Page 11: of Offshore Engineer Magazine (Mar/Apr 2024)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2024 Offshore Engineer Magazine

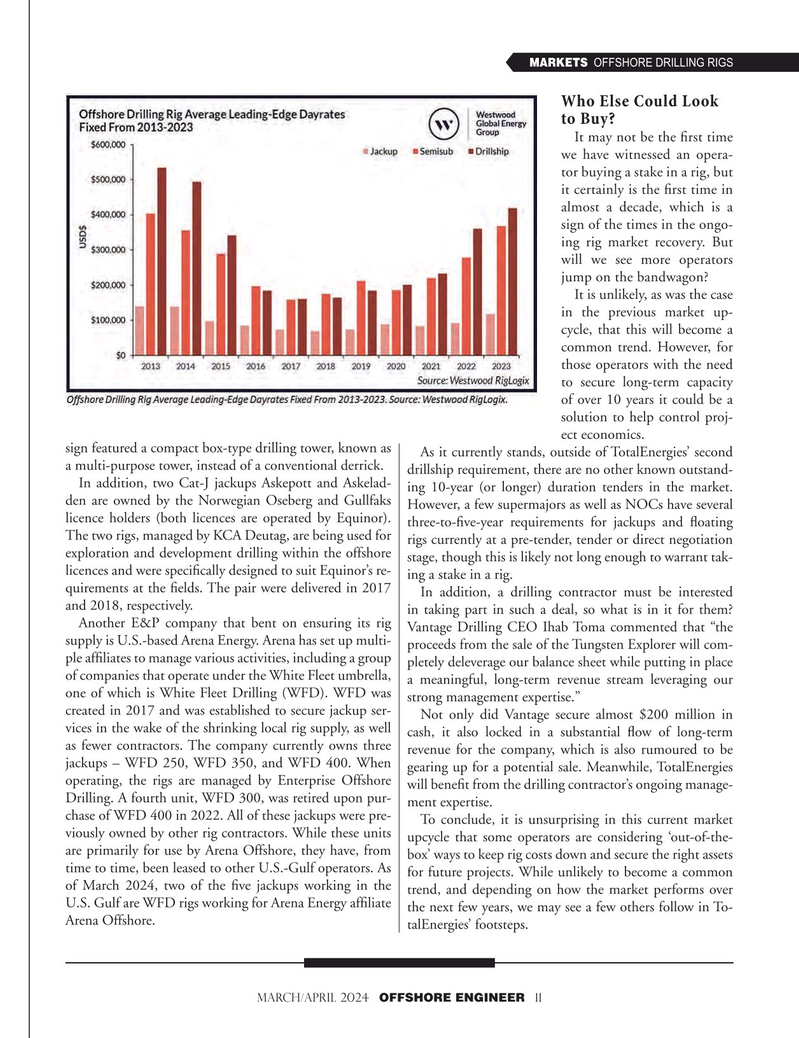

MARKETS OFFSHORE DRILLING RIGS

Who Else Could Look to Buy?

It may not be the frst time we have witnessed an opera- tor buying a stake in a rig, but it certainly is the frst time in almost a decade, which is a sign of the times in the ongo- ing rig market recovery. But will we see more operators jump on the bandwagon?

It is unlikely, as was the case in the previous market up- cycle, that this will become a common trend. However, for those operators with the need to secure long-term capacity of over 10 years it could be a solution to help control proj- ect economics. sign featured a compact box-type drilling tower, known as

As it currently stands, outside of TotalEnergies’ second a multi-purpose tower, instead of a conventional derrick. drillship requirement, there are no other known outstand-

In addition, two Cat-J jackups Askepott and Askelad- ing 10-year (or longer) duration tenders in the market. den are owned by the Norwegian Oseberg and Gullfaks However, a few supermajors as well as NOCs have several licence holders (both licences are operated by Equinor). three-to-fve-year requirements for jackups and foating

The two rigs, managed by KCA Deutag, are being used for rigs currently at a pre-tender, tender or direct negotiation exploration and development drilling within the offshore stage, though this is likely not long enough to warrant tak- licences and were specifcally designed to suit Equinor’s re- ing a stake in a rig. quirements at the felds. The pair were delivered in 2017

In addition, a drilling contractor must be interested and 2018, respectively. in taking part in such a deal, so what is in it for them?

Another E&P company that bent on ensuring its rig Vantage Drilling CEO Ihab Toma commented that “the supply is U.S.-based Arena Energy. Arena has set up multi- proceeds from the sale of the Tungsten Explorer will com- ple affliates to manage various activities, including a group pletely deleverage our balance sheet while putting in place of companies that operate under the White Fleet umbrella, a meaningful, long-term revenue stream leveraging our one of which is White Fleet Drilling (WFD). WFD was strong management expertise.” created in 2017 and was established to secure jackup ser-

Not only did Vantage secure almost $200 million in vices in the wake of the shrinking local rig supply, as well cash, it also locked in a substantial fow of long-term as fewer contractors. The company currently owns three revenue for the company, which is also rumoured to be jackups – WFD 250, WFD 350, and WFD 400. When gearing up for a potential sale. Meanwhile, TotalEnergies operating, the rigs are managed by Enterprise Offshore will beneft from the drilling contractor’s ongoing manage-

Drilling. A fourth unit, WFD 300, was retired upon pur- ment expertise. chase of WFD 400 in 2022. All of these jackups were pre-

To conclude, it is unsurprising in this current market viously owned by other rig contractors. While these units upcycle that some operators are considering ‘out-of-the- are primarily for use by Arena Offshore, they have, from box’ ways to keep rig costs down and secure the right assets time to time, been leased to other U.S.-Gulf operators. As for future projects. While unlikely to become a common of March 2024, two of the fve jackups working in the trend, and depending on how the market performs over

U.S. Gulf are WFD rigs working for Arena Energy affliate the next few years, we may see a few others follow in To-

Arena Offshore.

talEnergies’ footsteps.

MARCH/APRIL 2024 OFFSHORE ENGINEER 11

10

10

12

12