Page 17: of Offshore Engineer Magazine (Jul/Aug 2025)

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2025 Offshore Engineer Magazine

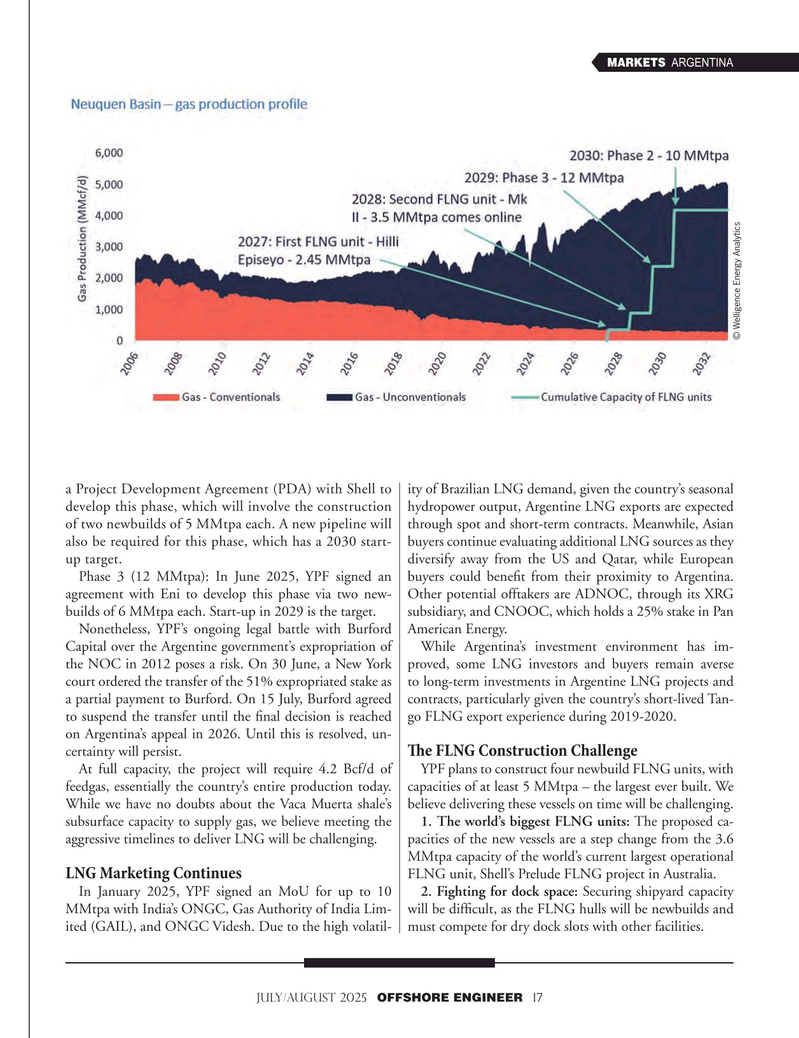

MARKETS ARGENTINA © Welligence Energy Analytics a Project Development Agreement (PDA) with Shell to ity of Brazilian LNG demand, given the country’s seasonal develop this phase, which will involve the construction hydropower output, Argentine LNG exports are expected of two newbuilds of 5 MMtpa each. A new pipeline will through spot and short-term contracts. Meanwhile, Asian also be required for this phase, which has a 2030 start- buyers continue evaluating additional LNG sources as they up target. diversify away from the US and Qatar, while European

Phase 3 (12 MMtpa): In June 2025, YPF signed an buyers could beneft from their proximity to Argentina. agreement with Eni to develop this phase via two new- Other potential offtakers are ADNOC, through its XRG builds of 6 MMtpa each. Start-up in 2029 is the target. subsidiary, and CNOOC, which holds a 25% stake in Pan

Nonetheless, YPF’s ongoing legal battle with Burford American Energy.

Capital over the Argentine government’s expropriation of While Argentina’s investment environment has im- the NOC in 2012 poses a risk. On 30 June, a New York proved, some LNG investors and buyers remain averse court ordered the transfer of the 51% expropriated stake as to long-term investments in Argentine LNG projects and a partial payment to Burford. On 15 July, Burford agreed contracts, particularly given the country’s short-lived Tan- to suspend the transfer until the fnal decision is reached go FLNG export experience during 2019-2020.

on Argentina’s appeal in 2026. Until this is resolved, un-

Te FLNG Construction Challenge certainty will persist.

At full capacity, the project will require 4.2 Bcf/d of YPF plans to construct four newbuild FLNG units, with feedgas, essentially the country’s entire production today. capacities of at least 5 MMtpa – the largest ever built. We

While we have no doubts about the Vaca Muerta shale’s believe delivering these vessels on time will be challenging.

subsurface capacity to supply gas, we believe meeting the 1. The world’s biggest FLNG units: The proposed ca- aggressive timelines to deliver LNG will be challenging. pacities of the new vessels are a step change from the 3.6

MMtpa capacity of the world’s current largest operational

FLNG unit, Shell’s Prelude FLNG project in Australia.

LNG Marketing Continues

In January 2025, YPF signed an MoU for up to 10 2. Fighting for dock space: Securing shipyard capacity

MMtpa with India’s ONGC, Gas Authority of India Lim- will be diffcult, as the FLNG hulls will be newbuilds and ited (GAIL), and ONGC Videsh. Due to the high volatil- must compete for dry dock slots with other facilities.

JULY/AUGUST 2025 OFFSHORE ENGINEER 17

16

16

18

18