Page 18: of Offshore Engineer Magazine (Mar/Apr 2017)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2017 Offshore Engineer Magazine

RIG MARKET REVIEW

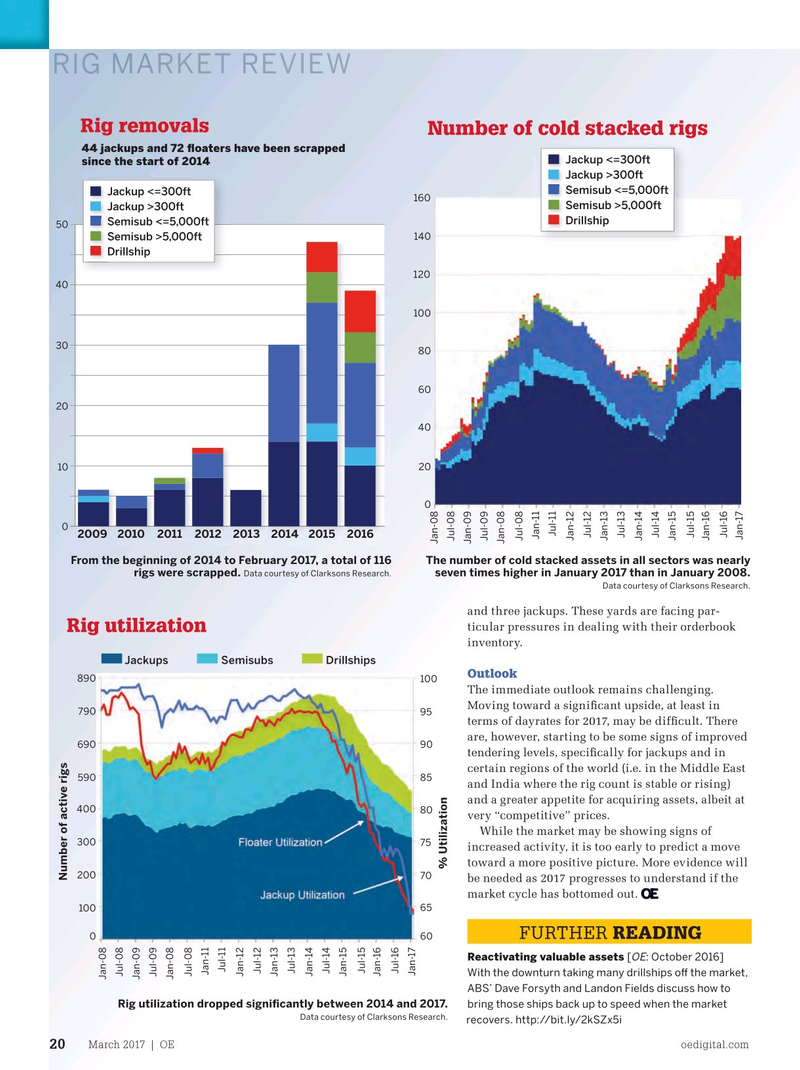

Rig removals

Number of cold stacked rigs 44 jackups and 72 ?oaters have been scrapped

Jackup <=300ftJackup <=300ft since the start of 2014

Jackup >300ftJackup >300ft

Semisub <=5,000ft

Jackup <=300ftJackup <=300ft 160

Semisub >5,000ft

Jackup >300ftJackup >300ft

Drillship

Semisub <=5,000ft 50 140

Semisub >5,000ft

Drillship 120 40 100 30 80 60 20 40 20 10 0 0

Jul-11 2009 2010 20112012201320142015 2016

Jul-15

Jul-16

Jul-14

Jul-12

Jul-13

Jan-11

Jan-17

Jan-15

Jan-16

Jan-14

Jul-08

Jul-08

Jan-12

Jan-13

Jul-09

Jan-08

Jan-08

Jan-09

From the beginning of 2014 to February 2017, a total of 116 The number of cold stacked assets in all sectors was nearly rigs were scrapped. seven times higher in January 2017 than in January 2008.

Data courtesy of Clarksons Research.

Data courtesy of Clarksons Research.

and three jackups. These yards are facing par- ticular pressures in dealing with their orderbook

Rig utilization inventory.

Jackups Semisubs Drillships

Outlook 890 100

The immediate outlook remains challenging.

Moving toward a signi? cant upside, at least in 790 95 terms of dayrates for 2017, may be dif? cult. There are, however, starting to be some signs of improved 690 90 tendering levels, speci? cally for jackups and in certain regions of the world (i.e. in the Middle East 590 85 and India where the rig count is stable or rising) and a greater appetite for acquiring assets, albeit at 400 80 very “competitive” prices.

While the market may be showing signs of 300 75 increased activity, it is too early to predict a move toward a more positive picture. More evidence will % Utilization 200 70

Number of active rigs be needed as 2017 progresses to understand if the market cycle has bottomed out. 100 65

FURTHER READING 0 60

Reactivating valuable assets [ : October 2016]OE

Jul-11

Jul-15

Jul-16

Jul-14

Jul-12

Jul-13

Jan-11

Jan-17

With the downturn taking many drillships o

17

17

19

19