Page 39: of Offshore Engineer Magazine (Jan/Feb 2019)

FPSO/FNLG Outlook and Technologies

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2019 Offshore Engineer Magazine

Source: Petrobras

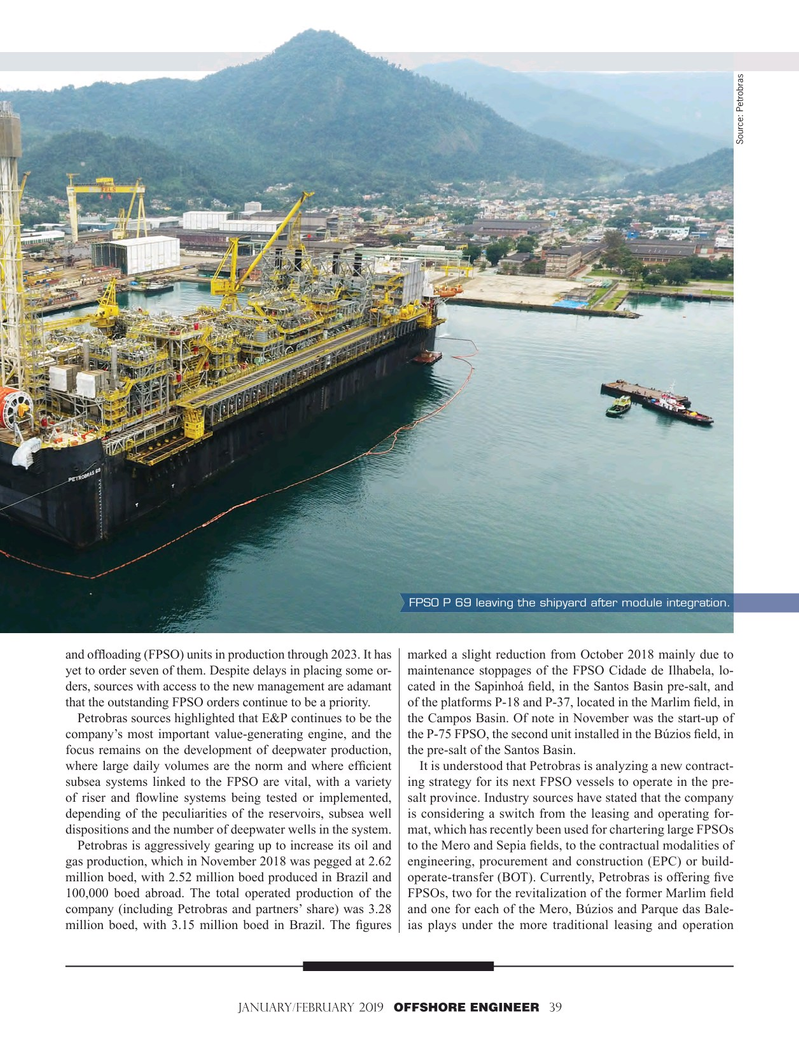

FPSO P 69 leaving the shipyard after module integration.

and of? oading (FPSO) units in production through 2023. It has marked a slight reduction from October 2018 mainly due to yet to order seven of them. Despite delays in placing some or- maintenance stoppages of the FPSO Cidade de Ilhabela, lo- ders, sources with access to the new management are adamant cated in the Sapinhoá ? eld, in the Santos Basin pre-salt, and that the outstanding FPSO orders continue to be a priority. of the platforms P-18 and P-37, located in the Marlim ? eld, in

Petrobras sources highlighted that E&P continues to be the the Campos Basin. Of note in November was the start-up of company’s most important value-generating engine, and the the P-75 FPSO, the second unit installed in the Búzios ? eld, in focus remains on the development of deepwater production, the pre-salt of the Santos Basin. where large daily volumes are the norm and where ef? cient It is understood that Petrobras is analyzing a new contract- subsea systems linked to the FPSO are vital, with a variety ing strategy for its next FPSO vessels to operate in the pre- of riser and ? owline systems being tested or implemented, salt province. Industry sources have stated that the company depending of the peculiarities of the reservoirs, subsea well is considering a switch from the leasing and operating for- dispositions and the number of deepwater wells in the system. mat, which has recently been used for chartering large FPSOs

Petrobras is aggressively gearing up to increase its oil and to the Mero and Sepia ? elds, to the contractual modalities of gas production, which in November 2018 was pegged at 2.62 engineering, procurement and construction (EPC) or build- million boed, with 2.52 million boed produced in Brazil and operate-transfer (BOT). Currently, Petrobras is offering ? ve 100,000 boed abroad. The total operated production of the FPSOs, two for the revitalization of the former Marlim ? eld company (including Petrobras and partners’ share) was 3.28 and one for each of the Mero, Búzios and Parque das Bale- million boed, with 3.15 million boed in Brazil. The ? gures ias plays under the more traditional leasing and operation

January/February 2019 OFFSHORE ENGINEER 39 32-49 OE 2019.indd 39 32-49 OE 2019.indd 39 1/21/2019 3:25:48 PM1/21/2019 3:25:48 PM

38

38

40

40