Page 10: of Offshore Engineer Magazine (Jan/Feb 2025)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2025 Offshore Engineer Magazine

MARKETS OSVs

In OSVs, All Asset

Segments are Not

Created Equal

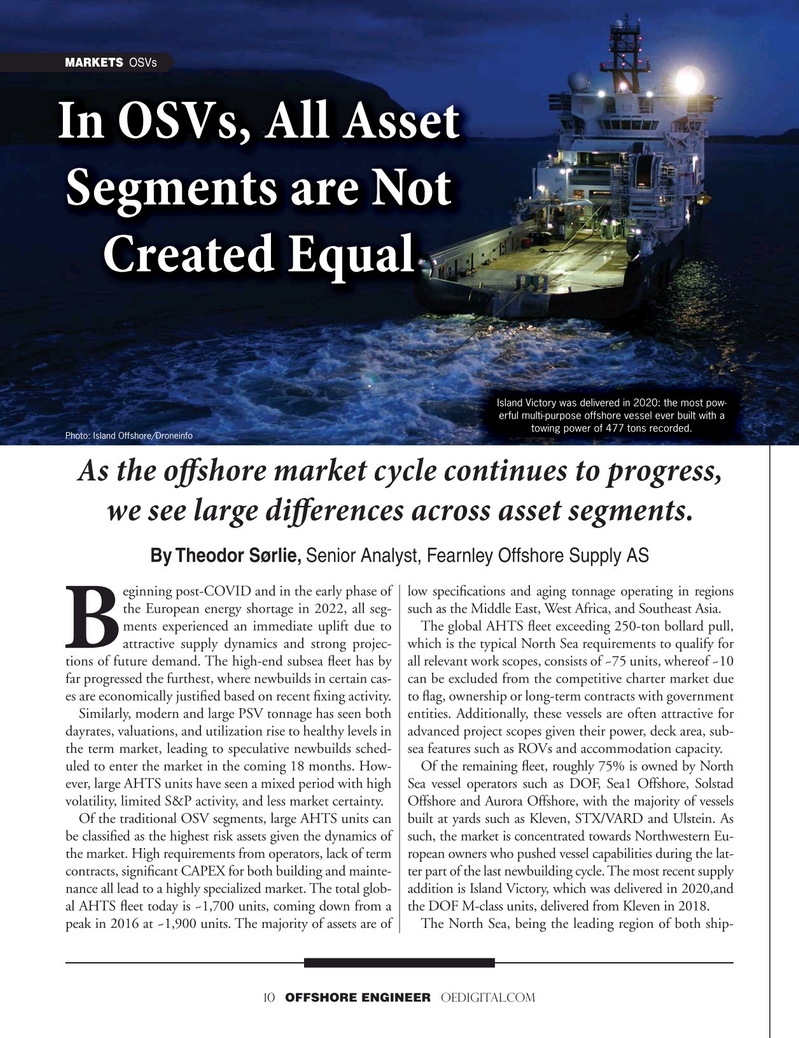

Island Victory was delivered in 2020: the most pow- erful multi-purpose offshore vessel ever built with a towing power of 477 tons recorded.

Photo: Island Offshore/Droneinfo

As the ofshore market cycle continues to progress, we see large diferences across asset segments.

By Theodor Sørlie, Senior Analyst, Fearnley Offshore Supply AS eginning post-COVID and in the early phase of low speci?cations and aging tonnage operating in regions the European energy shortage in 2022, all seg- such as the Middle East, West Africa, and Southeast Asia. ments experienced an immediate uplift due to The global AHTS ?eet exceeding 250-ton bollard pull,

Battractive supply dynamics and strong projec- which is the typical North Sea requirements to qualify for tions of future demand. The high-end subsea ?eet has by all relevant work scopes, consists of ~75 units, whereof ~10 far progressed the furthest, where newbuilds in certain cas- can be excluded from the competitive charter market due es are economically justi?ed based on recent ?xing activity. to ?ag, ownership or long-term contracts with government

Similarly, modern and large PSV tonnage has seen both entities. Additionally, these vessels are often attractive for dayrates, valuations, and utilization rise to healthy levels in advanced project scopes given their power, deck area, sub- the term market, leading to speculative newbuilds sched- sea features such as ROVs and accommodation capacity. uled to enter the market in the coming 18 months. How- Of the remaining ?eet, roughly 75% is owned by North ever, large AHTS units have seen a mixed period with high Sea vessel operators such as DOF, Sea1 Offshore, Solstad volatility, limited S&P activity, and less market certainty. Offshore and Aurora Offshore, with the majority of vessels

Of the traditional OSV segments, large AHTS units can built at yards such as Kleven, STX/VARD and Ulstein. As be classi?ed as the highest risk assets given the dynamics of such, the market is concentrated towards Northwestern Eu- the market. High requirements from operators, lack of term ropean owners who pushed vessel capabilities during the lat- contracts, signi?cant CAPEX for both building and mainte- ter part of the last newbuilding cycle. The most recent supply nance all lead to a highly specialized market. The total glob- addition is Island Victory, which was delivered in 2020,and al AHTS ?eet today is ~1,700 units, coming down from a the DOF M-class units, delivered from Kleven in 2018. peak in 2016 at ~1,900 units. The majority of assets are of The North Sea, being the leading region of both ship- 10 OFFSHORE ENGINEER OEDIGITAL.COM

9

9

11

11