Page 17: of Offshore Engineer Magazine (Jan/Feb 2020)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2020 Offshore Engineer Magazine

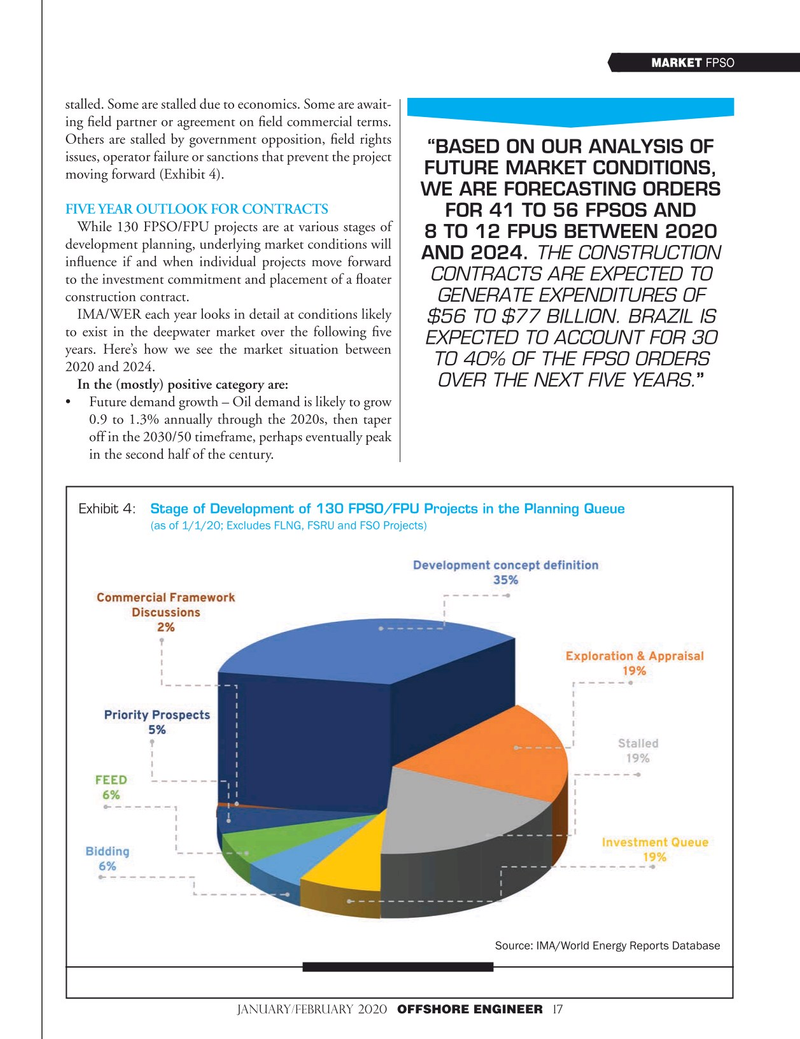

MARKET FPSO stalled. Some are stalled due to economics. Some are await- ing ? eld partner or agreement on ? eld commercial terms.

Others are stalled by government opposition, ? eld rights “BASED ON OUR ANALYSIS OF issues, operator failure or sanctions that prevent the project

FUTURE MARKET CONDITIONS, moving forward (Exhibit 4).

WE ARE FORECASTING ORDERS

FIVE YEAR OUTLOOK FOR CONTRACTS

FOR 41 TO 56 FPSOS AND

While 130 FPSO/FPU projects are at various stages of 8 TO 12 FPUS BETWEEN 2020 development planning, underlying market conditions will

AND 2024. THE CONSTRUCTION in? uence if and when individual projects move forward

CONTRACTS ARE EXPECTED TO to the investment commitment and placement of a ? oater construction contract.

GENERATE EXPENDITURES OF

IMA/WER each year looks in detail at conditions likely $56 TO $77 BILLION. BRAZIL IS to exist in the deepwater market over the following ? ve

EXPECTED TO ACCOUNT FOR 30 years. Here’s how we see the market situation between

TO 40% OF THE FPSO ORDERS 2020 and 2024.

OVER THE NEXT FIVE YEARS.”

In the (mostly) positive category are: • Future demand growth – Oil demand is likely to grow 0.9 to 1.3% annually through the 2020s, then taper off in the 2030/50 timeframe, perhaps eventually peak in the second half of the century.

Exhibit 4: Stage of Development of 130 FPSO/FPU Projects in the Planning Queue (as of 1/1/20; Excludes FLNG, FSRU and FSO Projects)

Source: IMA/World Energy Reports Database

JANUARY/FEBRUARY 2020 OFFSHORE ENGINEER 17

16

16

18

18