Page 14: of Offshore Engineer Magazine (Sep/Oct 2022)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2022 Offshore Engineer Magazine

MARKET REPORT JACK-UPS $100,000 with the new Saudi Aramco tender expected to end of 2023. We expect this will allow day rates to contin- result in day rates from $110,000 to $130,000 with higher ue in a gradual upward trend that could average $150,000 mobilization rates than before that could reach $45 mil- by the end of 2023.

lion. Those rates haven’t been seen since 2015.

Concluding Remarks

Outlook This once distressed sector is coming back to life and

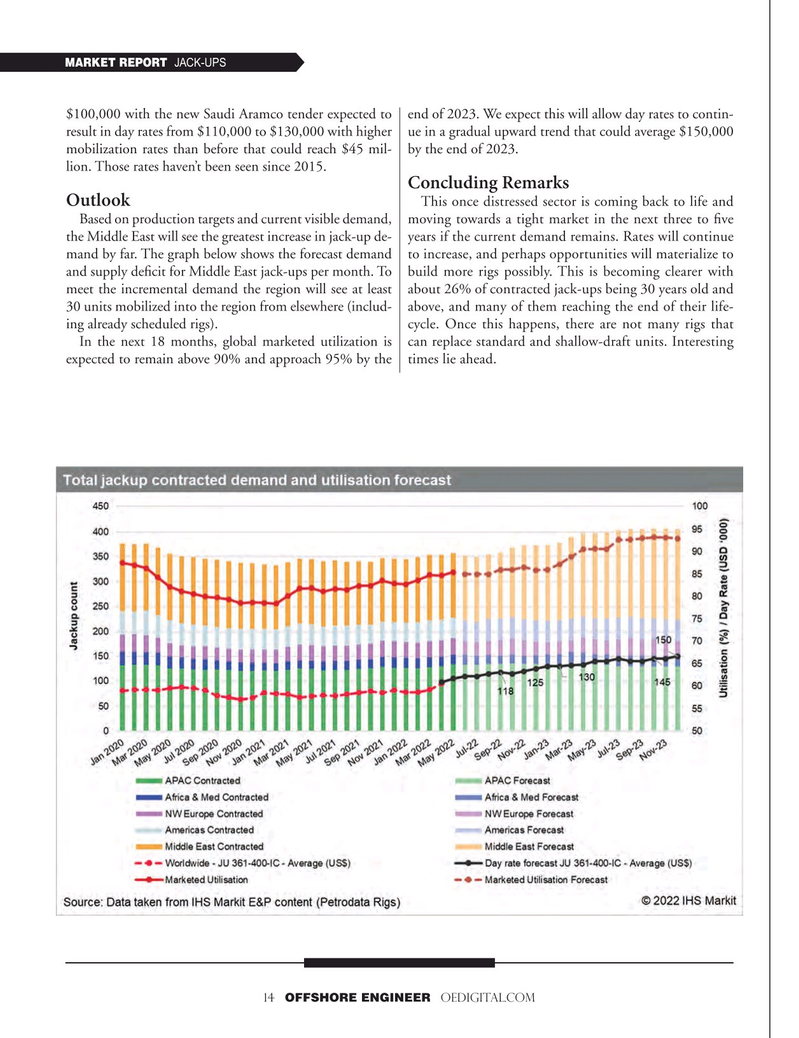

Based on production targets and current visible demand, moving towards a tight market in the next three to fve the Middle East will see the greatest increase in jack-up de- years if the current demand remains. Rates will continue mand by far. The graph below shows the forecast demand to increase, and perhaps opportunities will materialize to and supply defcit for Middle East jack-ups per month. To build more rigs possibly. This is becoming clearer with meet the incremental demand the region will see at least about 26% of contracted jack-ups being 30 years old and 30 units mobilized into the region from elsewhere (includ- above, and many of them reaching the end of their life- ing already scheduled rigs). cycle. Once this happens, there are not many rigs that

In the next 18 months, global marketed utilization is can replace standard and shallow-draft units. Interesting expected to remain above 90% and approach 95% by the times lie ahead.

14 OFFSHORE ENGINEER OEDIGITAL.COM

13

13

15

15