Page 13: of Offshore Engineer Magazine (Mar/Apr 2022)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2022 Offshore Engineer Magazine

MARKET REPORT U.S. OFFSHORE WIND

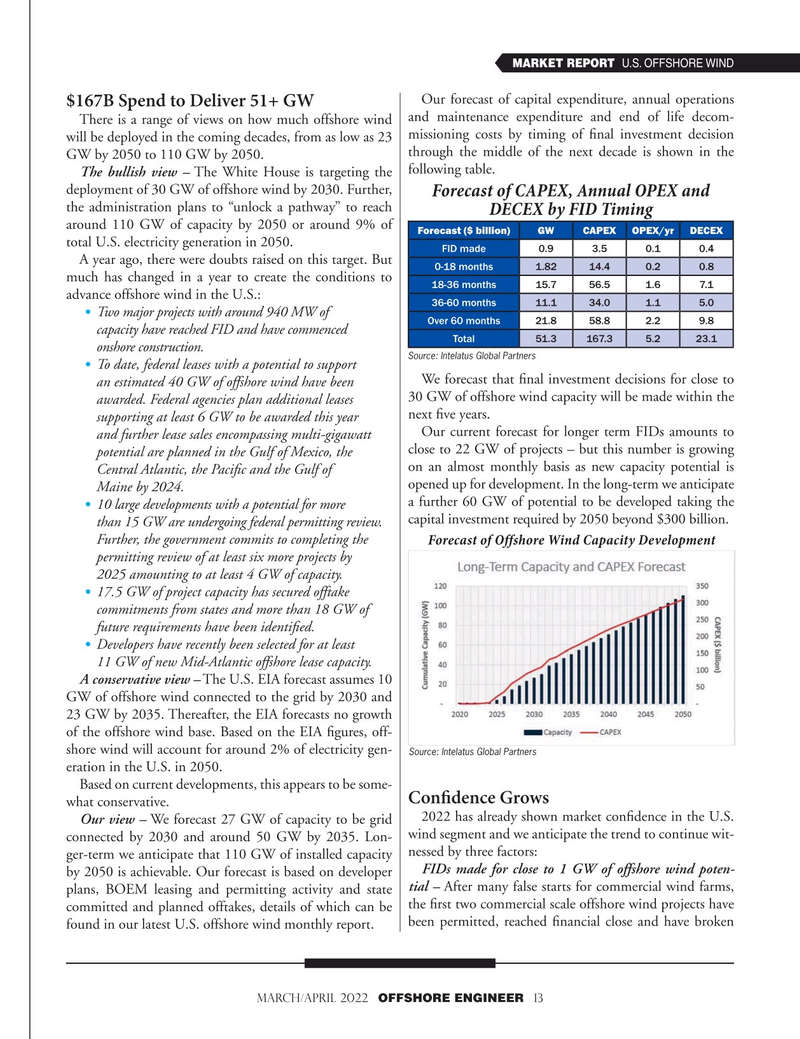

Our forecast of capital expenditure, annual operations $167B Spend to Deliver 51+ GW

There is a range of views on how much offshore wind and maintenance expenditure and end of life decom- will be deployed in the coming decades, from as low as 23 missioning costs by timing of ? nal investment decision through the middle of the next decade is shown in the

GW by 2050 to 110 GW by 2050.

The bullish view – The White House is targeting the following table. deployment of 30 GW of offshore wind by 2030. Further,

Forecast of CAPEX, Annual OPEX and the administration plans to “unlock a pathway” to reach

DECEX by FID Timing around 110 GW of capacity by 2050 or around 9% of

Forecast ($ billion)GWCAPEXOPEX/yrDECEX total U.S. electricity generation in 2050.

FID made 0.93.50.10.4

A year ago, there were doubts raised on this target. But 0-18 months 1.8214.40.20.8 much has changed in a year to create the conditions to 18-36 months 15.756.51.67.1 advance offshore wind in the U.S.: 36-60 months 11.134.01.15.0 • Two major projects with around 940 MW of

Over 60 months 21.858.82.29.8 capacity have reached FID and have commenced

Total 51.3167.35.223.1 onshore construction.

Source: Intelatus Global Partners •

To date, federal leases with a potential to support

We forecast that ? nal investment decisions for close to an estimated 40 GW of offshore wind have been 30 GW of offshore wind capacity will be made within the awarded. Federal agencies plan additional leases next ? ve years. supporting at least 6 GW to be awarded this year

Our current forecast for longer term FIDs amounts to and further lease sales encompassing multi-gigawatt close to 22 GW of projects – but this number is growing potential are planned in the Gulf of Mexico, the on an almost monthly basis as new capacity potential is Central Atlantic, the Paci? c and the Gulf of opened up for development. In the long-term we anticipate Maine by 2024. a further 60 GW of potential to be developed taking the • 10 large developments with a potential for more capital investment required by 2050 beyond $300 billion.

than 15 GW are undergoing federal permitting review. Further, the government commits to completing the Forecast of Offshore Wind Capacity Development permitting review of at least six more projects by 2025 amounting to at least 4 GW of capacity.

• 17.5 GW of project capacity has secured offtake commitments from states and more than 18 GW of future requirements have been identi? ed.

•

Developers have recently been selected for at least 11 GW of new Mid-Atlantic offshore lease capacity.

A conservative view – The U.S. EIA forecast assumes 10

GW of offshore wind connected to the grid by 2030 and 23 GW by 2035. Thereafter, the EIA forecasts no growth of the offshore wind base. Based on the EIA ? gures, off- shore wind will account for around 2% of electricity gen-

Source: Intelatus Global Partners eration in the U.S. in 2050.

Based on current developments, this appears to be some-

Conf dence Grows what conservative.

2022 has already shown market con? dence in the U.S.

Our view – We forecast 27 GW of capacity to be grid wind segment and we anticipate the trend to continue wit- connected by 2030 and around 50 GW by 2035. Lon- ger-term we anticipate that 110 GW of installed capacity nessed by three factors:

FIDs made for close to 1 GW of offshore wind poten- by 2050 is achievable. Our forecast is based on developer plans, BOEM leasing and permitting activity and state tial – After many false starts for commercial wind farms, committed and planned offtakes, details of which can be the ? rst two commercial scale offshore wind projects have been permitted, reached ? nancial close and have broken found in our latest U.S. offshore wind monthly report. march/april 2022 OFFSHORE ENGINEER 13

12

12

14

14