Page 19: of Offshore Engineer Magazine (Nov/Dec 2024)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2024 Offshore Engineer Magazine

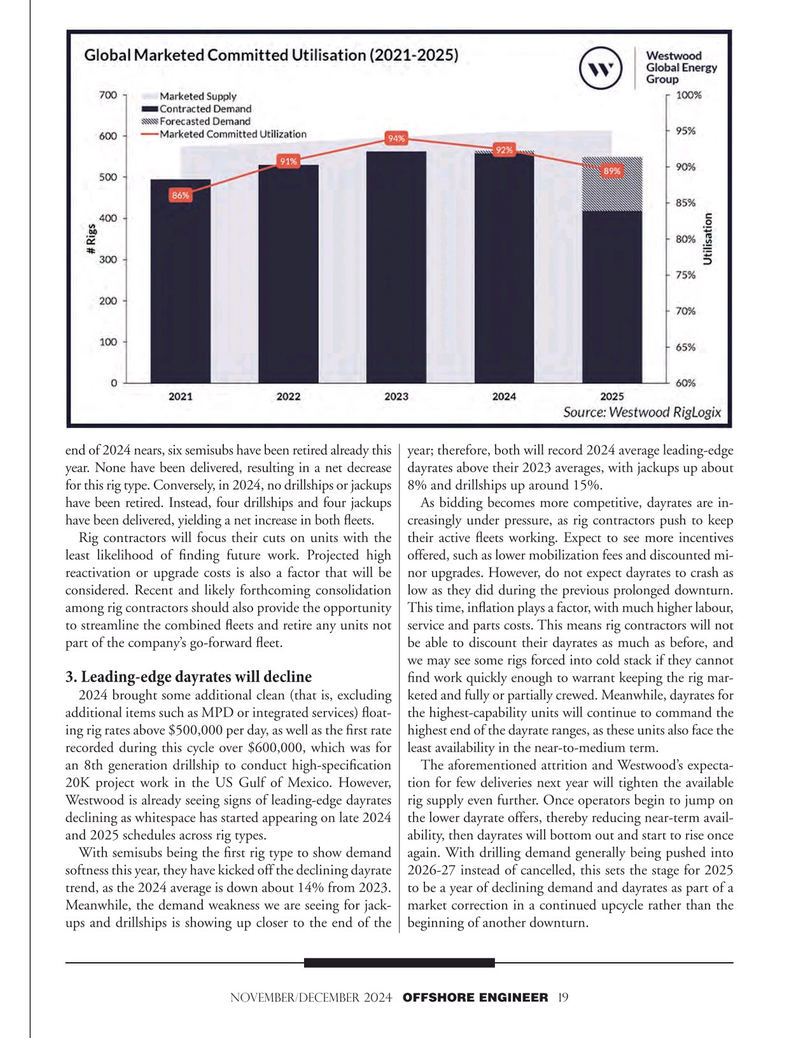

end of 2024 nears, six semisubs have been retired already this year; therefore, both will record 2024 average leading-edge year. None have been delivered, resulting in a net decrease dayrates above their 2023 averages, with jackups up about for this rig type. Conversely, in 2024, no drillships or jackups 8% and drillships up around 15%.

have been retired. Instead, four drillships and four jackups As bidding becomes more competitive, dayrates are in- have been delivered, yielding a net increase in both feets. creasingly under pressure, as rig contractors push to keep

Rig contractors will focus their cuts on units with the their active feets working. Expect to see more incentives least likelihood of fnding future work. Projected high offered, such as lower mobilization fees and discounted mi- reactivation or upgrade costs is also a factor that will be nor upgrades. However, do not expect dayrates to crash as considered. Recent and likely forthcoming consolidation low as they did during the previous prolonged downturn. among rig contractors should also provide the opportunity This time, infation plays a factor, with much higher labour, to streamline the combined feets and retire any units not service and parts costs. This means rig contractors will not part of the company’s go-forward feet. be able to discount their dayrates as much as before, and we may see some rigs forced into cold stack if they cannot fnd work quickly enough to warrant keeping the rig mar- 3. Leading-edge dayrates will decline 2024 brought some additional clean (that is, excluding keted and fully or partially crewed. Meanwhile, dayrates for additional items such as MPD or integrated services) foat- the highest-capability units will continue to command the ing rig rates above $500,000 per day, as well as the frst rate highest end of the dayrate ranges, as these units also face the recorded during this cycle over $600,000, which was for least availability in the near-to-medium term.

an 8th generation drillship to conduct high-specifcation The aforementioned attrition and Westwood’s expecta- 20K project work in the US Gulf of Mexico. However, tion for few deliveries next year will tighten the available

Westwood is already seeing signs of leading-edge dayrates rig supply even further. Once operators begin to jump on declining as whitespace has started appearing on late 2024 the lower dayrate offers, thereby reducing near-term avail- and 2025 schedules across rig types. ability, then dayrates will bottom out and start to rise once

With semisubs being the frst rig type to show demand again. With drilling demand generally being pushed into softness this year, they have kicked off the declining dayrate 2026-27 instead of cancelled, this sets the stage for 2025 trend, as the 2024 average is down about 14% from 2023. to be a year of declining demand and dayrates as part of a

Meanwhile, the demand weakness we are seeing for jack- market correction in a continued upcycle rather than the ups and drillships is showing up closer to the end of the beginning of another downturn.

november/december 2024 OFFSHORE ENGINEER 19

18

18

20

20