US Inland Waterways: Looking for Rainmakers

As 2022 moves into its final months, low water levels and drought form the basis of the news impacting inland waterways operators and barge companies. In the first week of October, numerous barges were reported grounded in the Mississippi River, particularly south of Baton Rouge. This has consequences: barge rates jumped 218% in St. Louis, compared to 2021.

Low water was so severe that on October 7 Ingram Barge CEO John Roberts issued a force majeure notice (force majeure - unforeseeable circumstances that prevent someone from fulfilling a contract).

“Chronic low water conditions throughout the inland river system have had a negative effect on many who rely on the river, including Ingram Barge. We informed customers yesterday that given the difficult operating conditions posed by this low water, we were providing formal notice of a force majeure event—namely that circumstances out of our control were preventing normal river transport operations in certain areas. We want to emphasize that this only affects a limited part of our operating network—points below Baton Rouge, La. We anticipate that available barge supply in the affected area will improve in the coming days."

“We informed customers [October 6] that given the difficult operating conditions posed by this low water, we were providing formal notice of a force majeure event—namely that circumstances out of our control were preventing normal river transport operations in certain areas.” - John Roberts, Ingram Barge Company President & CEO. (Photo: Ingram Barge Company)

“We informed customers [October 6] that given the difficult operating conditions posed by this low water, we were providing formal notice of a force majeure event—namely that circumstances out of our control were preventing normal river transport operations in certain areas.” - John Roberts, Ingram Barge Company President & CEO. (Photo: Ingram Barge Company)

Forecasts were grim. Extended streamflow predictions from the National Weather Service (NWS) showed nothing but declines through the first week of November for the lower Mississippi from Cape Girardeau to New Orleans.

Jeff Graschel is a hydrologist with the NWS Lower Mississippi River Forecast Center. He said that based on the center’s 28-day forecasts water levels this year could reach the extremely low levels experienced in 2012. Graschel said that hurricane Ian poured a lot of water into eastern portions of the Ohio River system. After the first week in October that water was reaching Cairo, Ill. Graschel said it then takes about 10 days for water from Cairo to reach New Orleans. However, even from a hurricane, this is just a drop in the proverbial bucket, not a replacement for normal rainfall events.

Graschel was asked about reservoirs and when and how they contribute to river levels. He explained that dams and reservoirs on tributaries are regulated locally, not for the system as a whole. He said the Corp of Engineers (COE) decides how much water can be released, an analysis that includes factors beyond navigation, such as electricity generation, agriculture, drinking water and recreation.

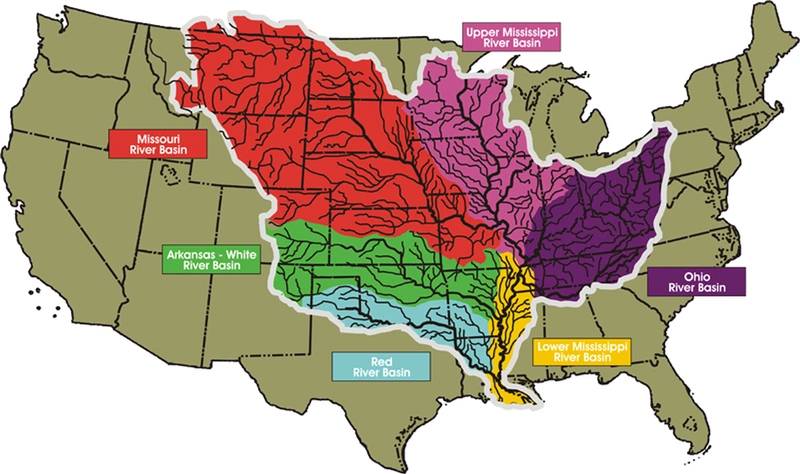

NWS provides data for Reservoir Water Supply Information. In relatively northern reservoirs, e.g., in Kentucky and Tennessee, water levels are high but, again, that status doesn’t directly impact release rates and volumes and, eventually, the lower Mississippi. Water levels on other waterways, such as the Tennessee system, were at targeted channel depths. However, the scale of those operations does not match the Mississippi, which is particularly critical during harvest season.

