Page 14: of Offshore Engineer Magazine (Jan/Feb 2018)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2018 Offshore Engineer Magazine

around it. These companies then come to the table with the best technical solution and ? nancing arrangement with a

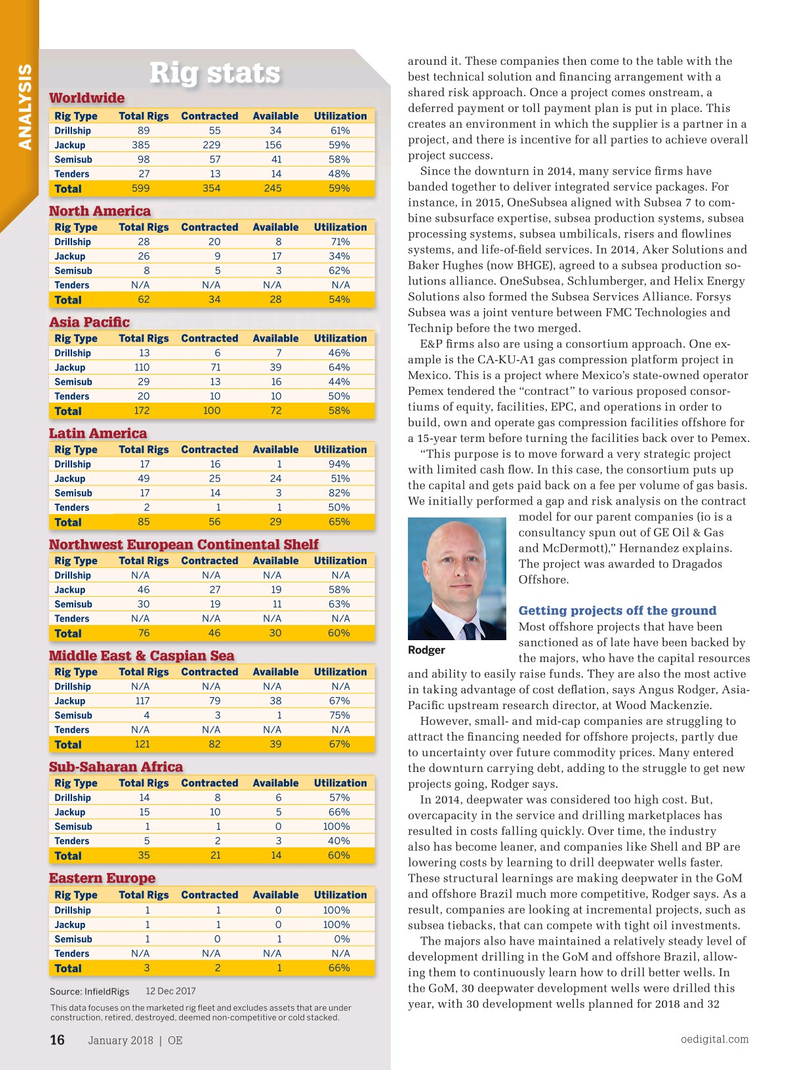

Rig stats shared risk approach. Once a project comes onstream, a

Worldwide deferred payment or toll payment plan is put in place. This

Rig Type Total Rigs Contracted Available Utilization creates an environment in which the supplier is a partner in a

Drillship 89 55 34 61% project, and there is incentive for all parties to achieve overall

Jackup 385 229 156 59%

ANALYSIS project success.

Semisub 98 57 41 58%

Since the downturn in 2014, many service ? rms have 27 13 14 48%

Tenders banded together to deliver integrated service packages. For 599 354 245 59%

Total instance, in 2015, OneSubsea aligned with Subsea 7 to com-

North America bine subsurface expertise, subsea production systems, subsea

Rig Type Total Rigs Contracted Available Utilization processing systems, subsea umbilicals, risers and ? owlines

Drillship 28 20 8 71% systems, and life-of-? eld services. In 2014, Aker Solutions and

Jackup 26 9 17 34%

Baker Hughes (now BHGE), agreed to a subsea production so-

Semisub 8 5 3 62% lutions alliance. OneSubsea, Schlumberger, and Helix Energy

Tenders

N/A N/AN/A N/A

Solutions also formed the Subsea Services Alliance. Forsys 62 34 28 54%

Total

Subsea was a joint venture between FMC Technologies and

Asia Paci? c

Technip before the two merged.

