Page 13: of Offshore Engineer Magazine (Mar/Apr 2023)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2023 Offshore Engineer Magazine

MARKETS THE RIG MARKET

Figure 1

Marketed supply in the region has been inching higher also additional requirements in the market from operators since the low of 2020. Currently sitting at 23 units, this to bring further rigs into the country for more wildcatting is fve rigs higher than it was in March 2022 and seven activity this year and the next. Meanwhile, Cote d’Ivoire rigs higher than March 2021. This is the result of the likes has also seen an increase in foating rig contracting activity of Blackford Dolphin, West Bollsta and Island Innova- following Eni’s large Baleine discovery, which it plans to tor, moving in from other regions such as Mexico and the put into production just 18 months after the initial dis-

North Sea for lucrative new jobs, or due to idle units in Las covery was made.

Palmas having been reactivated. Of the backlog secured for work in African waters from

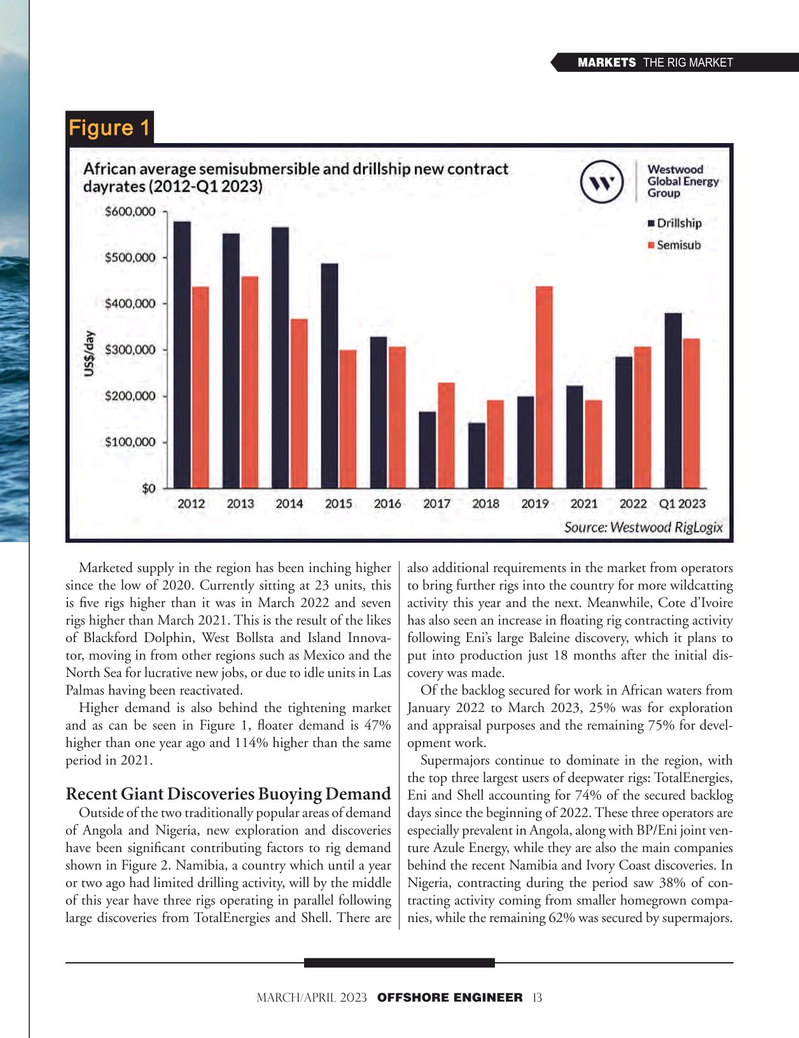

Higher demand is also behind the tightening market January 2022 to March 2023, 25% was for exploration and as can be seen in Figure 1, foater demand is 47% and appraisal purposes and the remaining 75% for devel- higher than one year ago and 114% higher than the same opment work. period in 2021. Supermajors continue to dominate in the region, with the top three largest users of deepwater rigs: TotalEnergies,

Eni and Shell accounting for 74% of the secured backlog

Recent Giant Discoveries Buoying Demand

Outside of the two traditionally popular areas of demand days since the beginning of 2022. These three operators are of Angola and Nigeria, new exploration and discoveries especially prevalent in Angola, along with BP/Eni joint ven- have been signifcant contributing factors to rig demand ture Azule Energy, while they are also the main companies shown in Figure 2. Namibia, a country which until a year behind the recent Namibia and Ivory Coast discoveries. In or two ago had limited drilling activity, will by the middle Nigeria, contracting during the period saw 38% of con- of this year have three rigs operating in parallel following tracting activity coming from smaller homegrown compa- large discoveries from TotalEnergies and Shell. There are nies, while the remaining 62% was secured by supermajors.

MARCH/APRIL 2023 OFFSHORE ENGINEER 13

12

12

14

14