Page 16: of Offshore Engineer Magazine (Jan/Feb 2021)

Floating Production Outlook

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2021 Offshore Engineer Magazine

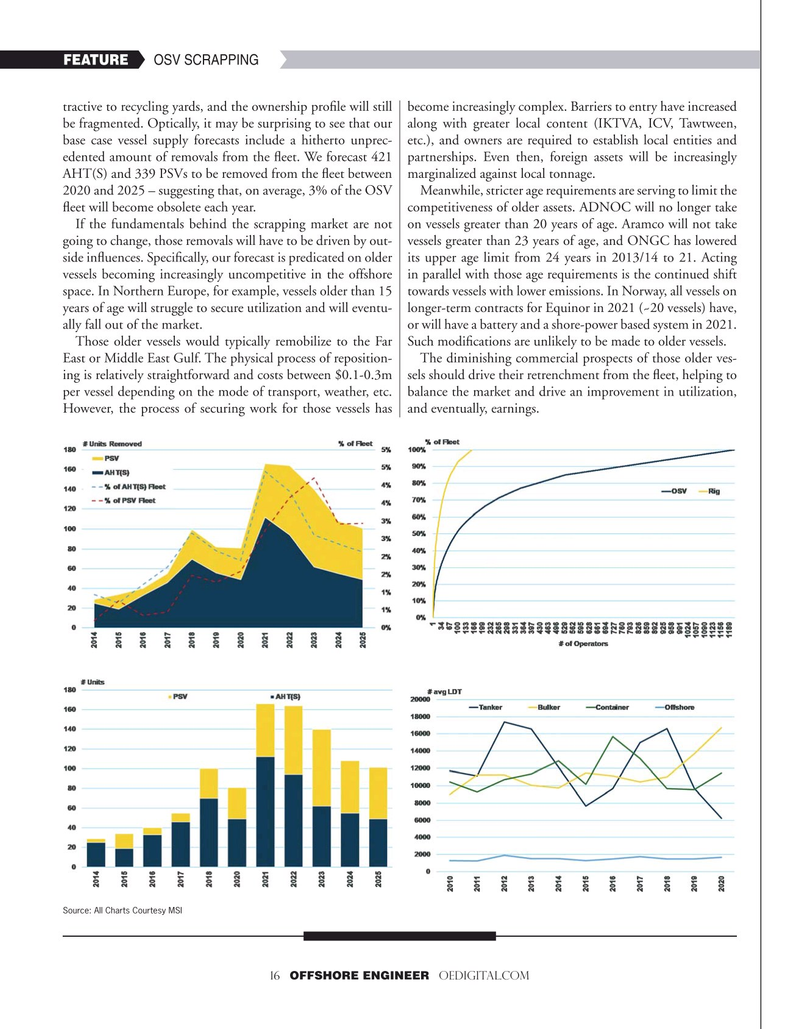

FEATURE OSV SCRAPPING tractive to recycling yards, and the ownership pro?le will still become increasingly complex. Barriers to entry have increased be fragmented. Optically, it may be surprising to see that our along with greater local content (IKTVA, ICV, Tawtween, base case vessel supply forecasts include a hitherto unprec- etc.), and owners are required to establish local entities and edented amount of removals from the ?eet. We forecast 421 partnerships. Even then, foreign assets will be increasingly

AHT(S) and 339 PSVs to be removed from the ?eet between marginalized against local tonnage.

2020 and 2025 – suggesting that, on average, 3% of the OSV Meanwhile, stricter age requirements are serving to limit the ?eet will become obsolete each year. competitiveness of older assets. ADNOC will no longer take

If the fundamentals behind the scrapping market are not on vessels greater than 20 years of age. Aramco will not take going to change, those removals will have to be driven by out- vessels greater than 23 years of age, and ONGC has lowered side in?uences. Speci?cally, our forecast is predicated on older its upper age limit from 24 years in 2013/14 to 21. Acting vessels becoming increasingly uncompetitive in the offshore in parallel with those age requirements is the continued shift space. In Northern Europe, for example, vessels older than 15 towards vessels with lower emissions. In Norway, all vessels on years of age will struggle to secure utilization and will eventu- longer-term contracts for Equinor in 2021 (~20 vessels) have, ally fall out of the market. or will have a battery and a shore-power based system in 2021.

Those older vessels would typically remobilize to the Far Such modi?cations are unlikely to be made to older vessels.

East or Middle East Gulf. The physical process of reposition- The diminishing commercial prospects of those older ves- ing is relatively straightforward and costs between $0.1-0.3m sels should drive their retrenchment from the ?eet, helping to per vessel depending on the mode of transport, weather, etc. balance the market and drive an improvement in utilization,

However, the process of securing work for those vessels has and eventually, earnings.

Source: All Charts Courtesy MSI 16 OFFSHORE ENGINEER OEDIGITAL.COM

15

15

17

17