Page 13: of Offshore Engineer Magazine (Nov/Dec 2022)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2022 Offshore Engineer Magazine

Saudi-backed driller ADES and UAE-supported ADNOC ture up to 2.3 million barrels of storage and 50,000 tonnes

Drilling have spent the past couple years expanding their of topsides. Globally, seven FPSO projects have been ?eets, acquiring dozens of new and used jackup rigs to drill awarded this year, with an additional 15 to be awarded in in the shallow waters of the Persian Gulf. Zooming in on 2023 and another 12 in 2024 (Figure 3).

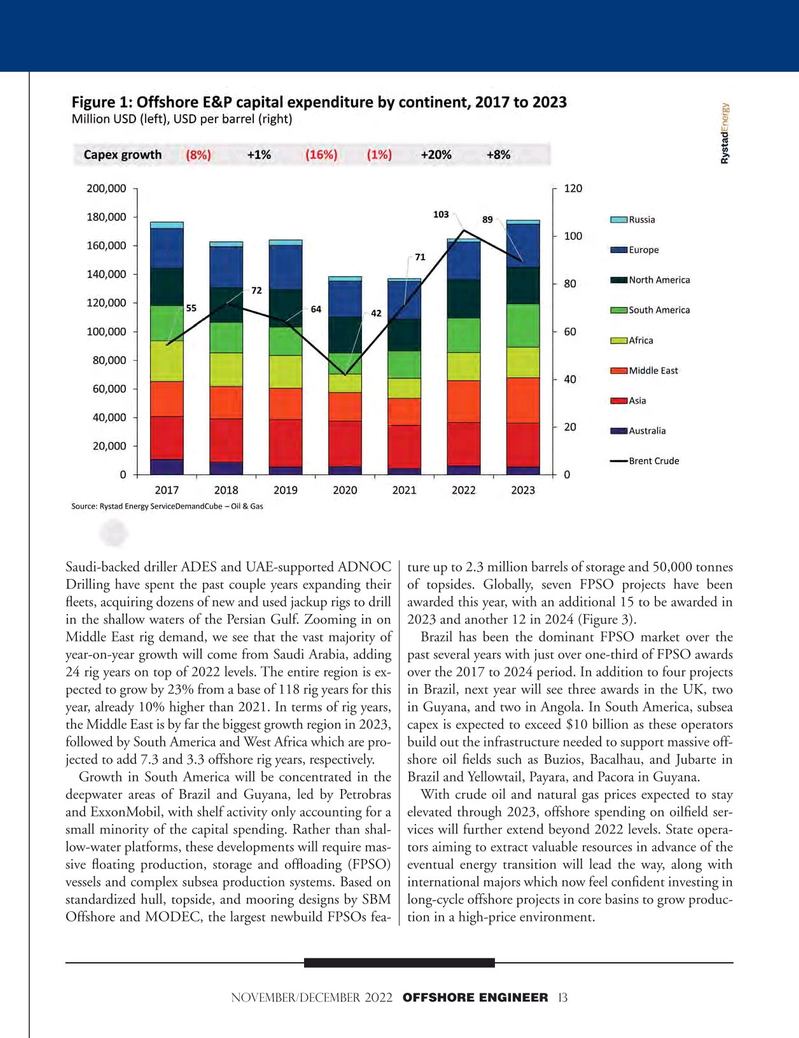

Middle East rig demand, we see that the vast majority of Brazil has been the dominant FPSO market over the year-on-year growth will come from Saudi Arabia, adding past several years with just over one-third of FPSO awards 24 rig years on top of 2022 levels. The entire region is ex- over the 2017 to 2024 period. In addition to four projects pected to grow by 23% from a base of 118 rig years for this in Brazil, next year will see three awards in the UK, two year, already 10% higher than 2021. In terms of rig years, in Guyana, and two in Angola. In South America, subsea the Middle East is by far the biggest growth region in 2023, capex is expected to exceed $10 billion as these operators followed by South America and West Africa which are pro- build out the infrastructure needed to support massive off- jected to add 7.3 and 3.3 offshore rig years, respectively. shore oil ?elds such as Buzios, Bacalhau, and Jubarte in

Growth in South America will be concentrated in the Brazil and Yellowtail, Payara, and Pacora in Guyana. deepwater areas of Brazil and Guyana, led by Petrobras With crude oil and natural gas prices expected to stay and ExxonMobil, with shelf activity only accounting for a elevated through 2023, offshore spending on oil?eld ser- small minority of the capital spending. Rather than shal- vices will further extend beyond 2022 levels. State opera- low-water platforms, these developments will require mas- tors aiming to extract valuable resources in advance of the sive ?oating production, storage and of?oading (FPSO) eventual energy transition will lead the way, along with vessels and complex subsea production systems. Based on international majors which now feel con?dent investing in standardized hull, topside, and mooring designs by SBM long-cycle offshore projects in core basins to grow produc-

Offshore and MODEC, the largest newbuild FPSOs fea- tion in a high-price environment.

november/december 2022 OFFSHORE ENGINEER 13

12

12

14

14