Page 14: of Offshore Engineer Magazine (Jan/Feb 2023)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2023 Offshore Engineer Magazine

MARKETS SUB-SAHARAN AFRICA FLNG

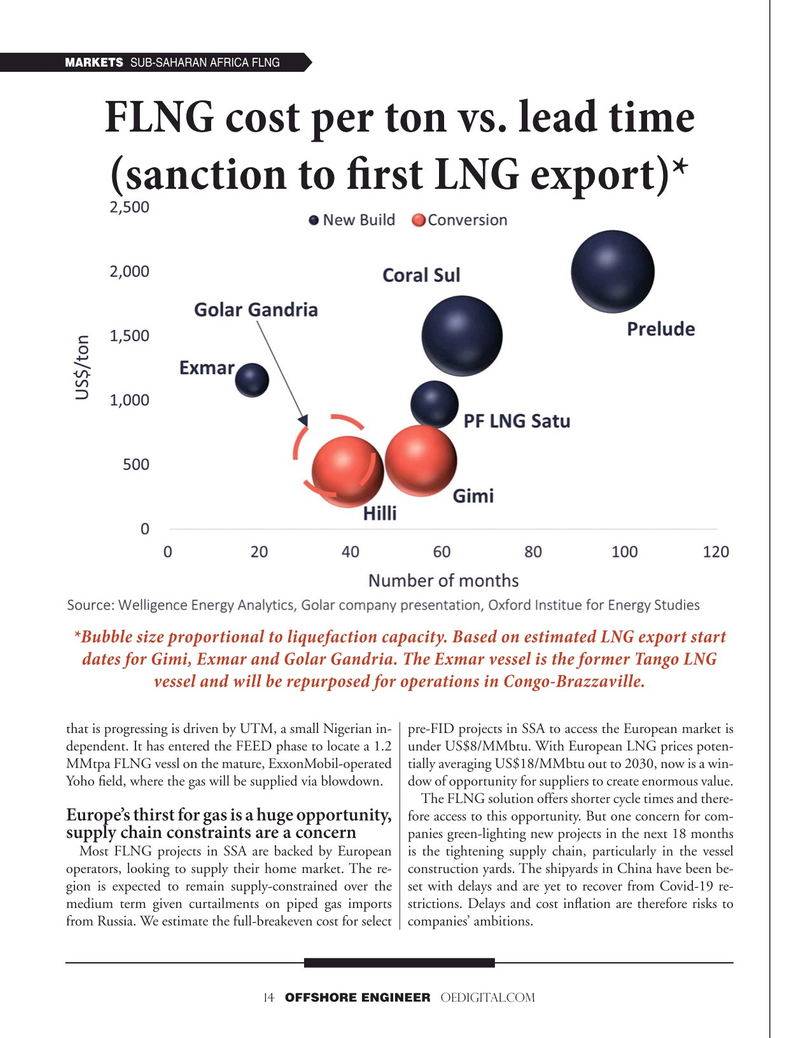

FLNG cost per ton vs. lead time (sanction to frst LNG export)* *Bubble size proportional to liquefaction capacity. Based on estimated LNG export start dates for Gimi, Exmar and Golar Gandria. The Exmar vessel is the former Tango LNG vessel and will be repurposed for operations in Congo-Brazzaville.

that is progressing is driven by UTM, a small Nigerian in- pre-FID projects in SSA to access the European market is dependent. It has entered the FEED phase to locate a 1.2 under US$8/MMbtu. With European LNG prices poten-

MMtpa FLNG vessl on the mature, ExxonMobil-operated tially averaging US$18/MMbtu out to 2030, now is a win-

Yoho ?eld, where the gas will be supplied via blowdown. dow of opportunity for suppliers to create enormous value.

The FLNG solution offers shorter cycle times and there- fore access to this opportunity. But one concern for com-

Europe’s thirst for gas is a huge opportunity, panies green-lighting new projects in the next 18 months supply chain constraints are a concern

Most FLNG projects in SSA are backed by European is the tightening supply chain, particularly in the vessel operators, looking to supply their home market. The re- construction yards. The shipyards in China have been be- gion is expected to remain supply-constrained over the set with delays and are yet to recover from Covid-19 re- medium term given curtailments on piped gas imports strictions. Delays and cost in?ation are therefore risks to from Russia. We estimate the full-breakeven cost for select companies’ ambitions.

14 OFFSHORE ENGINEER OEDIGITAL.COM

13

13

15

15