Page 9: of Offshore Engineer Magazine (Jul/Aug 2021)

The Robotics Revolution

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2021 Offshore Engineer Magazine

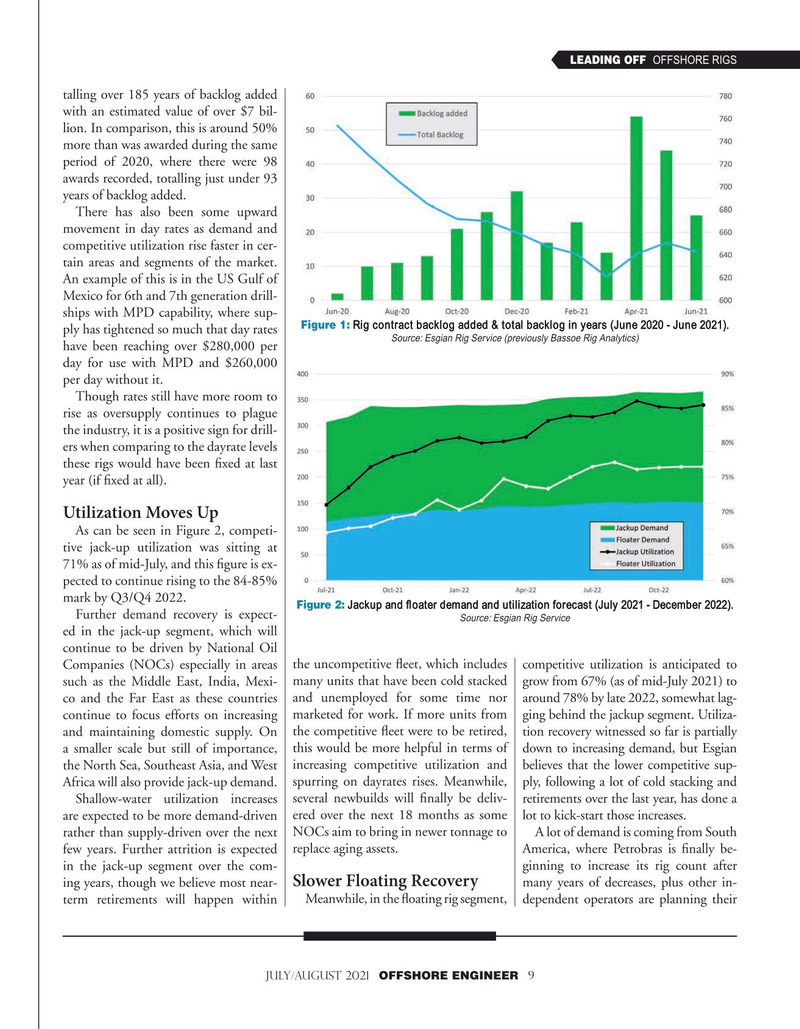

LEADING OFF OFFSHORE RIGS talling over 185 years of backlog added with an estimated value of over $7 bil- lion. In comparison, this is around 50% more than was awarded during the same period of 2020, where there were 98 awards recorded, totalling just under 93 years of backlog added.

There has also been some upward movement in day rates as demand and competitive utilization rise faster in cer- tain areas and segments of the market.

An example of this is in the US Gulf of

Mexico for 6th and 7th generation drill- ships with MPD capability, where sup-

Figure 1: Rig contract backlog added & total backlog in years (June 2020 - June 2021). ply has tightened so much that day rates

Source: Esgian Rig Service (previously Bassoe Rig Analytics) have been reaching over $280,000 per day for use with MPD and $260,000 per day without it.

Though rates still have more room to rise as oversupply continues to plague the industry, it is a positive sign for drill- ers when comparing to the dayrate levels these rigs would have been fxed at last year (if fxed at all).

Utilization Moves Up

As can be seen in Figure 2, competi- tive jack-up utilization was sitting at 71% as of mid-July, and this fgure is ex- pected to continue rising to the 84-85% mark by Q3/Q4 2022.

Figure 2: Jackup and foater demand and utilization forecast (July 2021 - December 2022).

Further demand recovery is expect-

Source: Esgian Rig Service ed in the jack-up segment, which will continue to be driven by National Oil

Companies (NOCs) especially in areas the uncompetitive feet, which includes competitive utilization is anticipated to such as the Middle East, India, Mexi- many units that have been cold stacked grow from 67% (as of mid-July 2021) to co and the Far East as these countries and unemployed for some time nor around 78% by late 2022, somewhat lag- continue to focus efforts on increasing marketed for work. If more units from ging behind the jackup segment. Utiliza- and maintaining domestic supply. On the competitive feet were to be retired, tion recovery witnessed so far is partially a smaller scale but still of importance, this would be more helpful in terms of down to increasing demand, but Esgian the North Sea, Southeast Asia, and West increasing competitive utilization and believes that the lower competitive sup-

Africa will also provide jack-up demand. spurring on dayrates rises. Meanwhile, ply, following a lot of cold stacking and

Shallow-water utilization increases several newbuilds will fnally be deliv- retirements over the last year, has done a are expected to be more demand-driven ered over the next 18 months as some lot to kick-start those increases.

rather than supply-driven over the next NOCs aim to bring in newer tonnage to A lot of demand is coming from South few years. Further attrition is expected replace aging assets. America, where Petrobras is fnally be- in the jack-up segment over the com- ginning to increase its rig count after

Slower Floating Recovery ing years, though we believe most near- many years of decreases, plus other in- term retirements will happen within Meanwhile, in the foating rig segment, dependent operators are planning their

JULY/AUGUST 2021 OFFSHORE ENGINEER 9

8

8

10

10