Page 10: of Offshore Engineer Magazine (Nov/Dec 2022)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2022 Offshore Engineer Magazine

Market Forecast 2023 ready supply and the soaring economics behind reactiva- Several units have mobilized out of the region in 2022, tion, brings us to our next prediction: dayrates will con- and the lower supply will contribute to further tightening tinue to rise next year. and dayrate increases.

As shown in Figure 1, dayrates have already been moving

More consolidation on the cards north, and rumors suggest that we could see a $500,000 drillship ?xture next year, which would be the ?rst since the One of the biggest talking points of 2022 was the merg- 2012-2014 period. Meanwhile, jack-up rates are also expect- er of Noble Corporation and Maersk Drilling – a sizeable ed to continue their upward trajectory, driven by continued combination and a key example of what the industry has high demand from NOCs, and Westwood anticipates see- been promoting for many years. ing further ?xtures for non-harsh environment units within With rig market fundamentals improving and drilling the recently recorded $130,000-$140,000 range. contractors streamlining their ?eets in the past few years, it

Westwood’s Offshore Rig Dayrate Forecast Report also seems to be the prime time for further merger and acquisi- shows that even the historically low rates for jack-ups in tion (M&A) activity. regions such as India will also rise in 2023. Rumors continue to circulate of ongoing talks regard-

Further upward movement for semi rates is even ex- ing certain rig owners. However, time will tell if and when pected next year in both the harsh and non-harsh envi- these discussions lead to further M&A activity. Despite rig ronment ?eets. market improvement, it is widely recognized that there is

The UK semi market is already showing signs of some still too much rig owner fragmentation, and further con- tightening, and the Norwegian 6th generation segment is solidation will be required to provide a smaller pool of also expected to become busier in the second half of 2023. players with larger market shares in the future.

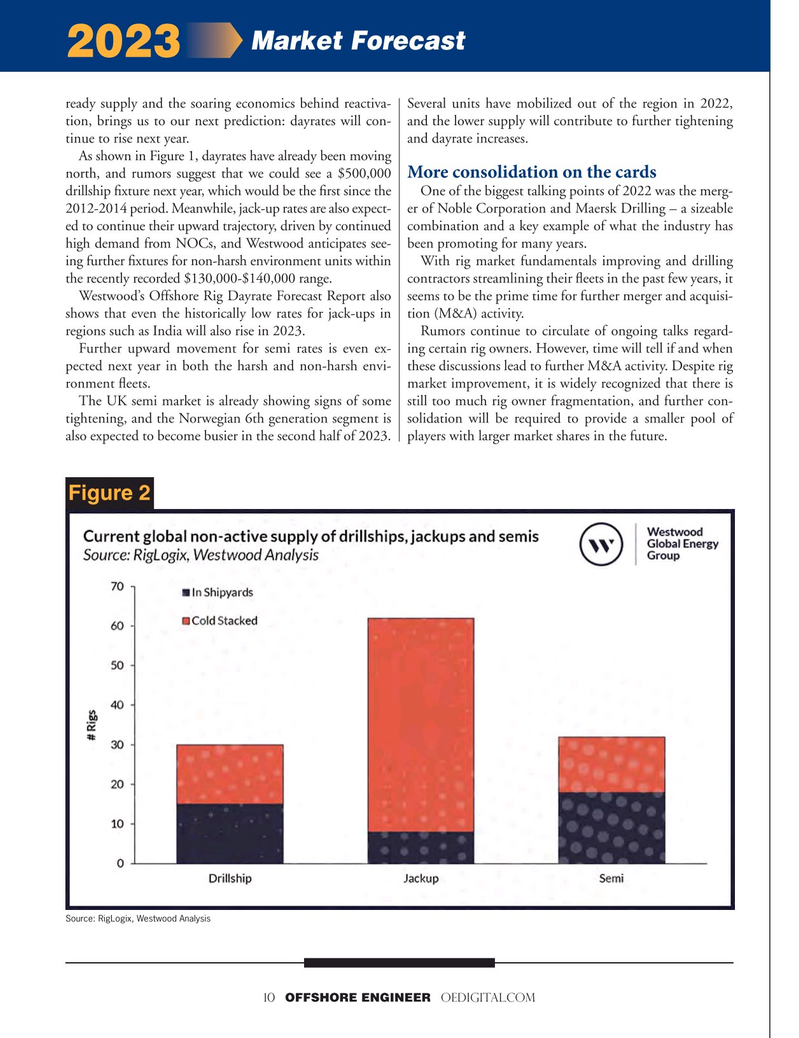

Figure 2

Source: RigLogix, Westwood Analysis 10 OFFSHORE ENGINEER OEDIGITAL.COM

9

9

11

11