Page 22: of Offshore Engineer Magazine (Mar/Apr 2025)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2025 Offshore Engineer Magazine

MARKETS RIGS

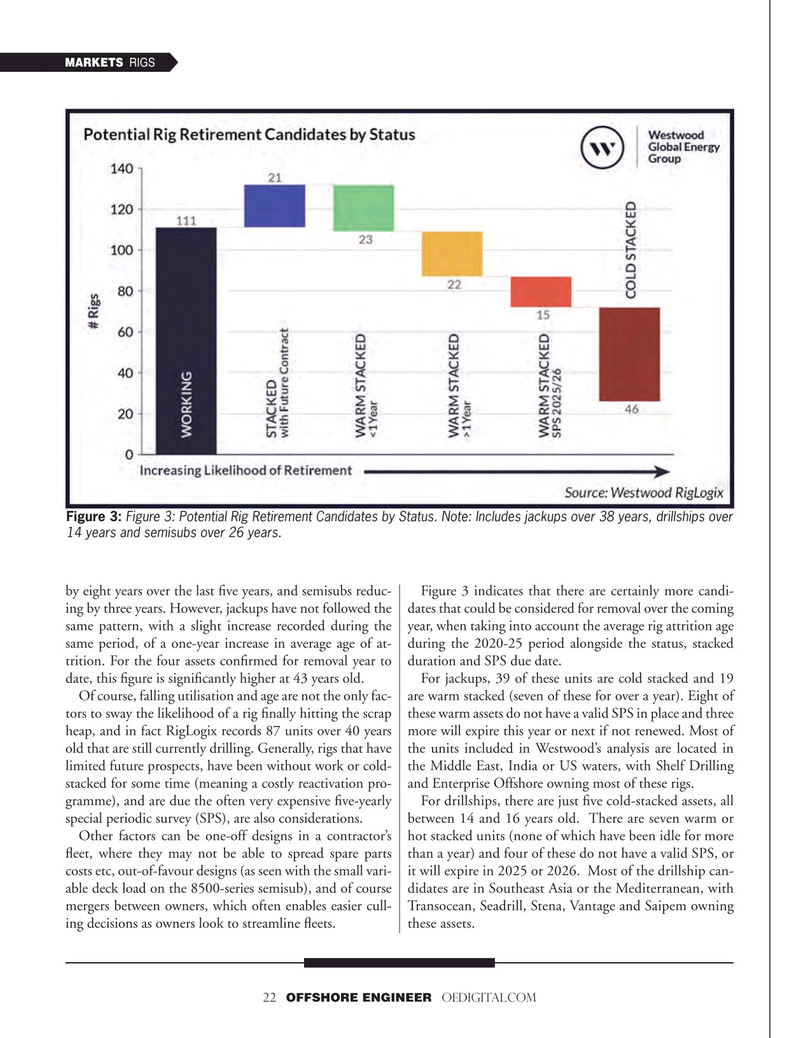

Figure 3: Figure 3: Potential Rig Retirement Candidates by Status. Note: Includes jackups over 38 years, drillships over 14 years and semisubs over 26 years. by eight years over the last fve years, and semisubs reduc- Figure 3 indicates that there are certainly more candi- ing by three years. However, jackups have not followed the dates that could be considered for removal over the coming same pattern, with a slight increase recorded during the year, when taking into account the average rig attrition age same period, of a one-year increase in average age of at- during the 2020-25 period alongside the status, stacked trition. For the four assets confrmed for removal year to duration and SPS due date.

date, this fgure is signifcantly higher at 43 years old. For jackups, 39 of these units are cold stacked and 19

Of course, falling utilisation and age are not the only fac- are warm stacked (seven of these for over a year). Eight of tors to sway the likelihood of a rig fnally hitting the scrap these warm assets do not have a valid SPS in place and three heap, and in fact RigLogix records 87 units over 40 years more will expire this year or next if not renewed. Most of old that are still currently drilling. Generally, rigs that have the units included in Westwood’s analysis are located in limited future prospects, have been without work or cold- the Middle East, India or US waters, with Shelf Drilling stacked for some time (meaning a costly reactivation pro- and Enterprise Offshore owning most of these rigs. gramme), and are due the often very expensive fve-yearly For drillships, there are just fve cold-stacked assets, all special periodic survey (SPS), are also considerations. between 14 and 16 years old. There are seven warm or

Other factors can be one-off designs in a contractor’s hot stacked units (none of which have been idle for more feet, where they may not be able to spread spare parts than a year) and four of these do not have a valid SPS, or costs etc, out-of-favour designs (as seen with the small vari- it will expire in 2025 or 2026. Most of the drillship can- able deck load on the 8500-series semisub), and of course didates are in Southeast Asia or the Mediterranean, with mergers between owners, which often enables easier cull- Transocean, Seadrill, Stena, Vantage and Saipem owning ing decisions as owners look to streamline feets. these assets. 22 OFFSHORE ENGINEER OEDIGITAL.COM

21

21

23

23