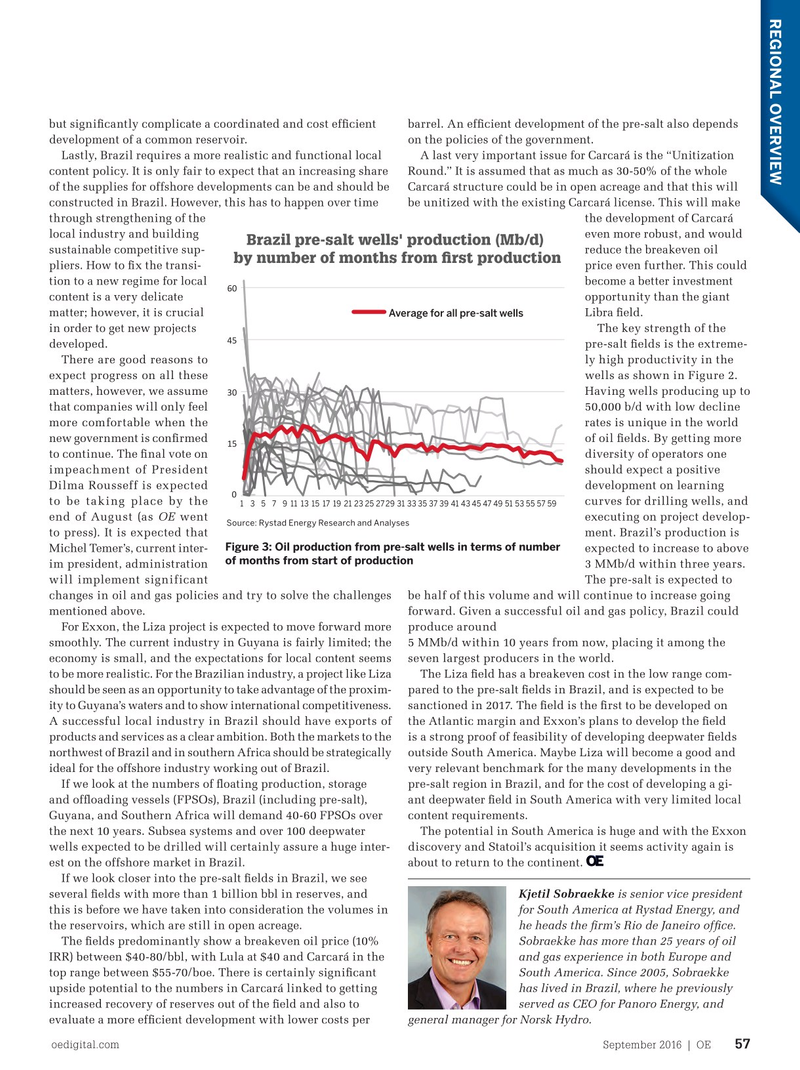

Average for all pre-salt wells in order to get new projects called “Repetro.” This The key strength of the 45 developed. is a crucial tax relief on pre-salt ? elds is the extreme- investments that could There are good reasons to ly high productivity in the in itself be a show stop- expect progress on all these wells as shown in Figure 2. per for new investments matters, however, we assume Having wells producing up to 30 in the sector. that companies will only feel 50,000 b/d with low decline

Thirdly, the govern- more comfortable when the rates is unique in the world ment is required to new government is con? rmed of oil ? elds. By getting more 15 show more ? exibility to continue. The ? nal vote on diversity of operators one regarding the deci- impeachment of President should expect a positive sions on either PSA or Dilma Rousseff is expected development on learning 0 normal concessions in to be taking place by the curves for drilling wells, and 1357911131517192123252729313335373941434547495153555759 the pre-salt area. Today, end of August (as OE went executing on project develop-

Source: Rystad Energy Research and Analyses the law states that there to press). It is expected that ment. Brazil’s production is

Figure 3: Oil production from pre-salt wells in terms of number should be PSA in all new Michel Temer’s, current inter- expected to increase to above of months from start of production pre-salt auctions, something that might complicate proceed- im president, administration 3 MMb/d within three years. ings signi? cantly when adding acreage to existing discoveries will implement significant The pre-salt is expected to (the upcoming Unitization Round). A unitization process is changes in oil and gas policies and try to solve the challenges be half of this volume and will continue to increase going implemented to simplify coordination between different con- mentioned above. forward. Given a successful oil and gas policy, Brazil could sortiums or companies realizing that they have rights to the For Exxon, the Liza project is expected to move forward more produce around same reservoir. By awarding new area in an existing discov- smoothly. The current industry in Guyana is fairly limited; the 5 MMb/d within 10 years from now, placing it among the ery with a completely different regulation will not simplify economy is small, and the expectations for local content seems seven largest producers in the world.

to be more realistic. For the Brazilian industry, a project like Liza The Liza ? eld has a breakeven cost in the low range com- should be seen as an opportunity to take advantage of the proxim- pared to the pre-salt ? elds in Brazil, and is expected to be

Brazil long-term production outlook ity to Guyana’s waters and to show international competitiveness. sanctioned in 2017. The ? eld is the ? rst to be developed on (MMb/d oil and NGLs)

A successful local industry in Brazil should have exports of the Atlantic margin and Exxon’s plans to develop the ? eld products and services as a clear ambition. Both the markets to the is a strong proof of feasibility of developing deepwater ? elds 6.0 northwest of Brazil and in southern Africa should be strategically outside South America. Maybe Liza will become a good and ideal for the offshore industry working out of Brazil. very relevant benchmark for the many developments in the

If we look at the numbers of ? oating production, storage pre-salt region in Brazil, and for the cost of developing a gi- 4.5 and of? oading vessels (FPSOs), Brazil (including pre-salt), ant deepwater ? eld in South America with very limited local

Guyana, and Southern Africa will demand 40-60 FPSOs over content requirements. the next 10 years. Subsea systems and over 100 deepwater The potential in South America is huge and with the Exxon 3.0 wells expected to be drilled will certainly assure a huge inter- discovery and Statoil’s acquisition it seems activity again is est on the offshore market in Brazil. about to return to the continent.

If we look closer into the pre-salt ? elds in Brazil, we see 1.5 several ? elds with more than 1 billion bbl in reserves, and Kjetil Sobraekke is senior vice president this is before we have taken into consideration the volumes in for South America at Rystad Energy, and the reservoirs, which are still in open acreage. he heads the ? rm’s Rio de Janeiro of? ce. 0

The ? elds predominantly show a breakeven oil price (10% Sobraekke has more than 25 years of oil 2010 20122014 2016 2018 2020 2022 2024 20262028 2030

IRR) between $40-80/bbl, with Lula at $40 and Carcará in the and gas experience in both Europe and top range between $55-70/boe. There is certainly signi? cant South America. Since 2005, Sobraekke

Post-saltOtherPre-salt upside potential to the numbers in Carcará linked to getting has lived in Brazil, where he previously

Source: Rystad Energy UCube increased recovery of reserves out of the ? eld and also to served as CEO for Panoro Energy, and

Figure 2: Brazil long-term production outlook.

evaluate a more ef? cient development with lower costs per general manager for Norsk Hydro.

oedigital.com September 2016 | OE 57 055_OE0916_Geo1_Rystad_jl1.indd 57 8/24/16 4:34 PM

54

54

56

56