Page 11: of Offshore Engineer Magazine (Sep/Oct 2022)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2022 Offshore Engineer Magazine

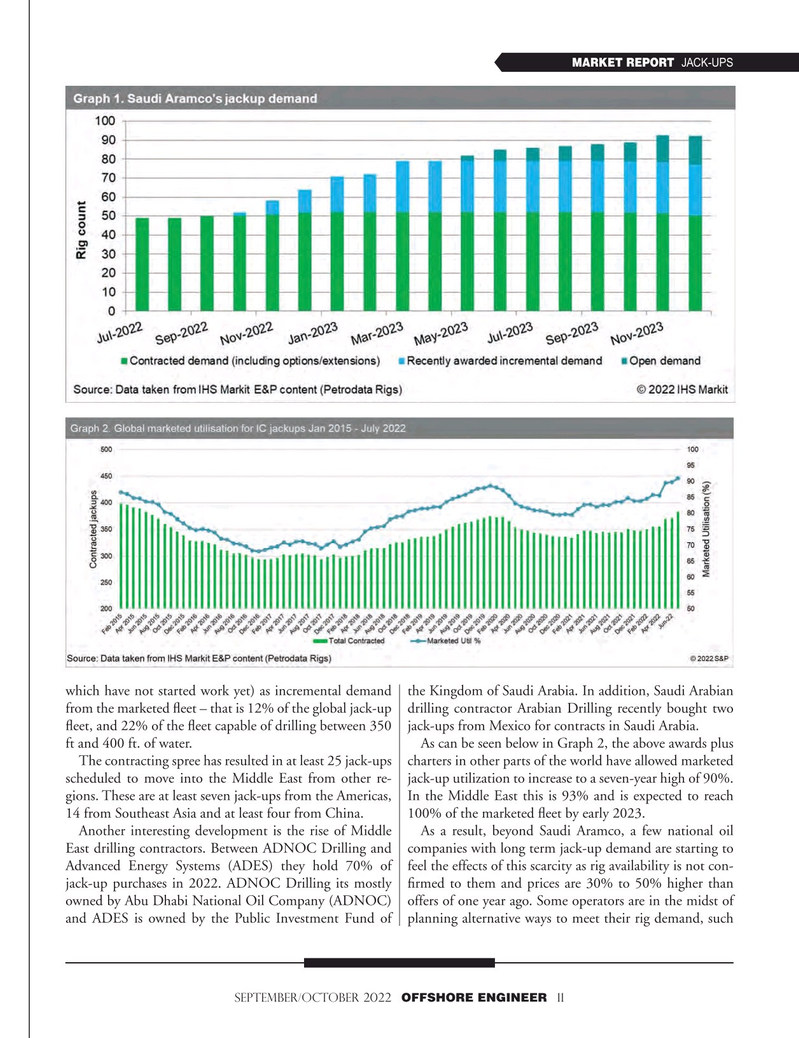

MARKET REPORT JACK-UPS which have not started work yet) as incremental demand the Kingdom of Saudi Arabia. In addition, Saudi Arabian from the marketed feet – that is 12% of the global jack-up drilling contractor Arabian Drilling recently bought two feet, and 22% of the feet capable of drilling between 350 jack-ups from Mexico for contracts in Saudi Arabia.

ft and 400 ft. of water. As can be seen below in Graph 2, the above awards plus

The contracting spree has resulted in at least 25 jack-ups charters in other parts of the world have allowed marketed scheduled to move into the Middle East from other re- jack-up utilization to increase to a seven-year high of 90%. gions. These are at least seven jack-ups from the Americas, In the Middle East this is 93% and is expected to reach 14 from Southeast Asia and at least four from China. 100% of the marketed feet by early 2023.

Another interesting development is the rise of Middle As a result, beyond Saudi Aramco, a few national oil

East drilling contractors. Between ADNOC Drilling and companies with long term jack-up demand are starting to

Advanced Energy Systems (ADES) they hold 70% of feel the effects of this scarcity as rig availability is not con- jack-up purchases in 2022. ADNOC Drilling its mostly frmed to them and prices are 30% to 50% higher than owned by Abu Dhabi National Oil Company (ADNOC) offers of one year ago. Some operators are in the midst of and ADES is owned by the Public Investment Fund of planning alternative ways to meet their rig demand, such

SEPTEMBER/OCTOBER 2022 OFFSHORE ENGINEER 11

10

10

12

12