Page 17: of Offshore Engineer Magazine (Mar/Apr 2025)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2025 Offshore Engineer Magazine

MARKETS DRILLSHIPS which is to be converted for deep-sea mining. Meanwhile,

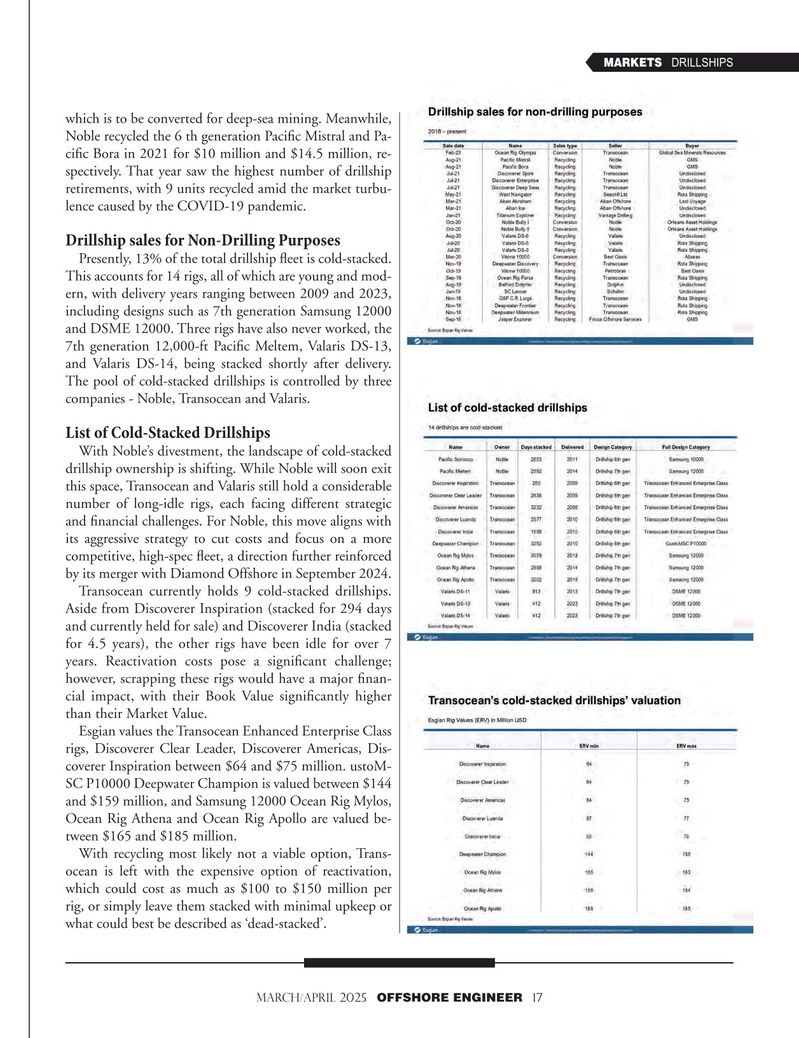

Noble recycled the 6 th generation Pacifc Mistral and Pa- cifc Bora in 2021 for $10 million and $14.5 million, re- spectively. That year saw the highest number of drillship retirements, with 9 units recycled amid the market turbu- lence caused by the COVID-19 pandemic.

Drillship sales for Non-Drilling Purposes

Presently, 13% of the total drillship feet is cold-stacked.

This accounts for 14 rigs, all of which are young and mod- ern, with delivery years ranging between 2009 and 2023, including designs such as 7th generation Samsung 12000 and DSME 12000. Three rigs have also never worked, the 7th generation 12,000-ft Pacifc Meltem, Valaris DS-13, and Valaris DS-14, being stacked shortly after delivery.

The pool of cold-stacked drillships is controlled by three companies - Noble, Transocean and Valaris.

List of Cold-Stacked Drillships

With Noble’s divestment, the landscape of cold-stacked drillship ownership is shifting. While Noble will soon exit this space, Transocean and Valaris still hold a considerable number of long-idle rigs, each facing different strategic and fnancial challenges. For Noble, this move aligns with its aggressive strategy to cut costs and focus on a more competitive, high-spec feet, a direction further reinforced by its merger with Diamond Offshore in September 2024.

Transocean currently holds 9 cold-stacked drillships.

Aside from Discoverer Inspiration (stacked for 294 days and currently held for sale) and Discoverer India (stacked for 4.5 years), the other rigs have been idle for over 7 years. Reactivation costs pose a signifcant challenge; however, scrapping these rigs would have a major fnan- cial impact, with their Book Value signifcantly higher than their Market Value.

Esgian values the Transocean Enhanced Enterprise Class rigs, Discoverer Clear Leader, Discoverer Americas, Dis- coverer Inspiration between $64 and $75 million. ustoM-

SC P10000 Deepwater Champion is valued between $144 and $159 million, and Samsung 12000 Ocean Rig Mylos,

Ocean Rig Athena and Ocean Rig Apollo are valued be- tween $165 and $185 million.

With recycling most likely not a viable option, Trans- ocean is left with the expensive option of reactivation, which could cost as much as $100 to $150 million per rig, or simply leave them stacked with minimal upkeep or what could best be described as ‘dead-stacked’.

march/april 2025 OFFSHORE ENGINEER 17

16

16

18

18