Page 15: of Offshore Engineer Magazine (Mar/Apr 2022)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2022 Offshore Engineer Magazine

MARKET REPORT U.S. OFFSHORE WIND

Federal agencies are advancing offshore leasing in Cali-

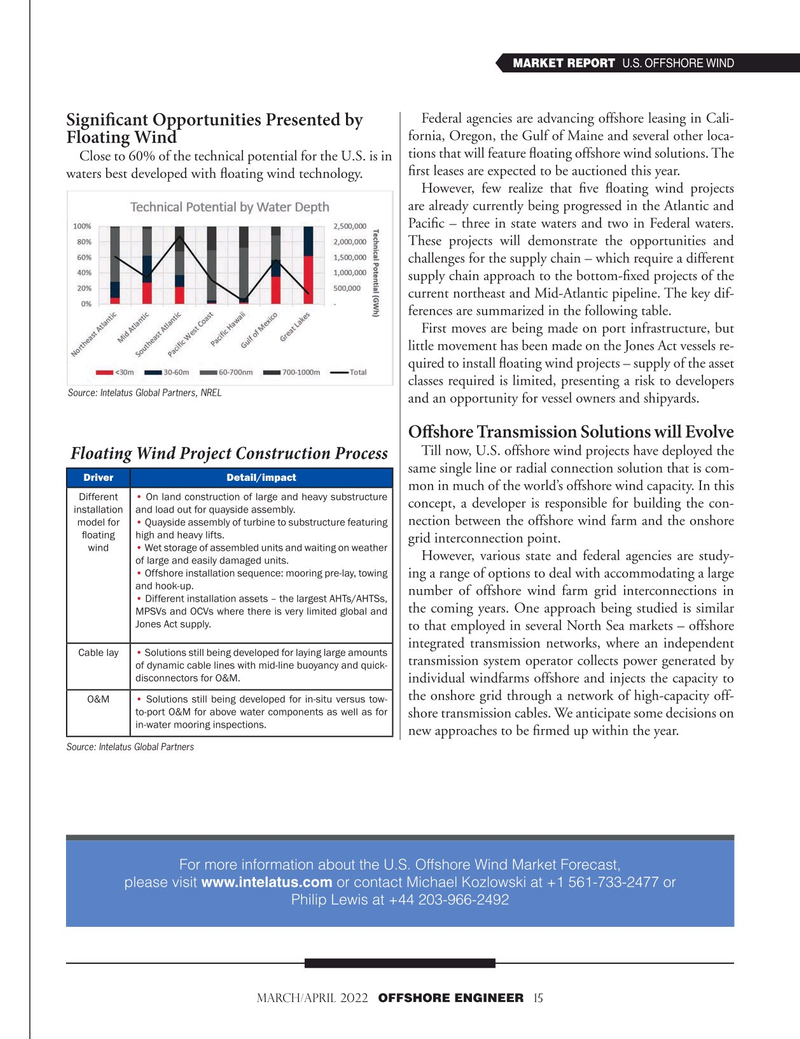

Signif cant Opportunities Presented by fornia, Oregon, the Gulf of Maine and several other loca-

Floating Wind

Close to 60% of the technical potential for the U.S. is in tions that will feature ? oating offshore wind solutions. The ? rst leases are expected to be auctioned this year.

waters best developed with ? oating wind technology.

However, few realize that ? ve ? oating wind projects are already currently being progressed in the Atlantic and

Paci? c – three in state waters and two in Federal waters.

These projects will demonstrate the opportunities and challenges for the supply chain – which require a different supply chain approach to the bottom-? xed projects of the current northeast and Mid-Atlantic pipeline. The key dif- ferences are summarized in the following table.

First moves are being made on port infrastructure, but little movement has been made on the Jones Act vessels re- quired to install ? oating wind projects – supply of the asset classes required is limited, presenting a risk to developers

Source: Intelatus Global Partners, NREL and an opportunity for vessel owners and shipyards.

Of shore Transmission Solutions will Evolve

Till now, U.S. offshore wind projects have deployed the

Floating Wind Project Construction Process same single line or radial connection solution that is com-

Driver Detail/impact mon in much of the world’s offshore wind capacity. In this

Different • On land construction of large and heavy substructure concept, a developer is responsible for building the con- installation and load out for quayside assembly. nection between the offshore wind farm and the onshore model for • Quayside assembly of turbine to substructure featuring ? oating high and heavy lifts. grid interconnection point. wind • Wet storage of assembled units and waiting on weather

However, various state and federal agencies are study- of large and easily damaged units. • Offshore installation sequence: mooring pre-lay, towing ing a range of options to deal with accommodating a large and hook-up. number of offshore wind farm grid interconnections in • Different installation assets – the largest AHTs/AHTSs, the coming years. One approach being studied is similar

MPSVs and OCVs where there is very limited global and

Jones Act supply.

to that employed in several North Sea markets – offshore integrated transmission networks, where an independent

Cable lay • Solutions still being developed for laying large amounts transmission system operator collects power generated by of dynamic cable lines with mid-line buoyancy and quick- disconnectors for O&M.

individual windfarms offshore and injects the capacity to the onshore grid through a network of high-capacity off-

O&M • Solutions still being developed for in-situ versus tow- to-port O&M for above water components as well as for shore transmission cables. We anticipate some decisions on in-water mooring inspections.

new approaches to be ? rmed up within the year.

Source: Intelatus Global Partners

For more information about the U.S. Offshore Wind Market Forecast, please visit www.intelatus.com or contact Michael Kozlowski at +1 561-733-2477 or

Philip Lewis at +44 203-966-2492 march/april 2022 OFFSHORE ENGINEER 15

14

14

16

16