Page 23: of Offshore Engineer Magazine (May/Jun 2024)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2024 Offshore Engineer Magazine

MARKETS OFFSHORE SUPPORT VESSELS (OSV) here are solid underlying fundamentals that

North Sea Demand Flat, are driving the increased vessel demand, chief

While Other Regions Record Rise among them is the increased offshore upstream

The implications thus vary depending on the region in

Tinvestment on a global level. Overall, spending question, and in the North Sea basin, for example, we fnd on exploration and production is set to increase roughly that vessel demand has remained stagnant with fat devel- 45% from 2021 to 2025, reaching a total of almost $200 opment in recent years. Moreover, the increased dayrates billion in the latter year.

herein has come about as a result of fewer vessels both active

Although this increased spending has translated into in- and in the feet as a whole, and in fact, the current OSV feet creased offshore activity as a whole, it should be noted that it in this region is at its lowest in well over a decade. has not hit all vessel segments equally, even among offshore

In both the Southeast Asian and Middle East regions drilling rigs. In fact, while the number of jackup drilling rigs the opposite is true, wherein the number of working units under contract has risen in accordance with increased in- has grown signifcantly, and the latter is currently at an all- vestments, the same cannot be said for foating drilling rigs. time high level. Despite this, dayrates in the Persian Gulf

As such, the OSV demand derived from E&P drilling has has yet to materialize to the same degree as seen elsewhere. developed accordingly, where benign and shallow-water re-

Granted, this is in large part due to the sever market share gions, typically dominated by high volume yet low capacity of government-controlled players throughout the supply

AHTS units, have seen the largest increase in terms of incre- chain, yet also as a result of persistently high vessel avail- mental demand. For deepwater and ultra-deepwater regions, ability for most asset classes.

we record a transition towards high-capacity ships, although

In both Brazil and off West Africa on the other hand, herein we also take note of a signifcant shift to subsea feld the dayrates has increased tremendously thus far in the up- developments as opposed to conventional infrastructure. cycle brought on by a combination of both a distinct lack

Finally, as several offshore oil and gas regions have and of suitable tonnage as well as higher vessel demand. More- will come into maturity, we register that there is a relatively over, as these areas are facing a shortage of local vessels to higher growth for production support more than explora- support the activity hikes, we have seen a large number of tion derived operations, thus favouring assets focused on ships mobilized from other regions, offering lucrative op- the former. These trends both have and will continue to portunities for international OSV owners. shape the vessel landscape as the ongoing trends are ex-

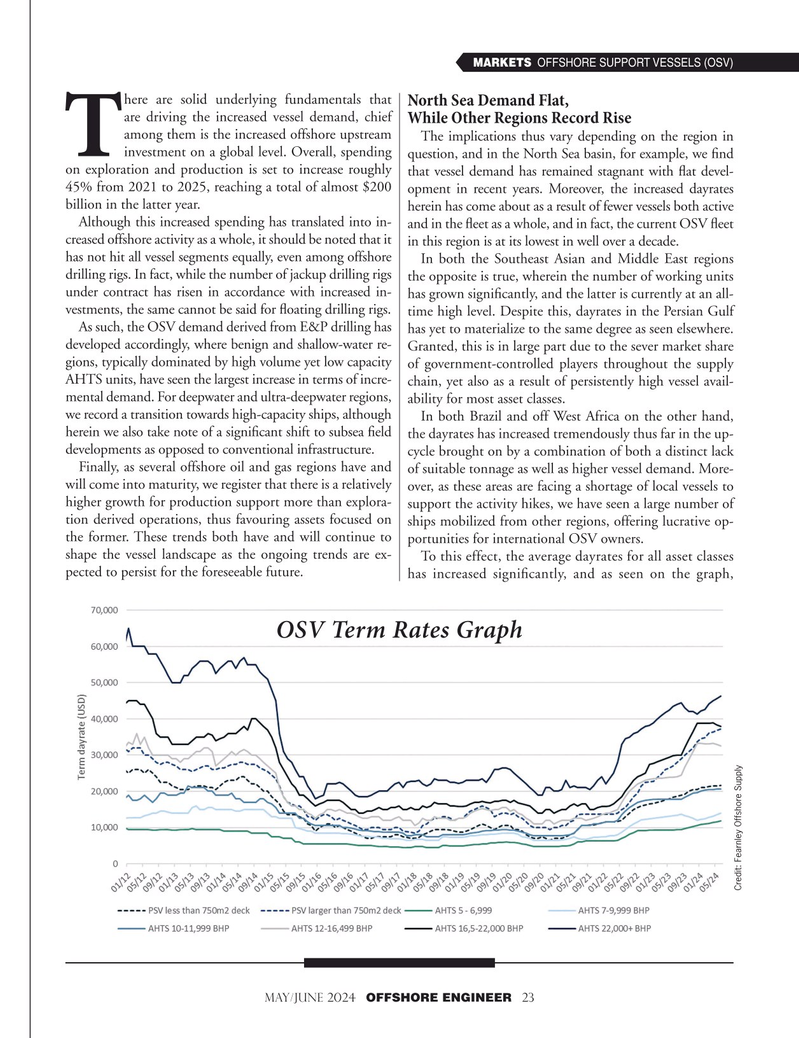

To this effect, the average dayrates for all asset classes pected to persist for the foreseeable future.

has increased signifcantly, and as seen on the graph,

OSV Term Rates Graph

Credit: Fearnley Offshore Supply

MAy/june 2024 OFFSHORE ENGINEER 23

22

22

24

24