Page 40: of Offshore Engineer Magazine (May/Jun 2024)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2024 Offshore Engineer Magazine

OFFSHORE WIND SHOW ME THE MONEY

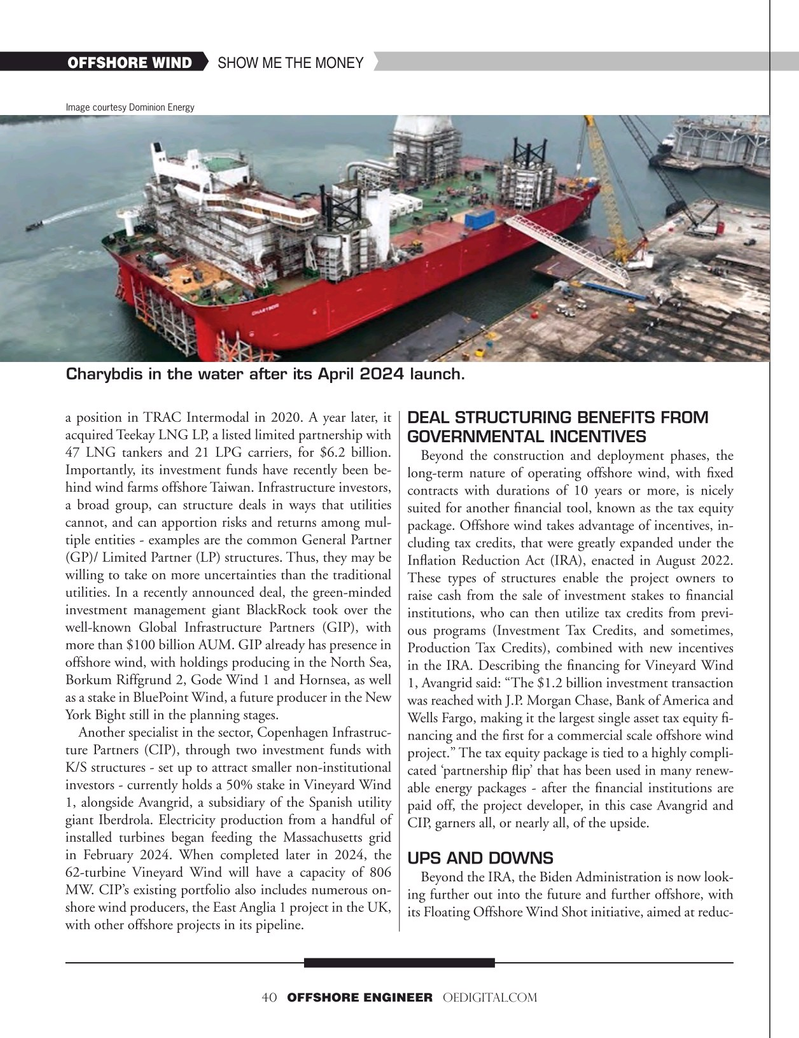

Image courtesy Dominion Energy

Charybdis in the water after its April 2024 launch.

a position in TRAC Intermodal in 2020. A year later, it

DEAL STRUCTURING BENEFITS FROM acquired Teekay LNG LP, a listed limited partnership with

GOVERNMENTAL INCENTIVES 47 LNG tankers and 21 LPG carriers, for $6.2 billion.

Beyond the construction and deployment phases, the

Importantly, its investment funds have recently been be- long-term nature of operating offshore wind, with fxed hind wind farms offshore Taiwan. Infrastructure investors, contracts with durations of 10 years or more, is nicely a broad group, can structure deals in ways that utilities suited for another fnancial tool, known as the tax equity cannot, and can apportion risks and returns among mul- package. Offshore wind takes advantage of incentives, in- tiple entities - examples are the common General Partner cluding tax credits, that were greatly expanded under the (GP)/ Limited Partner (LP) structures. Thus, they may be Infation Reduction Act (IRA), enacted in August 2022. willing to take on more uncertainties than the traditional These types of structures enable the project owners to utilities. In a recently announced deal, the green-minded raise cash from the sale of investment stakes to fnancial investment management giant BlackRock took over the institutions, who can then utilize tax credits from previ- well-known Global Infrastructure Partners (GIP), with ous programs (Investment Tax Credits, and sometimes, more than $100 billion AUM. GIP already has presence in Production Tax Credits), combined with new incentives offshore wind, with holdings producing in the North Sea, in the IRA. Describing the fnancing for Vineyard Wind

Borkum Riffgrund 2, Gode Wind 1 and Hornsea, as well 1, Avangrid said: “The $1.2 billion investment transaction as a stake in BluePoint Wind, a future producer in the New was reached with J.P. Morgan Chase, Bank of America and

York Bight still in the planning stages.

Wells Fargo, making it the largest single asset tax equity f-

Another specialist in the sector, Copenhagen Infrastruc- nancing and the frst for a commercial scale offshore wind ture Partners (CIP), through two investment funds with project.” The tax equity package is tied to a highly compli-

K/S structures - set up to attract smaller non-institutional cated ‘partnership fip’ that has been used in many renew- investors - currently holds a 50% stake in Vineyard Wind able energy packages - after the fnancial institutions are 1, alongside Avangrid, a subsidiary of the Spanish utility paid off, the project developer, in this case Avangrid and giant Iberdrola. Electricity production from a handful of CIP, garners all, or nearly all, of the upside. installed turbines began feeding the Massachusetts grid in February 2024. When completed later in 2024, the

UPS AND DOWNS 62-turbine Vineyard Wind will have a capacity of 806

Beyond the IRA, the Biden Administration is now look-

MW. CIP’s existing portfolio also includes numerous on- ing further out into the future and further offshore, with shore wind producers, the East Anglia 1 project in the UK, its Floating Offshore Wind Shot initiative, aimed at reduc- with other offshore projects in its pipeline. 40 OFFSHORE ENGINEER OEDIGITAL.COM

39

39

41

41