Rig Type Total Rigs Contracted Available Utilization

E&P ? rms also are using a consortium approach. One ex-

Drillship 13 6 7 46% ample is the CA-KU-A1 gas compression platform project in 110 71 39 64%

Jackup

Mexico. This is a project where Mexico’s state-owned operator

Semisub 29 13 16 44%

Pemex tendered the “contract” to various proposed consor-

Tenders 20 10 10 50% tiums of equity, facilities, EPC, and operations in order to 172 100 72 58%

Total build, own and operate gas compression facilities offshore for

Latin America a 15-year term before turning the facilities back over to Pemex.

Rig Type Total Rigs Contracted Available Utilization “This purpose is to move forward a very strategic project

Drillship 17 16 1 94% with limited cash ? ow. In this case, the consortium puts up

Jackup 49 25 24 51% the capital and gets paid back on a fee per volume of gas basis.

Semisub 17 14 3 82%

We initially performed a gap and risk analysis on the contract

Tenders 2 1 1 50% model for our parent companies (io is a 85 56 29 65%

Total consultancy spun out of GE Oil & Gas

Northwest European Continental Shelf and McDermott),” Hernandez explains.

Rig Type Total Rigs Contracted Available Utilization

The project was awarded to Dragados

N/A N/AN/A N/A

Drillship

Offshore. 46 27 19 58%

Jackup 30 19 11 63%Semisub

Getting projects off the ground

N/A N/AN/A N/A

Tenders

Most offshore projects that have been 76 46 30 60%

Total sanctioned as of late have been backed by

Rodger

Middle East & Caspian Sea the majors, who have the capital resources

Rig Type Total Rigs Contracted Available Utilization and ability to easily raise funds. They are also the most active

N/A N/AN/A N/A

Drillship in taking advantage of cost de? ation, says Angus Rodger, Asia-

Jackup 117 79 38 67%

Paci? c upstream research director, at Wood Mackenzie.

Semisub 4 3 1 75%

However, small- and mid-cap companies are struggling to

Tenders

N/A N/AN/A N/A attract the ? nancing needed for offshore projects, partly due 121 82 39 67%

Total to uncertainty over future commodity prices. Many entered

Sub-Saharan Africa the downturn carrying debt, adding to the struggle to get new

Rig Type Total Rigs Contracted Available Utilization projects going, Rodger says.

Drillship 14 8 6 57%

In 2014, deepwater was considered too high cost. But,

Jackup 15 10 5 66% overcapacity in the service and drilling marketplaces has

Semisub 1 1 0100% resulted in costs falling quickly. Over time, the industry

Tenders 5 2 3 40% also has become leaner, and companies like Shell and BP are 35 21 14 60%

Total lowering costs by learning to drill deepwater wells faster.

These structural learnings are making deepwater in the GoM

Eastern Europe and offshore Brazil much more competitive, Rodger says. As a

Rig Type Total Rigs Contracted Available Utilization result, companies are looking at incremental projects, such as 1 1 0100%

Drillship 1 1 0100%

Jackup subsea tiebacks, that can compete with tight oil investments. 1 0 1 0%

Semisub

The majors also have maintained a relatively steady level of

Tenders

N/A N/AN/A N/A development drilling in the GoM and offshore Brazil, allow- 3 2 1 66%

Total ing them to continuously learn how to drill better wells. In the GoM, 30 deepwater development wells were drilled this

Source: In? eldRigs 12 Dec 2017 year, with 30 development wells planned for 2018 and 32

This data focuses on the marketed rig ? eet and excludes assets that are under construction, retired, destroyed, deemed non-competitive or cold stacked.

oedigital.com

January 2018 | OE 16 014_OE0118_inDepth_Analysis.indd 16 12/27/17 1:52 PM

13

13

15

15