(Image: Mississippi River Commission)

(Image: Mississippi River Commission)

Missouri River draft AOP

As this article goes to press water policy issues are in the planning stage within the Missouri River Water Management Division which is developing its 2022-2023 Annual Operating Plan (AOP) for the 2,341 miles long Missouri, which flows into the Mississippi at St. Louis (the Missouri is the longest river on the continent; about 100 miles longer than the Mississippi). The Missouri Division and the Columbia River Basin are unique in developing AOPs because they control dam operations. Other ACE units have oversight roles but not operational ones. The Missouri Division operates the six mainstem dams on the Missouri River.

The Corps’ Draft AOP was released in September. Public meetings are scheduled October 24 through the 27th, written comments will be accepted until November 23. The plan presents modeled release rates depending on varying rainfall and runoff estimates. It presents how navigation releases will be balanced against other demands. And it lists the seasonal decision dates when these actions will be taken.

Coincidentally, in early October, ACE announced worsening drought conditions in the upper Missouri.

September runoff above Sioux City, Iowa was 0.6 million acre-feet (MAF), 47% of the long-term average. Soil conditions were very dry. The Drought Mitigation Center reported that over 90% of the Missouri basin was experiencing some form of abnormally dry conditions or drought, almost a 20% increase from the end of August.

“Runoff in the upper Missouri River Basin was below average during the month of September and is expected to remain low throughout the rest of 2022,” said John Remus, chief of the U.S. Army Corps of Engineers’ Missouri River Basin Water Management Division. The 2022 calendar year runoff forecast for the upper Basin, updated on Oct. 1, was 19.5 MAF, 76% of average and 0.7 MAF lower than the prior month’s annual runoff forecast. Average annual runoff for the upper Basin is 25.7 MAF.

For navigation, USACE wrote that Gavins Point Dam releases will be set to provide navigation flow support at a level 500 cfs above minimum service at all four target locations (Sioux City, Omaha, Nebraska City and Kansas City). Season support will end on November 28 at the mouth of the Missouri River. USACE writes that “releases will be adjusted as necessary to meet all downstream navigation targets.”

Release rates at other dams will drop. Consider:

- At Big Bend Dam last month’s releases were 28,900 cfs. Forecast rate is 19,500 cfs.

- Oahe Dam drops from 29,100 cfs last month to a forecast of 20,300.

- Fort Peck drops from 7700 to 4000 cfs.

The Corps’ notice includes this caution:

“The forecast reservoir releases and elevations discussed above are not definitive. Additional precipitation, lack of precipitation or other circumstances could cause adjustments to the reservoir release rates.”

(Photo: Ingram Barge Company)

(Photo: Ingram Barge Company)

Food: national impacts

Mike Steenhoek, Executive Director of the Soy Transportation Coalition based in Ankeny, Iowa, keeps a close eye on the inland waterways, particularly the Mississippi. In early October, Steenhoek commented that "conditions continue to deteriorate due to historically low water." He added, "The strength of U.S. soybean exports and the condition of the inland waterway system are closely interconnected."

Channel depth and width limits are impacting agricultural economics at an inopportune time, Steenhoek said. Barge transportation is essential: 80% of ag exports occur between September and February; 54% of soybean exports depend on barges.

Steenhoek said that, because of low water, barge and towing companies have set a 25-barge maximum tow south of St. Louis, a limit that contrasts with 30-40 barges under normal conditions. Because total capacity has decreased there is demand for more barges, plus crews and towboats, to transport the 2022 harvest. Rates have skyrocketed. Steenhoek cited U.S. DOA statistics: On 10/4 the cost to transport a ton of soybeans from St. Louis was $90.45. In 2021, the same shipment cost $28.45, a 218% increase.

This slams farmers because the price a farmer receives at point of sale is influenced by how efficiently, or not, agricultural products clear the market. Supply chain problems cause transactions to confront a "negative basis," i.e., when a storage facility can't move product out it pays less for product coming in - from the farmers. As examples, Steenhoek cited the following:

•In Aurora, Ind., (near Cincinnati): negative soybean basis was $1.29. Normal negative is $0.35-$0.40. Negative corn basis was $1.02; normal is $0.25-$0.35.

•In Davenport, Iowa, negative soybean basis was $0.90; normal is $0.30 to $0.45. For corn, negative was $0.30; normal negative is $0.20.

•Near Memphis: negative soybean basis was $1.15; same as last year. For corn negative was $0.75; normal at this time of year is even to negative $0.20.

