Page 21: of Offshore Engineer Magazine (Nov/Dec 2022)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2022 Offshore Engineer Magazine

©AA+W/AdobeStock

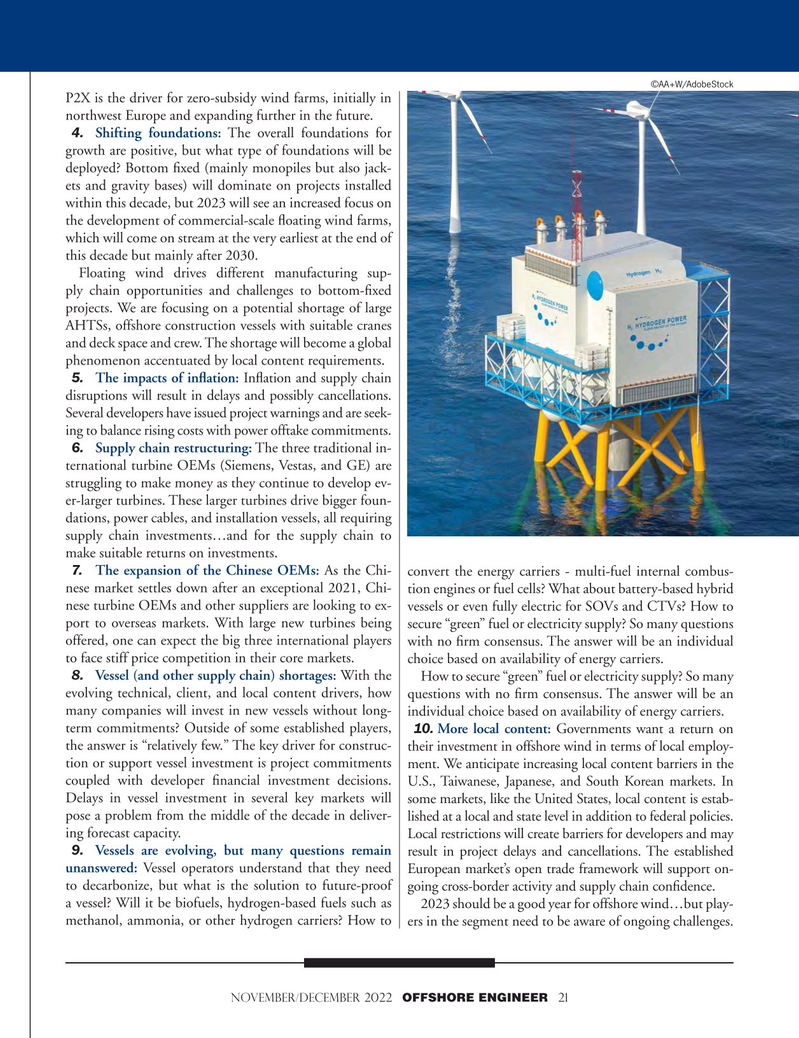

P2X is the driver for zero-subsidy wind farms, initially in northwest Europe and expanding further in the future.

4. Shifting foundations: The overall foundations for growth are positive, but what type of foundations will be deployed? Bottom ?xed (mainly monopiles but also jack- ets and gravity bases) will dominate on projects installed within this decade, but 2023 will see an increased focus on the development of commercial-scale ?oating wind farms, which will come on stream at the very earliest at the end of this decade but mainly after 2030.

Floating wind drives different manufacturing sup- ply chain opportunities and challenges to bottom-?xed projects. We are focusing on a potential shortage of large

AHTSs, offshore construction vessels with suitable cranes and deck space and crew. The shortage will become a global phenomenon accentuated by local content requirements.

5. The impacts of in?ation: In?ation and supply chain disruptions will result in delays and possibly cancellations.

Several developers have issued project warnings and are seek- ing to balance rising costs with power offtake commitments.

6. Supply chain restructuring: The three traditional in- ternational turbine OEMs (Siemens, Vestas, and GE) are struggling to make money as they continue to develop ev- er-larger turbines. These larger turbines drive bigger foun- dations, power cables, and installation vessels, all requiring supply chain investments…and for the supply chain to make suitable returns on investments.

7. The expansion of the Chinese OEMs: As the Chi- convert the energy carriers - multi-fuel internal combus- nese market settles down after an exceptional 2021, Chi- tion engines or fuel cells? What about battery-based hybrid nese turbine OEMs and other suppliers are looking to ex- vessels or even fully electric for SOVs and CTVs? How to port to overseas markets. With large new turbines being secure “green” fuel or electricity supply? So many questions offered, one can expect the big three international players with no ?rm consensus. The answer will be an individual to face stiff price competition in their core markets. choice based on availability of energy carriers. 8. Vessel (and other supply chain) shortages: W ith the How to secure “green” fuel or electricity supply? So many evolving technical, client, and local content drivers, how questions with no ?rm consensus. The answer will be an many companies will invest in new vessels without long- individual choice based on availability of energy carriers.

term commitments? Outside of some established players, 10. More local content: Governments want a return on the answer is “relatively few.” The key driver for construc- their investment in offshore wind in terms of local employ- tion or support vessel investment is project commitments ment. We anticipate increasing local content barriers in the coupled with developer ?nancial investment decisions. U.S., Taiwanese, Japanese, and South Korean markets. In

Delays in vessel investment in several key markets will some markets, like the United States, local content is estab- pose a problem from the middle of the decade in deliver- lished at a local and state level in addition to federal policies. ing forecast capacity. Local restrictions will create barriers for developers and may 9. Vessels are evolving, but many questions remain result in project delays and cancellations. The established unanswered: Vessel operators understand that they need European market’s open trade framework will support on- to decarbonize, but what is the solution to future-proof going cross-border activity and supply chain con?dence.

a vessel? Will it be biofuels, hydrogen-based fuels such as 2023 should be a good year for offshore wind…but play- methanol, ammonia, or other hydrogen carriers? How to ers in the segment need to be aware of ongoing challenges.

november/december 2022 OFFSHORE ENGINEER 21

20

20

22

22