Page 7: of Offshore Engineer Magazine (Nov/Dec 2023)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2023 Offshore Engineer Magazine

MARKETS OFFSHORE DRILLING RIGS

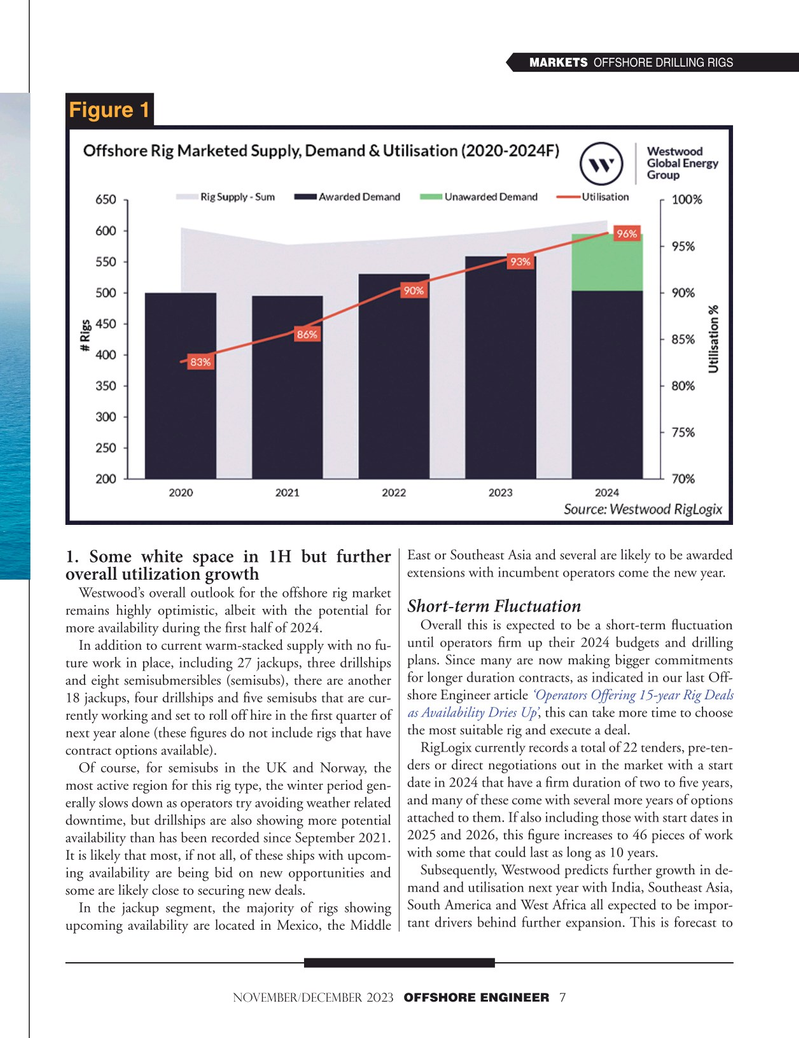

Figure 1

East or Southeast Asia and several are likely to be awarded 1. Some white space in 1H but further extensions with incumbent operators come the new year. overall utilization growth

Westwood’s overall outlook for the offshore rig market

Short-term Fluctuation remains highly optimistic, albeit with the potential for

Overall this is expected to be a short-term fuctuation more availability during the frst half of 2024. until operators frm up their 2024 budgets and drilling

In addition to current warm-stacked supply with no fu- ture work in place, including 27 jackups, three drillships plans. Since many are now making bigger commitments and eight semisubmersibles (semisubs), there are another for longer duration contracts, as indicated in our last Off- shore Engineer article ‘Operators Offering 15-year Rig Deals 18 jackups, four drillships and fve semisubs that are cur- rently working and set to roll off hire in the frst quarter of as Availability Dries Up’, this can take more time to choose next year alone (these fgures do not include rigs that have the most suitable rig and execute a deal.

RigLogix currently records a total of 22 tenders, pre-ten- contract options available).

Of course, for semisubs in the UK and Norway, the ders or direct negotiations out in the market with a start date in 2024 that have a frm duration of two to fve years, most active region for this rig type, the winter period gen- erally slows down as operators try avoiding weather related and many of these come with several more years of options downtime, but drillships are also showing more potential attached to them. If also including those with start dates in availability than has been recorded since September 2021. 2025 and 2026, this fgure increases to 46 pieces of work with some that could last as long as 10 years.

It is likely that most, if not all, of these ships with upcom-

Subsequently, Westwood predicts further growth in de- ing availability are being bid on new opportunities and mand and utilisation next year with India, Southeast Asia, some are likely close to securing new deals.

In the jackup segment, the majority of rigs showing South America and West Africa all expected to be impor- upcoming availability are located in Mexico, the Middle tant drivers behind further expansion. This is forecast to november/december 2023 OFFSHORE ENGINEER 7

6

6

8

8