Page 22: of Offshore Engineer Magazine (Mar/Apr 2019)

Deepwater: The Big New Horizon

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2019 Offshore Engineer Magazine

SUBSEA INSIGHTS Target 2020

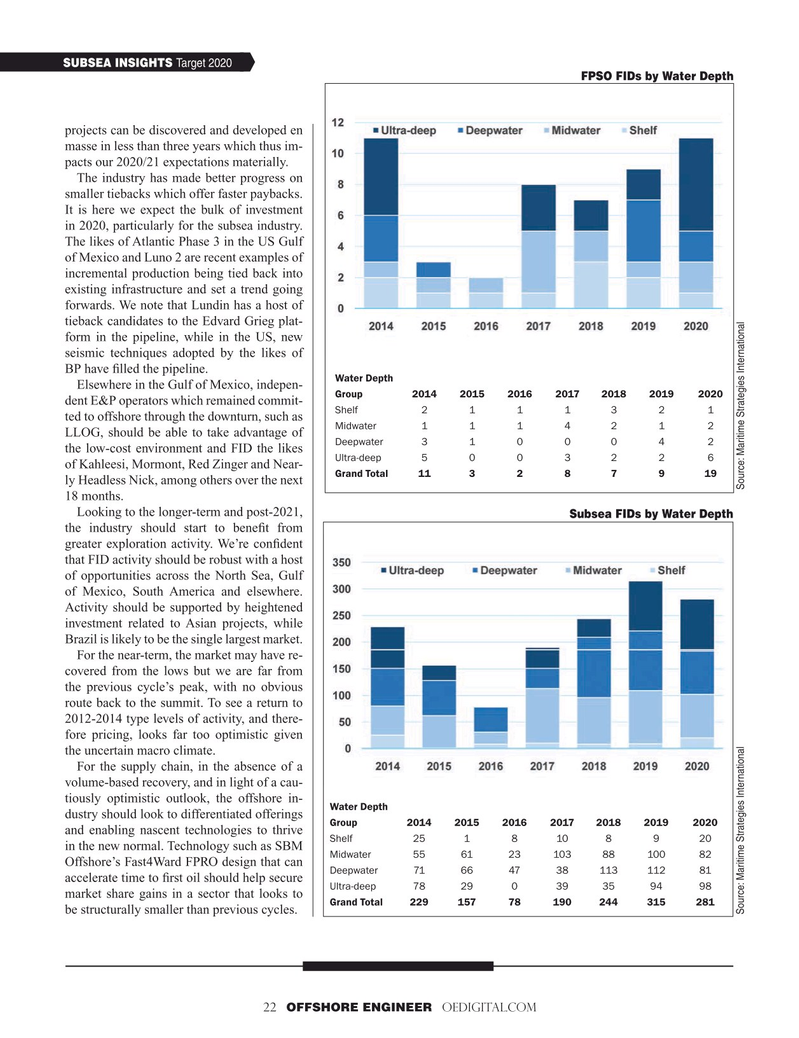

FPSO FIDs by Water Depth projects can be discovered and developed en masse in less than three years which thus im- pacts our 2020/21 expectations materially.

The industry has made better progress on smaller tiebacks which offer faster paybacks.

It is here we expect the bulk of investment in 2020, particularly for the subsea industry.

The likes of Atlantic Phase 3 in the US Gulf of Mexico and Luno 2 are recent examples of incremental production being tied back into existing infrastructure and set a trend going forwards. We note that Lundin has a host of tieback candidates to the Edvard Grieg plat- form in the pipeline, while in the US, new seismic techniques adopted by the likes of

BP have ? lled the pipeline.

Water Depth

Elsewhere in the Gulf of Mexico, indepen-

Group 2014 2015 2016 2017 2018 2019 2020 dent E&P operators which remained commit-

Shelf 2 1 1 1 3 2 1 ted to offshore through the downturn, such as

Midwater 1 1 1 4 2 1 2

LLOG, should be able to take advantage of

Deepwater 3 1 0 0 0 4 2 the low-cost environment and FID the likes

Ultra-deep 5 0 0 3 2 2 6 of Kahleesi, Mormont, Red Zinger and Near-

Grand Total 11 3 2 8 7 9 19 ly Headless Nick, among others over the next 18 months.

Looking to the longer-term and post-2021,

Subsea FIDs by Water Depth the industry should start to bene? t from greater exploration activity. We’re con? dent that FID activity should be robust with a host of opportunities across the North Sea, Gulf of Mexico, South America and elsewhere.

Activity should be supported by heightened investment related to Asian projects, while

Brazil is likely to be the single largest market.

For the near-term, the market may have re- covered from the lows but we are far from the previous cycle’s peak, with no obvious route back to the summit. To see a return to 2012-2014 type levels of activity, and there- fore pricing, looks far too optimistic given the uncertain macro climate.

For the supply chain, in the absence of a volume-based recovery, and in light of a cau- tiously optimistic outlook, the offshore in-

Water Depth dustry should look to differentiated offerings

Group 2014 2015 2016 2017 2018 2019 2020 and enabling nascent technologies to thrive

Shelf 25 1 8 10 8 9 20 in the new normal. Technology such as SBM

Midwater 55 61 23 103 88 100 82

Offshore’s Fast4Ward FPRO design that can

Deepwater 71 66 47 38 113 112 81 accelerate time to ? rst oil should help secure

Ultra-deep 78 29 0 39 35 94 98 market share gains in a sector that looks to

Grand Total 229 157 78 190 244 315 281 be structurally smaller than previous cycles.

Source: Maritime Strategies International Source: Maritime Strategies International 22 OFFSHORE ENGINEER OEDIGITAL.COM 18-31 OE 2019.indd 22 4/15/2019 11:17:23 AM

21

21

23

23