Page 19: of Offshore Engineer Magazine (Jan/Feb 2024)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2024 Offshore Engineer Magazine

MARKETS FLOATING PRODUCTION he established foating production segment is forecast to experience continued growth through this decade, driving demand for, among other

T things, moorings, subsea systems, umbilicals, risers, fowlines and the large anchor handlers and subsea support vessels that will install and maintain the elements.

At the same time, the foating wind segment will move from demonstration and pilot-scale projects to pre-com- mercial and commercial-scale arrays and will consume large amounts of mooring components and dynamic elec- trical cables as well as the large anchor handler and subsea support vessel capacity that will install and maintain the elements.

Much of the new foating wind supply chain will lever- age the existing foating oil & gas supply chains. Players experienced in deepwater oil & gas operations, whether developers, EPCI contractors or component and service suppliers, will fnd a growing opportunity to leverage their skills in the emerging foating wind segment.

These are the fndings of a new whitepaper produced by Intelatus Global partners entitled “Floating Production and Floating Wind – increasingly close segments”.

A Growing Floating Production Segment

According to the latest Intelatus deepwater foating pro- duction forecast, foating production activity in the oil & gas sector is set to grow at an average 25 foaters per year through 2030, and the foundations are in place for contin- ued activity through the next decade.

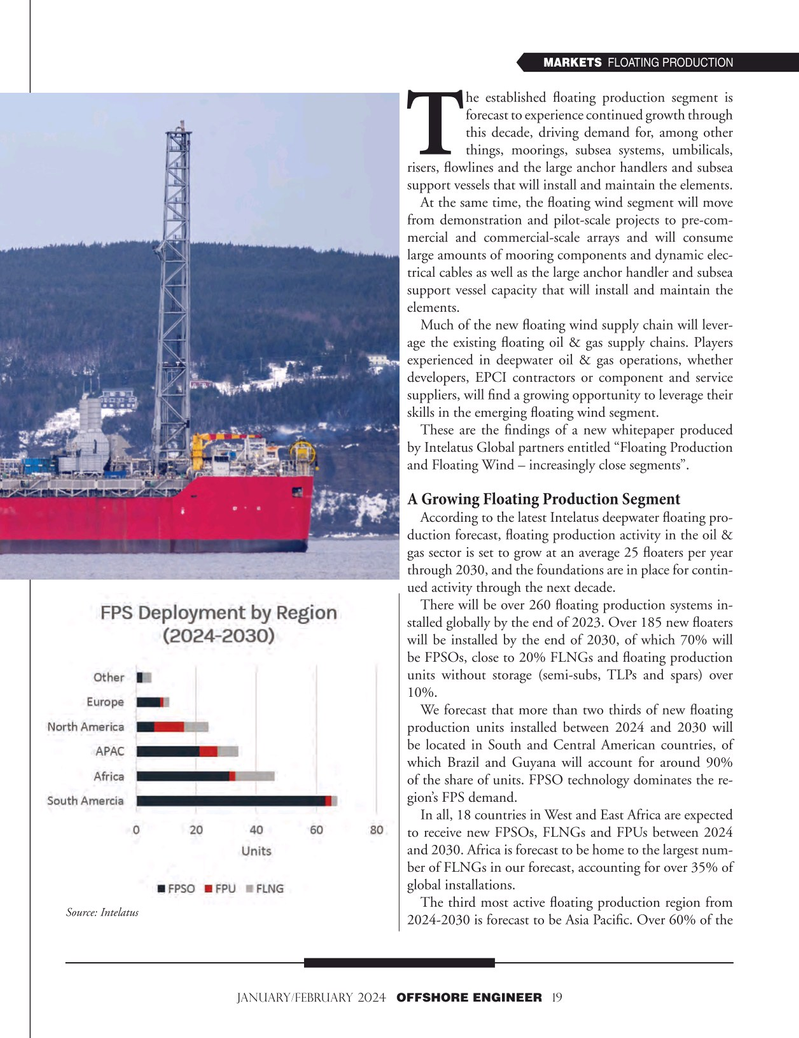

There will be over 260 foating production systems in- stalled globally by the end of 2023. Over 185 new foaters will be installed by the end of 2030, of which 70% will be FPSOs, close to 20% FLNGs and foating production units without storage (semi-subs, TLPs and spars) over 10%.

We forecast that more than two thirds of new foating production units installed between 2024 and 2030 will be located in South and Central American countries, of which Brazil and Guyana will account for around 90% of the share of units. FPSO technology dominates the re- gion’s FPS demand.

In all, 18 countries in West and East Africa are expected to receive new FPSOs, FLNGs and FPUs between 2024 and 2030. Africa is forecast to be home to the largest num- ber of FLNGs in our forecast, accounting for over 35% of global installations.

The third most active foating production region from

Source: Intelatus 2024-2030 is forecast to be Asia Pacifc. Over 60% of the january/february 2024 OFFSHORE ENGINEER 19

18

18

20

20