Page 30: of Offshore Engineer Magazine (Nov/Dec 2022)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2022 Offshore Engineer Magazine

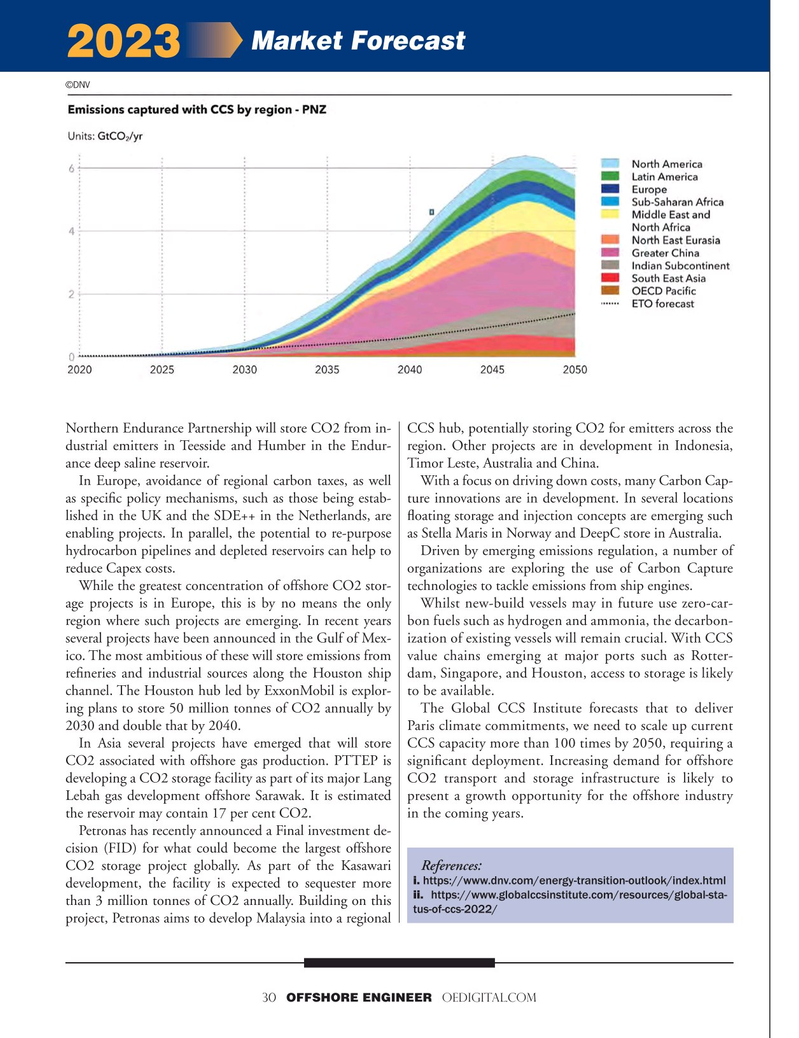

Market Forecast 2023 ©DNV

Northern Endurance Partnership will store CO2 from in- CCS hub, potentially storing CO2 for emitters across the dustrial emitters in Teesside and Humber in the Endur- region. Other projects are in development in Indonesia, ance deep saline reservoir. Timor Leste, Australia and China.

In Europe, avoidance of regional carbon taxes, as well With a focus on driving down costs, many Carbon Cap- as speci?c policy mechanisms, such as those being estab- ture innovations are in development. In several locations lished in the UK and the SDE++ in the Netherlands, are ?oating storage and injection concepts are emerging such enabling projects. In parallel, the potential to re-purpose as Stella Maris in Norway and DeepC store in Australia. hydrocarbon pipelines and depleted reservoirs can help to Driven by emerging emissions regulation, a number of reduce Capex costs. organizations are exploring the use of Carbon Capture

While the greatest concentration of offshore CO2 stor- technologies to tackle emissions from ship engines. age projects is in Europe, this is by no means the only Whilst new-build vessels may in future use zero-car- region where such projects are emerging. In recent years bon fuels such as hydrogen and ammonia, the decarbon- several projects have been announced in the Gulf of Mex- ization of existing vessels will remain crucial. With CCS ico. The most ambitious of these will store emissions from value chains emerging at major ports such as Rotter- re?neries and industrial sources along the Houston ship dam, Singapore, and Houston, access to storage is likely channel. The Houston hub led by ExxonMobil is explor- to be available.

ing plans to store 50 million tonnes of CO2 annually by The Global CCS Institute forecasts that to deliver 2030 and double that by 2040. Paris climate commitments, we need to scale up current

In Asia several projects have emerged that will store CCS capacity more than 100 times by 2050, requiring a

CO2 associated with offshore gas production. PTTEP is signi?cant deployment. Increasing demand for offshore developing a CO2 storage facility as part of its major Lang CO2 transport and storage infrastructure is likely to

Lebah gas development offshore Sarawak. It is estimated present a growth opportunity for the offshore industry the reservoir may contain 17 per cent CO2. in the coming years.

Petronas has recently announced a Final investment de- cision (FID) for what could become the largest offshore

CO2 storage project globally. As part of the Kasawari References: i. https://www.dnv.com/energy-transition-outlook/index.html development, the facility is expected to sequester more ii. https://www.globalccsinstitute.com/resources/global-sta- than 3 million tonnes of CO2 annually. Building on this tus-of-ccs-2022/ project, Petronas aims to develop Malaysia into a regional 30 OFFSHORE ENGINEER OEDIGITAL.COM

29

29

31

31