Page 17: of Offshore Engineer Magazine (Jul/Aug 2023)

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2023 Offshore Engineer Magazine

RENEWABLE ENERGY FLOATING WIND

Maersk Supply Service

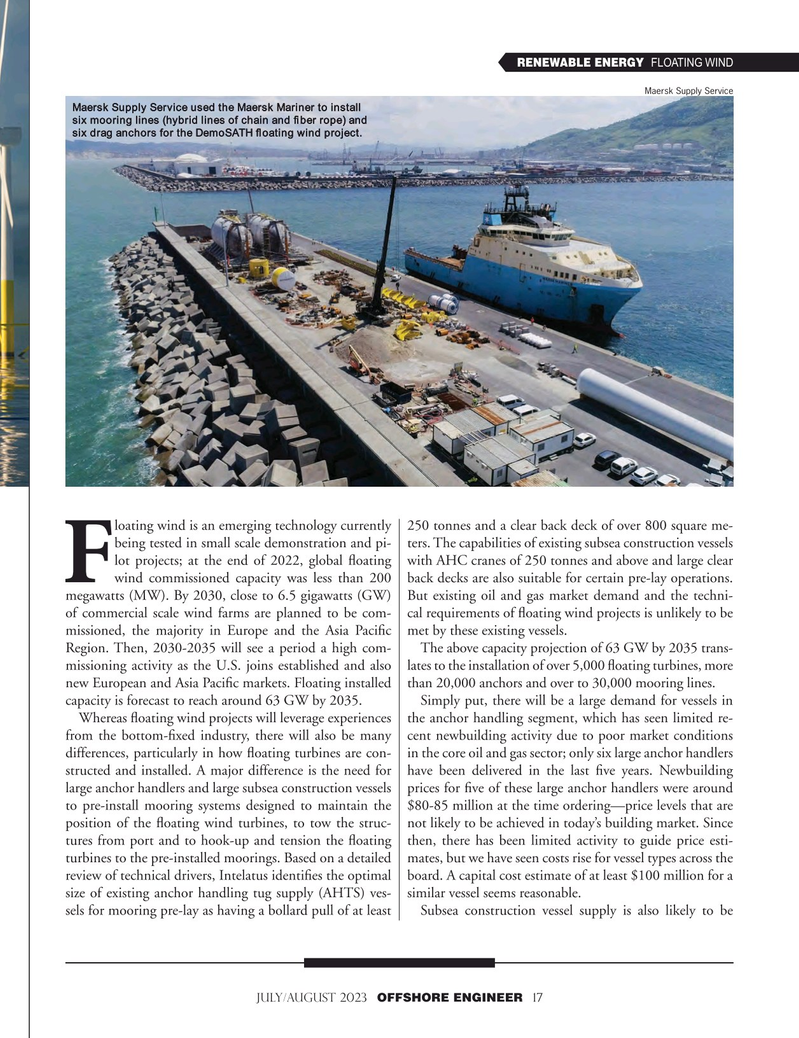

Maersk Supply Service used the Maersk Mariner to install six mooring lines (hybrid lines of chain and fber rope) and six drag anchors for the DemoSATH foating wind project. loating wind is an emerging technology currently 250 tonnes and a clear back deck of over 800 square me- being tested in small scale demonstration and pi- ters. The capabilities of existing subsea construction vessels lot projects; at the end of 2022, global foating with AHC cranes of 250 tonnes and above and large clear

Fwind commissioned capacity was less than 200 back decks are also suitable for certain pre-lay operations. megawatts (MW). By 2030, close to 6.5 gigawatts (GW) But existing oil and gas market demand and the techni- of commercial scale wind farms are planned to be com- cal requirements of foating wind projects is unlikely to be missioned, the majority in Europe and the Asia Pacifc met by these existing vessels.

Region. Then, 2030-2035 will see a period a high com- The above capacity projection of 63 GW by 2035 trans- missioning activity as the U.S. joins established and also lates to the installation of over 5,000 foating turbines, more new European and Asia Pacifc markets. Floating installed than 20,000 anchors and over to 30,000 mooring lines.

capacity is forecast to reach around 63 GW by 2035. Simply put, there will be a large demand for vessels in

Whereas foating wind projects will leverage experiences the anchor handling segment, which has seen limited re- from the bottom-fxed industry, there will also be many cent newbuilding activity due to poor market conditions differences, particularly in how foating turbines are con- in the core oil and gas sector; only six large anchor handlers structed and installed. A major difference is the need for have been delivered in the last fve years. Newbuilding large anchor handlers and large subsea construction vessels prices for fve of these large anchor handlers were around to pre-install mooring systems designed to maintain the $80-85 million at the time ordering—price levels that are position of the foating wind turbines, to tow the struc- not likely to be achieved in today’s building market. Since tures from port and to hook-up and tension the foating then, there has been limited activity to guide price esti- turbines to the pre-installed moorings. Based on a detailed mates, but we have seen costs rise for vessel types across the review of technical drivers, Intelatus identifes the optimal board. A capital cost estimate of at least $100 million for a size of existing anchor handling tug supply (AHTS) ves- similar vessel seems reasonable.

sels for mooring pre-lay as having a bollard pull of at least Subsea construction vessel supply is also likely to be july/august 2023 OFFSHORE ENGINEER 17

16

16

18

18