Page 20: of Offshore Engineer Magazine (Jan/Feb 2023)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2023 Offshore Engineer Magazine

MARKETS FLOATING OFFSHORE WIND loating wind is an emerging technology. Cur- differences drive demand for a different type of vessel than rently being tested in small scale demonstration seen for bottom-?xed offshore wind projects. and pilot projects, global ?oating wind commis- For ?oating wind projects, we will see the largest anchor

F sioned capacity at the end of 2022 was less than handlers and light subsea construction vessels deployed to 200 MW. By 2030, close to 11 GW of commercial scale pre-install mooring systems designed to maintain the posi- wind farms are planned to be commissioned in Europe and tion of the ?oating wind turbines, to tow the structures from the Asia Paci?c Region. 2030-2035 will see a period a high port and to hook-up the ?oating turbines to pre-existing commissioning activity as the USA joins established Euro- moorings. For example, our analysis identi?es the optimal pean and Asia Paci?c markets. Floating installed capacity size of AHTS for mooring pre-lay as having a bollard pull of is forecast to reach 63 GW by 2035. This translates to the at least 250 tonnes and a clear back deck of over 800 square installation of close to 4,000 ?oating turbines, over 16,000 meters. The following chart identi?es only 63 current opti- anchors and close to 17,000 mooring lines. mal AHTSs with the ideal bollard pull and clear deck space

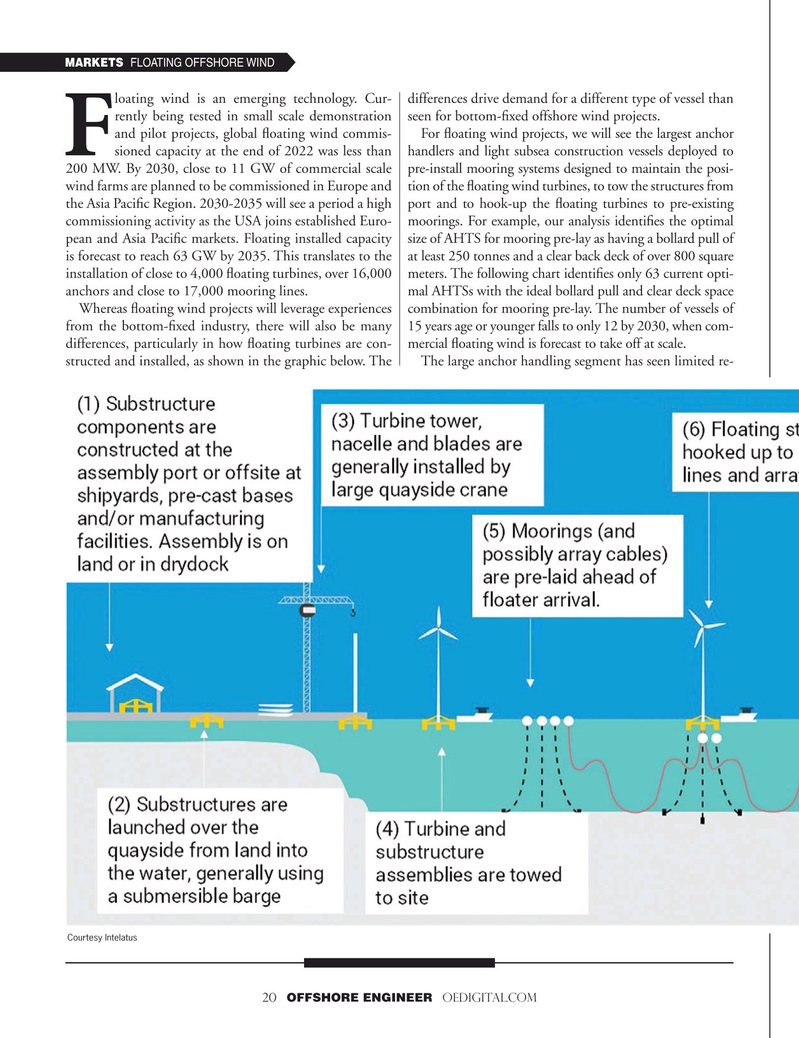

Whereas ?oating wind projects will leverage experiences combination for mooring pre-lay. The number of vessels of from the bottom-?xed industry, there will also be many 15 years age or younger falls to only 12 by 2030, when com- differences, particularly in how ?oating turbines are con- mercial ?oating wind is forecast to take off at scale. structed and installed, as shown in the graphic below. The The large anchor handling segment has seen limited re-

Courtesy Intelatus 20 OFFSHORE ENGINEER OEDIGITAL.COM

19

19

21

21