Page 25: of Offshore Engineer Magazine (Mar/Apr 2021)

Offshore Wind Outlook

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2021 Offshore Engineer Magazine

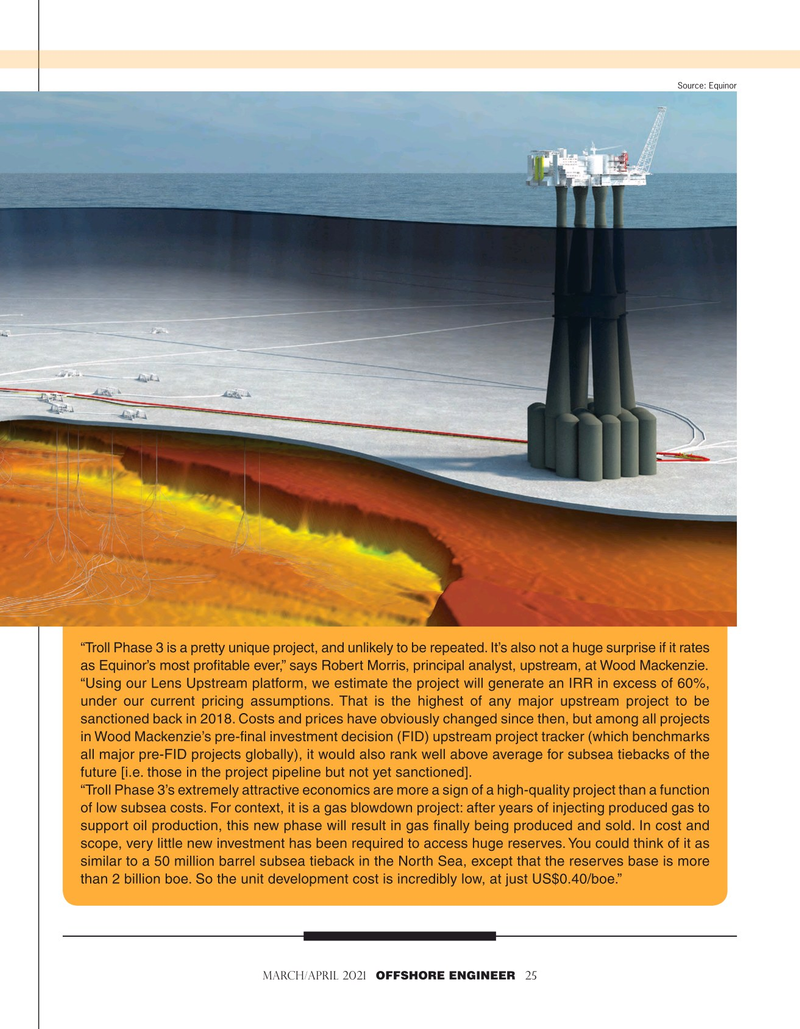

Source: Equinor “Troll Phase 3 is a pretty unique project, and unlikely to be repeated. It’s also not a huge surprise if it rates as Equinor’s most proftable ever,” says Robert Morris, principal analyst, upstream, at Wood Mackenzie. “Using our Lens Upstream platform, we estimate the project will generate an IRR in excess of 60%, under our current pricing assumptions. That is the highest of any major upstream project to be sanctioned back in 2018. Costs and prices have obviously changed since then, but among all projects in Wood Mackenzie’s pre-fnal investment decision (FID) upstream project tracker (which benchmarks all major pre-FID projects globally), it would also rank well above average for subsea tiebacks of the future [i.e. those in the project pipeline but not yet sanctioned]. “Troll Phase 3’s extremely attractive economics are more a sign of a high-quality project than a function of low subsea costs. For context, it is a gas blowdown project: after years of injecting produced gas to support oil production, this new phase will result in gas fnally being produced and sold. In cost and scope, very little new investment has been required to access huge reserves. You could think of it as similar to a 50 million barrel subsea tieback in the North Sea, except that the reserves base is more than 2 billion boe. So the unit development cost is incredibly low, at just US$0.40/boe.”

March/April 2021 OFFSHORE ENGINEER 25

24

24

26

26