Page 14: of Offshore Engineer Magazine (May/Jun 2019)

Offshore Renewables Review

Read this page in Pdf, Flash or Html5 edition of May/Jun 2019 Offshore Engineer Magazine

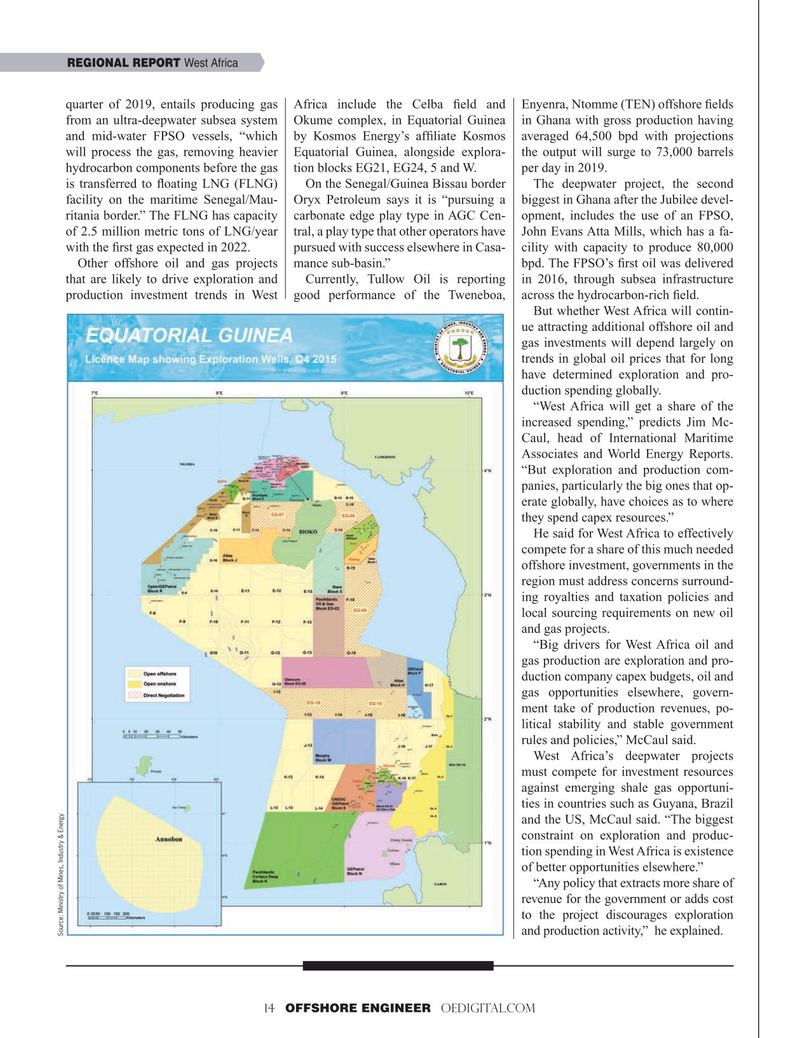

REGIONAL REPORT West Africa quarter of 2019, entails producing gas Africa include the Celba ? eld and Enyenra, Ntomme (TEN) offshore ? elds from an ultra-deepwater subsea system Okume complex, in Equatorial Guinea in Ghana with gross production having and mid-water FPSO vessels, “which by Kosmos Energy’s af? liate Kosmos averaged 64,500 bpd with projections will process the gas, removing heavier Equatorial Guinea, alongside explora- the output will surge to 73,000 barrels hydrocarbon components before the gas tion blocks EG21, EG24, 5 and W. per day in 2019.

is transferred to ? oating LNG (FLNG) On the Senegal/Guinea Bissau border The deepwater project, the second facility on the maritime Senegal/Mau- Oryx Petroleum says it is “pursuing a biggest in Ghana after the Jubilee devel- ritania border.” The FLNG has capacity carbonate edge play type in AGC Cen- opment, includes the use of an FPSO, of 2.5 million metric tons of LNG/year tral, a play type that other operators have John Evans Atta Mills, which has a fa- with the ? rst gas expected in 2022. pursued with success elsewhere in Casa- cility with capacity to produce 80,000

Other offshore oil and gas projects mance sub-basin.” bpd. The FPSO’s ? rst oil was delivered that are likely to drive exploration and Currently, Tullow Oil is reporting in 2016, through subsea infrastructure production investment trends in West good performance of the Tweneboa, across the hydrocarbon-rich ? eld.

But whether West Africa will contin- ue attracting additional offshore oil and gas investments will depend largely on trends in global oil prices that for long have determined exploration and pro- duction spending globally.

“West Africa will get a share of the increased spending,” predicts Jim Mc-

Caul, head of International Maritime

Associates and World Energy Reports. “But exploration and production com- panies, particularly the big ones that op- erate globally, have choices as to where they spend capex resources.”

He said for West Africa to effectively compete for a share of this much needed offshore investment, governments in the region must address concerns surround- ing royalties and taxation policies and local sourcing requirements on new oil and gas projects.

“Big drivers for West Africa oil and gas production are exploration and pro- duction company capex budgets, oil and gas opportunities elsewhere, govern- ment take of production revenues, po- litical stability and stable government rules and policies,” McCaul said.

West Africa’s deepwater projects must compete for investment resources against emerging shale gas opportuni- ties in countries such as Guyana, Brazil and the US, McCaul said. “The biggest constraint on exploration and produc- tion spending in West Africa is existence of better opportunities elsewhere.” “Any policy that extracts more share of revenue for the government or adds cost to the project discourages exploration and production activity,” he explained.

Source: Ministry of Mines, Industry & Energy 14 OFFSHORE ENGINEER OEDIGITAL.COM

13

13

15

15