Operators’ interests

Lynn M. Muench is Senior Vice President – Regional Advocacy for the American Waterways Operators (AWO); she is based in St. Louis. Muench was asked about the Missouri River AOP, whether AWO participates in that planning process. “Absolutely,” she said. “We’ve been engaged in that process for the last 23 years.” She said AOP development was critical, not just for the Missouri River but also for the middle Mississippi. “We look to maximize flows,” she explained.

This advocacy works within a larger coalition, which Muench chairs, including agricultural groups and farming interests. One goal is encouraging the USACE to complete its plan by the end of December. That timing allows river operators to look ahead at likely conditions and plan accordingly, both for operations and rates. This partnership has supported increased funding to maintain Missouri River navigation.

Muench added that new federal waterways infrastructure spending “is really going to be huge,” i.e., hugely beneficial. She specifically cited benefits from redundant locks—one lock failure won’t shut down the river. Transport efficiencies will go way up, as will the green profile for waterways shipping. “We won’t be stopping and waiting, taking tows apart and putting them back together,” she pointed out. “We’re going to keep moving.”

Coast Guard Cutter Chena provides aid to navigation on the Lower Mississippi River on October 13, 2022. The Coast Guard, U.S. Army Corps of Engineers and industry partners are working together to ensure navigational safety and minimize interruptions to the flow of commerce along the Mississippi River. (Photo: U.S. Coast Guard)

Coast Guard Cutter Chena provides aid to navigation on the Lower Mississippi River on October 13, 2022. The Coast Guard, U.S. Army Corps of Engineers and industry partners are working together to ensure navigational safety and minimize interruptions to the flow of commerce along the Mississippi River. (Photo: U.S. Coast Guard)

“We need rain”

In August, the Mississippi River Commission (MRC) conducted its annual low-water inspection trip on the River, holding four public meetings in Tennessee, Mississippi and Louisiana. Charles Camillo is MRC’s Executive Director. He said these meetings have been held since 1882. The seven-member Commission was established in 1879. Its mission: “to develop plans to improve the condition of the Mississippi River, foster navigation, promote commerce and prevent destructive floods.”

Camillo said about 200 people attended the low-water meetings this year, a number rebounding after COVID. Most people attending represent groups linked to the river’s operations, such as ports and related associations and businesses. About 70 people provided testimony which is reviewed by the Commission and then presented to the Army Corps with advisories for follow up.

Regarding the drought and low water, Camillo commented that he would rather fight a flood than a drought since options are so limited. No one can control the weather, and he added that ports and waterway officials will continue to do what they can, e.g., dredging, scouring and maintaining dikes.

Camillo said that many comments this year were “a thank you” to federal officials for supporting infrastructure money. Local officials noted that money for dredging allowed ports to stay open, despite low water challenges.

Lisa Parker is Director of Public Affairs, Mississippi Valley Division, U.S. Army Corps of Engineers. Parker said the Corps is confident it can maintain 9-foot navigation throughout the system. All Corps’ dredges are engaged and ready to respond, she said.

She noted that flood control projects on tributaries are proceeding with regular winter pool drawdowns. “This flow augmentation,” she said, “off of the Ohio and Missouri Rivers, along with other smaller tributaries, is helping the low flow situation on the lower Mississippi River at least through October.”

Still, the situation could worsen, and the Corps is considering delaying some winter drawdowns for release if conditions become critical.

“The last time we experienced conditions like this was in 2012,” Parker said. “The bottom line is, we need rain.”

Read US Inland Waterways: Looking for Rainmakers in Pdf, Flash or Html5 edition of November 2022 Marine News

Other stories from November 2022 issue

Content

- US Mid-term Elections Bring Changes, Uncertainty in Congressional Maritime Leadership page: 18

- Recruiting Gen Z in the Marine Industry page: 21

- Great Lakes Winter Supply Chain – A Cause for Concern page: 24

- Alternative Fuels, Newbuilds and Retrofits are Key to Marine Industry Growth page: 27

- Fortunes Return to the Sea as the Wind Blows Offshore page: 30

- US Inland Waterways: Looking for Rainmakers page: 34

- Infrastructure Improvements Set to Boost Efficiency at Lock and Dam 25 page: 40

- Marine News' Top Vessels of 2022 page: 44

- With HybriGen, BAE Systems Helps the Maritime Industry to Decarbonize page: 62