Page 20: of Offshore Engineer Magazine (Mar/Apr 2017)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2017 Offshore Engineer Magazine

for the next few years, which will keep many of the deepwater

RIG MARKET REVIEW rigs idle through 2019. With very little precedence to go by, the true cost of reactivation is still unclear. Publically disclosed estimates of $25-$35 million for reactivation of a 6th genera- tion drillship only covers capex estimates, which are incurred by the drilling contractor and do not re? ect the true overall picture of putting a rig back to work. There are 100 newer generation rigs in hot mode today (fully crewed and operable), but only 20% of the units have ? rm contracts into 2020. Despite efforts to keep rigs as warm as possible, long-term idle time will likely result in fewer economical choices for operators in 2020 versus what is available today.

Survival mode

Keeping a rig hot is not an easy task under current market conditions. With limited opportunities for new ? xtures, there is heavy emphasis to maintain revenue ef? ciency (measure of how much a rig earns while under contract). Every drilling s the cyclical downturn in the deepwater market contractor in the deepwater space must maintain strict ? nan- continues to drag out, drilling contractors are set- cial and operational discipline in order to keep contracted rigs

A tling into a new way of life. The standard mode of under full rate at the lowest possible cost without compromis- survival rests in the ability to leverage debt, sustain costs, ing safety. So far drillers appear to be up to the task as the

Leslie Cook, maintain revenue ef? ciency, and preserve idle relationships major contractors are maintaining revenue ef? ciencies above with customers and crews. 95% with razor thin margins and no major safety incidents. of Wood Mackenzie,

Contracted ? oating rig counts have reduced by nearly 30% Over the past two years, as dayrates have continued to free over the past year and by 50% since the peak in 2014. Over fall, drilling contractors have successfully reduced daily oper- examines falling 80 ? oating rigs have been idled since 2016 and utilization is ating costs by upwards of 30% by reducing onshore logistics, heading towards 50%. Deepwater ports are ? lling up around manpower, and wages.

dayrates in the the world as half of the existing ? eet is now idle. Roughly Currently, there are 147 ? oating rigs under contract of which three-fourths of older generation rigs are now idle or rolling off roughly 80% are working. Among the working ? eet, 45% are ? oating rigs sector, contract in 2017, many of which will be permanently retired. operating in Brazil and US Gulf of Mexico. Total well demand

Among 3rd-5th generation rigs, hot supply consists of approxi- in 2017 is forecast to drop another 10% with declines expected mately 35 moored units and 10 dynamic positioned rigs. in both exploration and development programs. As a result, rig and the view

The pressure to keep 6th and 7th generation rigs in operation demand is expected to be somewhere around 110 units average is of growing concern among drilling contractors with high ex- for the year, so we expect to see a continuation of rigs going idle out to 2020.

posure to the ultra-deepwater market. These newer generation at the end of their contracts, and contractors will ? ght to get rigs took a hard hit in 2016 as operators terminated several con- one well at a time in an effort to keep rigs hot. Long-term fun- tracts early in effort to get out from under high dayrates. Term damentals favor a return to deepwater activity, but the climb up contracts signed at legacy high dayrates back in the peak years is poised to be even more challenging than the fall. of 2011-2012 are now rolling off contract. In 2017, over 60% of the rigs rolling off contract are among this high-speci? cation Leslie Cook is a principal analyst in the ? eet and leading edge rates for new rigs have plummeted from Upstream Supply Chain Group at Wood mid-US$500’s to low-$200’s causing serious cash ? ow concerns Mackenzie. She is recognized for her for ? rms in the drilling supply chain. sector expertise in the supply and demand

Long-term stacking of rigs causes disruption throughout the dynamics of the offshore drilling market. supply chain which inevitably will impact operators when the market begins to climb back up. Based on current industry esti- mates, global oil prices are predicted to stay at or below $60/bbl

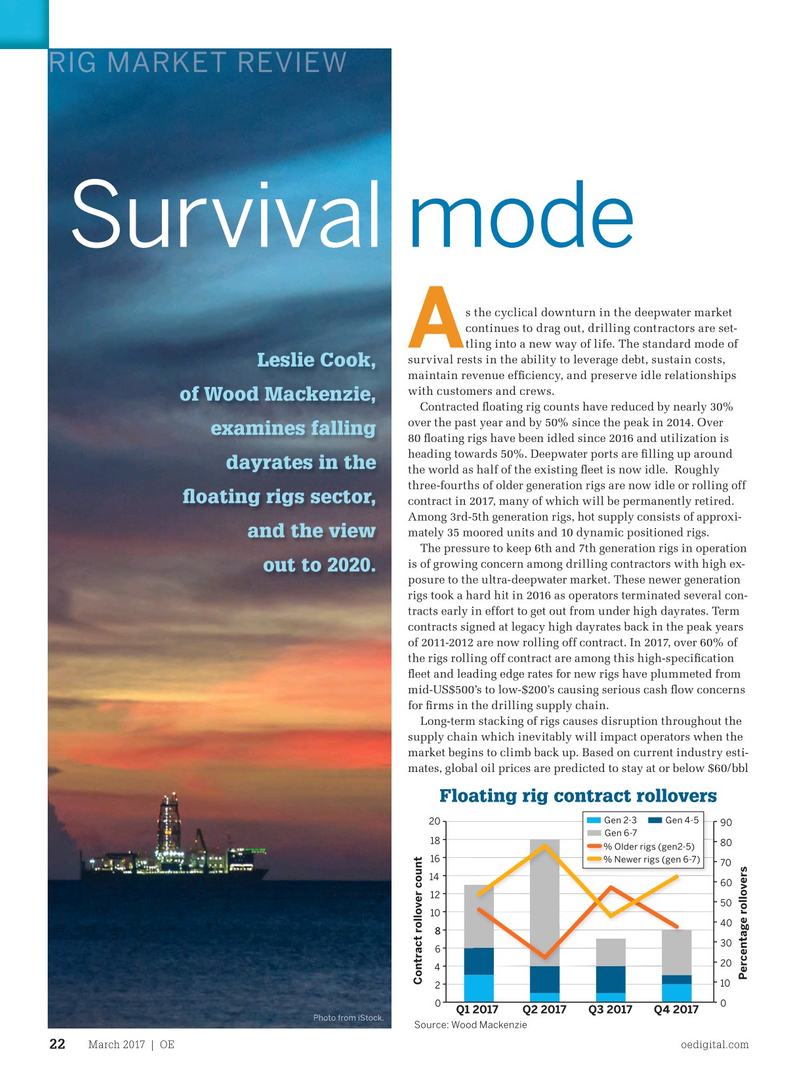

Floating rig contract rollovers

Current ?eet status 120

Gen 2-3 Gen 4-5 20 90

Gen 2-3

Gen 6-7

Gen 4-5 18 80 % Older rigs (gen2-5) 100

Gen 6-7 16 % Newer rigs (gen 6-7) 70 14 80 60 12 50 60 10 40 8 40 30 6

Floating rig count 20 4 20

Percentage rollovers

Contract rollover count 10 2 0 0 0

Q1 2017 Q2 2017 Q3 2017 Q4 2017

Hot Warm Cold Retired

Photo from iStock.

Source: Wood Mackenzie

Source: Wood Mackenzie

March 2017 | OE oedigital.com 22 022_OE0217_Feat2_Leslie.indd 22 2/21/17 5:10 PM

19

19

21

21