Page 18: of Offshore Engineer Magazine (Jan/Feb 2019)

FPSO/FNLG Outlook and Technologies

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2019 Offshore Engineer Magazine

MARKETS FLNG & FSRU

LNG liquefaction has historically been a land-based ac- tinction of being the most expensive vessel (of any type) ever tivity. Until three years ago, production of LNG took place built. Gimi, a 40-year-old LNG carrier being converted by entirely in land-based plants. But ? oating LNG plants have Golar to a 2.5 mtpa FLNG, is the ? rst of several FLNGs to be advantages over land-based alternatives in certain situations, used by BP to develop deepwater gas/oil discoveries offshore and FLNGs now account for around 3% of LNG plant ca- Mauritania/Senegal. It is similar to the Hilli Episeyo FLNG pacity in service or scheduled to be operational within the now operating offshore Cameroon. Tango, a purpose-built 0.5 next two years. mtpa LNG production barge owned by Exmar, will be used

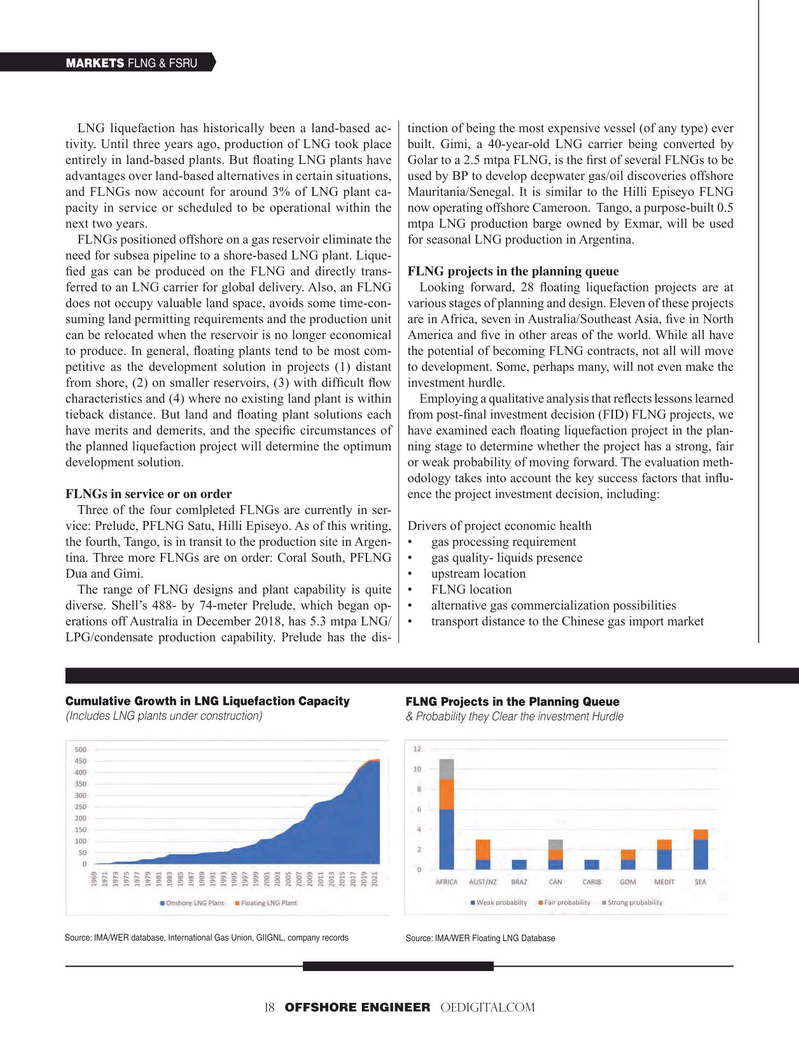

FLNGs positioned offshore on a gas reservoir eliminate the for seasonal LNG production in Argentina. need for subsea pipeline to a shore-based LNG plant. Lique- ? ed gas can be produced on the FLNG and directly trans- FLNG projects in the planning queue ferred to an LNG carrier for global delivery. Also, an FLNG Looking forward, 28 ? oating liquefaction projects are at does not occupy valuable land space, avoids some time-con- various stages of planning and design. Eleven of these projects suming land permitting requirements and the production unit are in Africa, seven in Australia/Southeast Asia, ? ve in North can be relocated when the reservoir is no longer economical America and ? ve in other areas of the world. While all have to produce. In general, ? oating plants tend to be most com- the potential of becoming FLNG contracts, not all will move petitive as the development solution in projects (1) distant to development. Some, perhaps many, will not even make the from shore, (2) on smaller reservoirs, (3) with dif? cult ? ow investment hurdle.

characteristics and (4) where no existing land plant is within Employing a qualitative analysis that re? ects lessons learned tieback distance. But land and ? oating plant solutions each from post-? nal investment decision (FID) FLNG projects, we have merits and demerits, and the speci? c circumstances of have examined each ? oating liquefaction project in the plan- the planned liquefaction project will determine the optimum ning stage to determine whether the project has a strong, fair development solution. or weak probability of moving forward. The evaluation meth- odology takes into account the key success factors that in? u-

FLNGs in service or on order ence the project investment decision, including:

Three of the four comlpleted FLNGs are currently in ser- vice: Prelude, PFLNG Satu, Hilli Episeyo. As of this writing, Drivers of project economic health the fourth, Tango, is in transit to the production site in Argen- • gas processing requirement tina. Three more FLNGs are on order: Coral South, PFLNG • gas quality- liquids presence

Dua and Gimi. • upstream location

The range of FLNG designs and plant capability is quite • FLNG location diverse. Shell’s 488- by 74-meter Prelude, which began op- • alternative gas commercialization possibilities erations off Australia in December 2018, has 5.3 mtpa LNG/ • transport distance to the Chinese gas import market

LPG/condensate production capability. Prelude has the dis-

Cumulative Growth in LNG Liquefaction Capacity FLNG Projects in the Planning Queue (Includes LNG plants under construction) & Probability they Clear the investment Hurdle

Source: IMA/WER database, International Gas Union, GIIGNL, company records Source: IMA/WER Floating LNG Database 18 OFFSHORE ENGINEER OEDIGITAL.COM 18-31 OE 2019.indd 18 18-31 OE 2019.indd 18 1/22/2019 9:20:36 AM1/22/2019 9:20:36 AM

17

17

19

19