Page 12: of Offshore Engineer Magazine (May/Jun 2019)

Offshore Renewables Review

Read this page in Pdf, Flash or Html5 edition of May/Jun 2019 Offshore Engineer Magazine

REGIONAL REPORT West Africa

West Africa Of shore Outlook

By Shem Oirere he outlook for West Africa’s offshore oil and gas production storage and of? oading units (FPSO) came online at market remains positive despite some hiccups hinged the end of 2018 and is expected to have a maximum output on delay by some countries in the region to align of 200,000 barrels per day (bpd). In Ghana, Eni recently con-

Ttheir hydrocarbon regulations to prevailing market tracted Yinson to convert an FPSO at a Singaporean shipyard trends and the intensifying global competition for a share of for production and processing of oil in the country,” he said.

international oil companies’ planned capital expenditure for “With similar purchases and conversions planned in Nige- deep- and ultra-deepwater resources. ria, Ghana, Senegal and Equatorial Guinea, it is expected that

Despite the post-2014 growth pressures on the back of fast- the West African market will prove to be an increasingly at- falling global oil prices, a number of West African offshore tractive export location for FPSO expertise and services, to be projects, though delayed, were kept alive partly by an emerg- rendered by international partners,” Adeosun added.

ing trend of governments in the region committing to not only Global oil and gas exploration and production companies change their petroleum codes to attract more private invest- such as ExxonMobil, Total, Tullow, Kosmos and Oryx Petro- ments, but also restructure their governance structures and em- leum have, through joint ventures with participation of nation- brace policies that support growth of free market economies. al oil entities in West Africa, led in the highly expensive search

Currently, leading West Africa oil and gas market players for oil and gas in the region’s deep and ultra-deep waters.

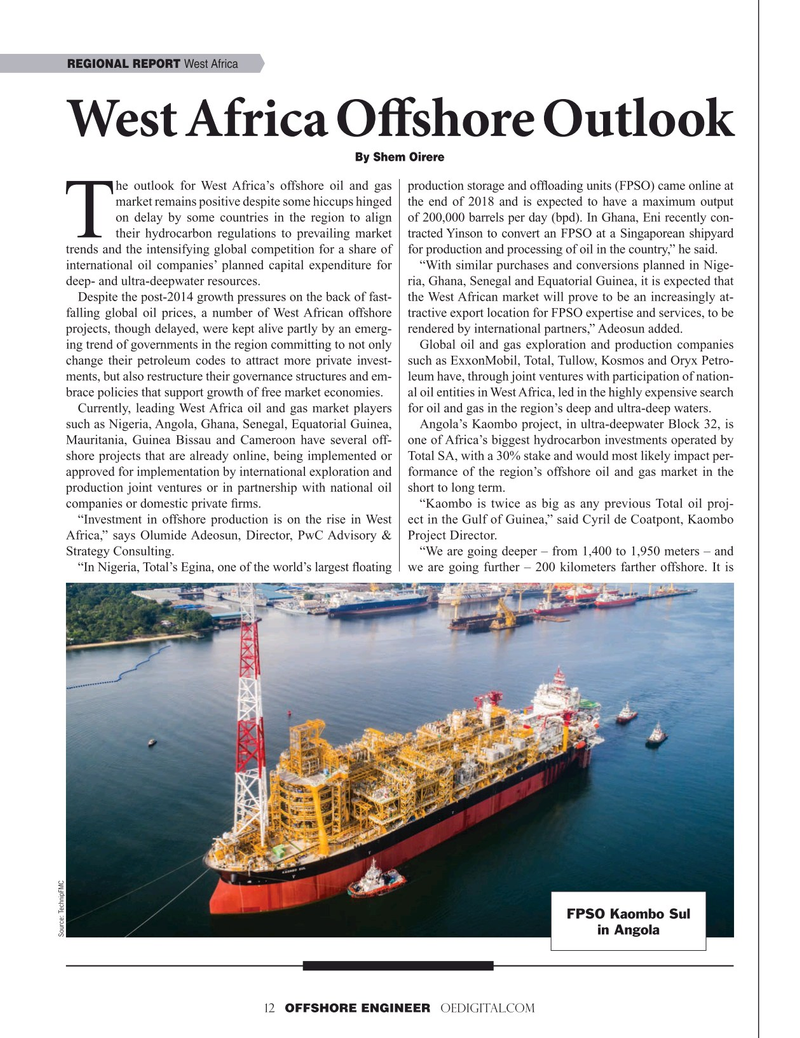

such as Nigeria, Angola, Ghana, Senegal, Equatorial Guinea, Angola’s Kaombo project, in ultra-deepwater Block 32, is

Mauritania, Guinea Bissau and Cameroon have several off- one of Africa’s biggest hydrocarbon investments operated by shore projects that are already online, being implemented or Total SA, with a 30% stake and would most likely impact per- approved for implementation by international exploration and formance of the region’s offshore oil and gas market in the production joint ventures or in partnership with national oil short to long term.

companies or domestic private ? rms. “Kaombo is twice as big as any previous Total oil proj- “Investment in offshore production is on the rise in West ect in the Gulf of Guinea,” said Cyril de Coatpont, Kaombo

Africa,” says Olumide Adeosun, Director, PwC Advisory & Project Director.

Strategy Consulting. “We are going deeper – from 1,400 to 1,950 meters – and “In Nigeria, Total’s Egina, one of the world’s largest ? oating we are going further – 200 kilometers farther offshore. It is

FPSO Kaombo Sul in Angola

Source: TechnipFMC 12 OFFSHORE ENGINEER OEDIGITAL.COM

11

11

13

13