Page 43: of Offshore Engineer Magazine (Jan/Feb 2018)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2018 Offshore Engineer Magazine

REGIONAL OVERVIEW descent to a low of around $40, triggered by higher supply producing countries, to implement production adjustments than demand, as the global economy continued its slow recov- or output reduction to help restore market balance. The ery, while supply from non-conventional or shale oil in the US adjustment commenced in January 2017, and initially ran for surged. a period of six months until it was extended for nine more

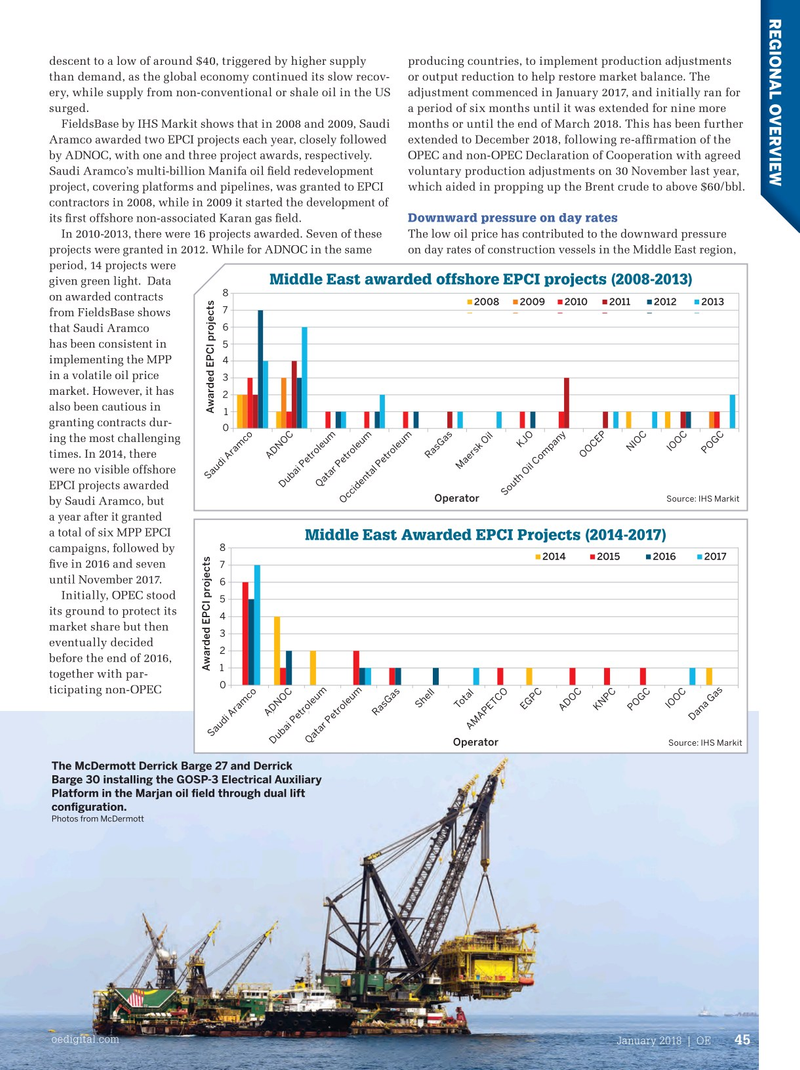

FieldsBase by IHS Markit shows that in 2008 and 2009, Saudi months or until the end of March 2018. This has been further

Aramco awarded two EPCI projects each year, closely followed extended to December 2018, following re-af? rmation of the by ADNOC, with one and three project awards, respectively. OPEC and non-OPEC Declaration of Cooperation with agreed

Saudi Aramco’s multi-billion Manifa oil ? eld redevelopment voluntary production adjustments on 30 November last year, project, covering platforms and pipelines, was granted to EPCI which aided in propping up the Brent crude to above $60/bbl. contractors in 2008, while in 2009 it started the development of

Downward pressure on day rates its ? rst offshore non-associated Karan gas ? eld.

In 2010-2013, there were 16 projects awarded. Seven of these The low oil price has contributed to the downward pressure projects were granted in 2012. While for ADNOC in the same on day rates of construction vessels in the Middle East region, period, 14 projects were

Middle East awarded offshore EPCI projects (2008-2013) given green light. Data 8 on awarded contracts 2008 2009 2010 2011 2012 2013 7 from FieldsBase shows 6 that Saudi Aramco has been consistent in 5 implementing the MPP 4 in a volatile oil price 3 market. However, it has 2 also been cautious in

Awarded EPCI projects 1 granting contracts dur- 0 ing the most challenging

KJO

NIOC

IOOC

POGC times. In 2014, there

OOCEP

RasGas

ADNOC

Maersk Oil were no visible offshore

Saudi Aramco

Qatar Petroleum

Dubai Petroleum

EPCI projects awarded

South Oil Company

Source: IHS Markit

Operator

Occidental Petroleum by Saudi Aramco, but a year after it granted a total of six MPP EPCI

Middle East Awarded EPCI Projects (2014-2017) 8 campaigns, followed by 2014 2015 2016 2017 ? ve in 2016 and seven 7 until November 2017.

6

Initially, OPEC stood 5 its ground to protect its 4 market share but then 3 eventually decided 2 before the end of 2016,

Awarded EPCI projects 1 together with par- 0 ticipating non-OPEC

Shell

IOOC

Total

EGPC

KNPC

POGC

ADOC

RasGas

ADNOC

Dana Gas

AMAPETCO

Saudi Aramco

Qatar Petroleum

Dubai Petroleum

Operator

Source: IHS Markit

The McDermott Derrick Barge 27 and Derrick

Barge 30 installing the GOSP-3 Electrical Auxiliary

Platform in the Marjan oil ? eld through dual lift con? guration.

Photos from McDermott oedigital.com

January 2018 | OE 45 044_OE0118_Geo1_IHS.indd 45 12/27/17 8:12 PM

42

42

44

44