Page 11: of Offshore Engineer Magazine (Sep/Oct 2023)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2023 Offshore Engineer Magazine

MARKETS OFFSHORE DRILLING RIGS and newbuild ultra-deepwater seventh generation drillship

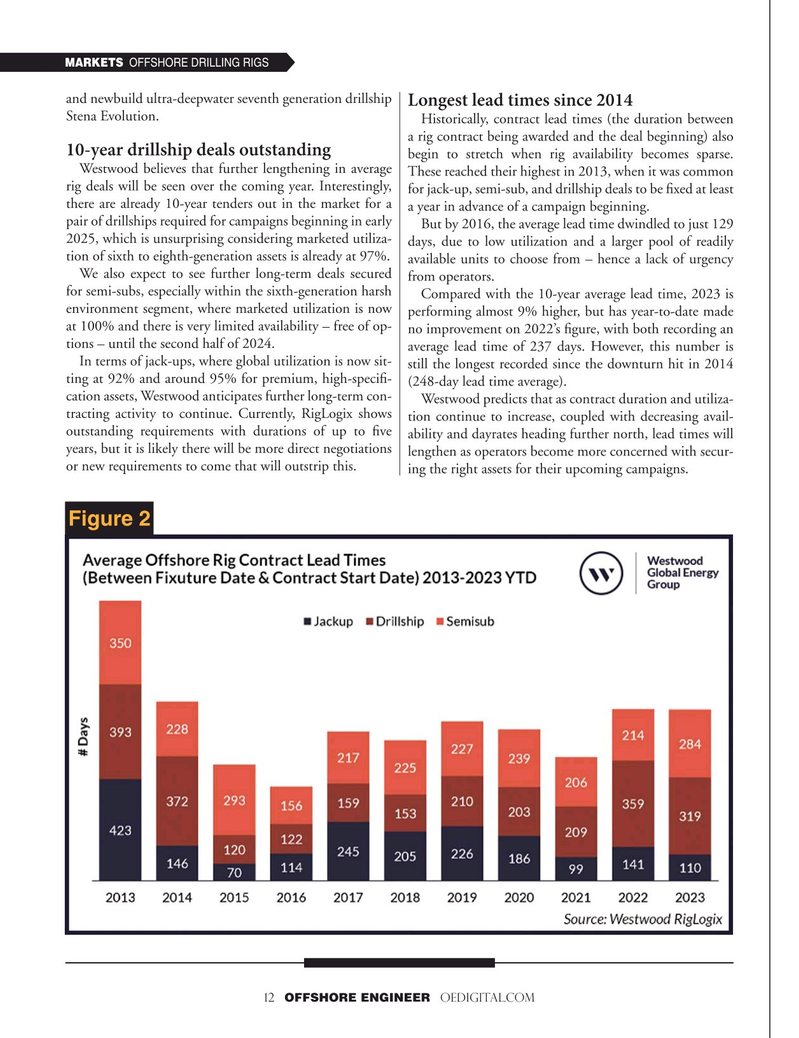

Longest lead times since 2014

Stena Evolution.

Historically, contract lead times (the duration between a rig contract being awarded and the deal beginning) also 10-year drillship deals outstanding begin to stretch when rig availability becomes sparse.

Westwood believes that further lengthening in average These reached their highest in 2013, when it was common rig deals will be seen over the coming year. Interestingly, for jack-up, semi-sub, and drillship deals to be ?xed at least there are already 10-year tenders out in the market for a a year in advance of a campaign beginning. pair of drillships required for campaigns beginning in early

But by 2016, the average lead time dwindled to just 129 2025, which is unsurprising considering marketed utiliza- days, due to low utilization and a larger pool of readily tion of sixth to eighth-generation assets is already at 97%. available units to choose from – hence a lack of urgency

We also expect to see further long-term deals secured from operators. for semi-subs, especially within the sixth-generation harsh

Compared with the 10-year average lead time, 2023 is environment segment, where marketed utilization is now performing almost 9% higher, but has year-to-date made at 100% and there is very limited availability – free of op- no improvement on 2022’s ?gure, with both recording an tions – until the second half of 2024. average lead time of 237 days. However, this number is

In terms of jack-ups, where global utilization is now sit- still the longest recorded since the downturn hit in 2014 ting at 92% and around 95% for premium, high-speci?- (248-day lead time average). cation assets, Westwood anticipates further long-term con-

Westwood predicts that as contract duration and utiliza- tracting activity to continue. Currently, RigLogix shows tion continue to increase, coupled with decreasing avail- outstanding requirements with durations of up to ?ve ability and dayrates heading further north, lead times will years, but it is likely there will be more direct negotiations lengthen as operators become more concerned with secur- or new requirements to come that will outstrip this. ing the right assets for their upcoming campaigns.

Figure 2 12 OFFSHORE ENGINEER OEDIGITAL.COM

10

10

12

12