Page 20: of Offshore Engineer Magazine (Jul/Aug 2019)

Subsea Processing

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2019 Offshore Engineer Magazine

REGIONAL REPORT Northwest Europe

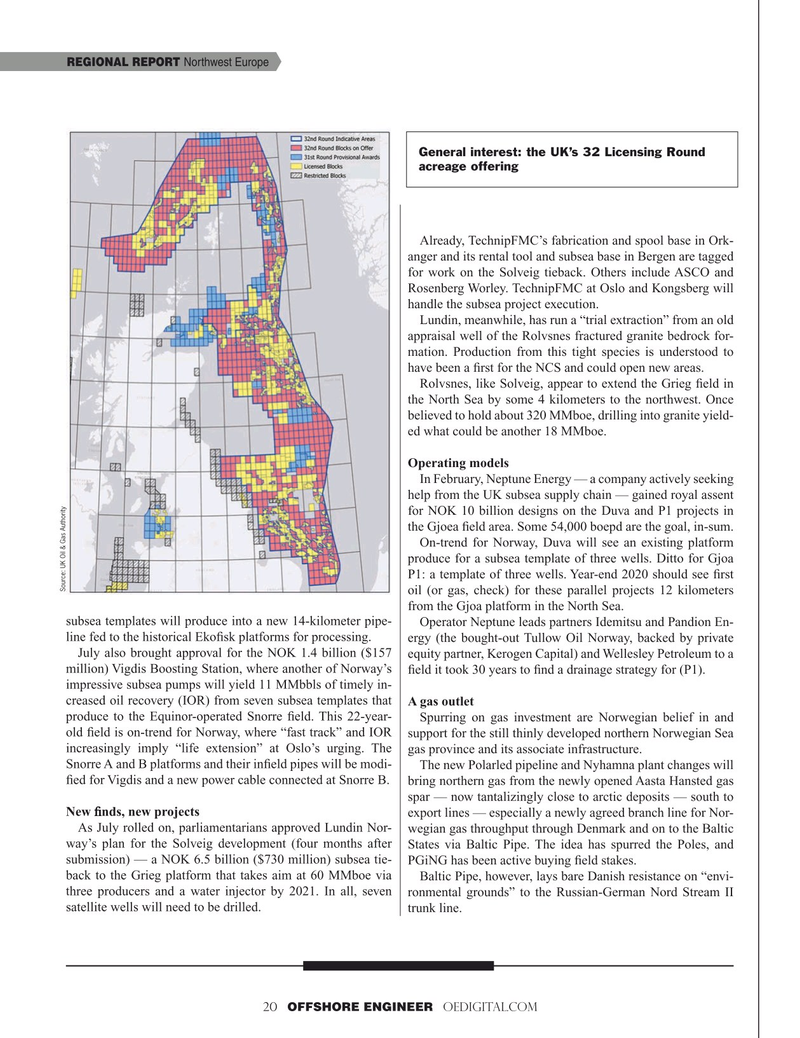

General interest: the UK’s 32 Licensing Round acreage offering

Already, TechnipFMC’s fabrication and spool base in Ork- anger and its rental tool and subsea base in Bergen are tagged for work on the Solveig tieback. Others include ASCO and

Rosenberg Worley. TechnipFMC at Oslo and Kongsberg will handle the subsea project execution.

Lundin, meanwhile, has run a “trial extraction” from an old appraisal well of the Rolvsnes fractured granite bedrock for- mation. Production from this tight species is understood to have been a ? rst for the NCS and could open new areas.

Rolvsnes, like Solveig, appear to extend the Grieg ? eld in the North Sea by some 4 kilometers to the northwest. Once believed to hold about 320 MMboe, drilling into granite yield- ed what could be another 18 MMboe.

Operating models

In February, Neptune Energy — a company actively seeking help from the UK subsea supply chain — gained royal assent for NOK 10 billion designs on the Duva and P1 projects in the Gjoea ? eld area. Some 54,000 boepd are the goal, in-sum.

On-trend for Norway, Duva will see an existing platform produce for a subsea template of three wells. Ditto for Gjoa

P1: a template of three wells. Year-end 2020 should see ? rst

Source: UK Oil & Gas Authority oil (or gas, check) for these parallel projects 12 kilometers from the Gjoa platform in the North Sea. subsea templates will produce into a new 14-kilometer pipe- Operator Neptune leads partners Idemitsu and Pandion En- line fed to the historical Eko? sk platforms for processing. ergy (the bought-out Tullow Oil Norway, backed by private

July also brought approval for the NOK 1.4 billion ($157 equity partner, Kerogen Capital) and Wellesley Petroleum to a million) Vigdis Boosting Station, where another of Norway’s ? eld it took 30 years to ? nd a drainage strategy for (P1). impressive subsea pumps will yield 11 MMbbls of timely in- creased oil recovery (IOR) from seven subsea templates that A gas outlet produce to the Equinor-operated Snorre ? eld. This 22-year- Spurring on gas investment are Norwegian belief in and old ? eld is on-trend for Norway, where “fast track” and IOR support for the still thinly developed northern Norwegian Sea increasingly imply “life extension” at Oslo’s urging. The gas province and its associate infrastructure.

Snorre A and B platforms and their in? eld pipes will be modi- The new Polarled pipeline and Nyhamna plant changes will ? ed for Vigdis and a new power cable connected at Snorre B. bring northern gas from the newly opened Aasta Hansted gas spar — now tantalizingly close to arctic deposits — south to

New ? nds, new projects export lines — especially a newly agreed branch line for Nor-

As July rolled on, parliamentarians approved Lundin Nor- wegian gas throughput through Denmark and on to the Baltic way’s plan for the Solveig development (four months after States via Baltic Pipe. The idea has spurred the Poles, and submission) — a NOK 6.5 billion ($730 million) subsea tie- PGiNG has been active buying ? eld stakes. back to the Grieg platform that takes aim at 60 MMboe via Baltic Pipe, however, lays bare Danish resistance on “envi- three producers and a water injector by 2021. In all, seven ronmental grounds” to the Russian-German Nord Stream II satellite wells will need to be drilled. trunk line.

20 OFFSHORE ENGINEER OEDIGITAL.COM

19

19

21

21