Dredge Construction Booming in Competitive US Market

A dredge building boom that has been underway in the United States for several years is still going strong as the market remains highly completive for solid project workloads in both the public and private sectors.

According The Mike Hooks Report, an analysis of the FY22 U.S. federal dredging market compiled in September 2023 by Michael Gerhardt, senior director of government affairs at Mike Hooks, LLC, 52 Jones Act dredging companies were awarded federal dredging contracts in FY2022. On average there were three bidders per project, with 20 projects receiving five or more bidders.

Seventy-two percent of the time, the private sector industry winning bid was lower than the Independent Government Estimate (IGE); and 95% of the time, the private sector industry winning bid was lower than the Government Estimated Awardable Range (GEAR), which is IGE + 25%. When compared to the IGE, 59 projects were lower by more than 10%, 27 projects were lower by more than 25% and 15 projects were lower by more than 40%.

“What does this mean? It means that the U.S. dredging industry (private sector dredging companies) is fiercely competitive and is delivering a service that saves the federal government, and therefore the taxpayer, hundreds of millions—$670 million in FY22 alone (when compared to the GEAR), and this trend happens year over year,” Gerhardt said.

The U.S. federal dredging market bid out to U.S.-flag Jones Act private sector dredging contractors has grown 408% in value since 1993. In these 30 years the subset of hopper dredging contract awards has increased 620%, Gerhardt added.

“While there have been peaks and valleys over this time period due to funding and level of need, there has been a steady climb,” Gerhardt said. “On average the hopper dredging market, which has fluctuated between $300 million and $700 million over the past seven years, annually accounts for approximately 30% of the total market.”

Gerhardt noted that his report only details federal dredging projects, and that work in the private sector has also been solid.

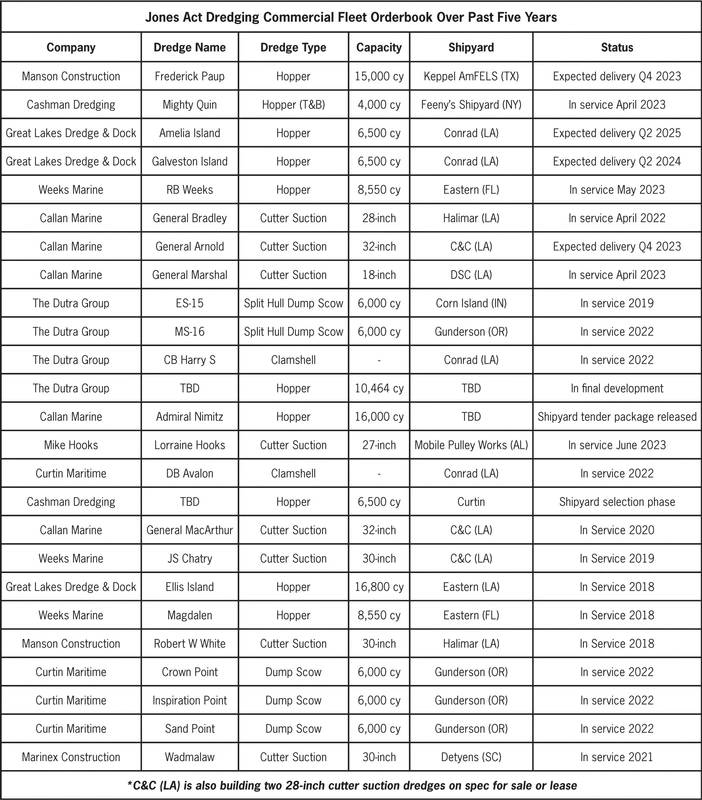

To help meet the steady demand, the industry has invested heavily in new construction of U.S. owned, built and crewed Jones Act dredges: over $2.5 billion over the past five years. Newbuild dredges have been “rolling off the blocks”, said William P. Doyle, CEO, Dredging Contractors of America. Doyle said he expects this trend will continue into the foreseeable future, noting dredging companies have also been investing in other equipment to support their activities, such as cranes, barges, tugs, scows, tender boats, survey vessels, boosters, pipelines, pontoons, etc.

“The U.S. Jones Act dredging industry is not just highly competitive and in the midst of the largest fleet capitalization ever, but it is reliable. The foreign entities have a tendency to overpromise and underperform— then walk away when times get tough,” Doyle said.

Other stories from November 2023 issue

Content

- Dredge Construction Booming in Competitive US Market page: 08

- Insights: Frank Manning, President & COO, Diversified Marine, Inc. page: 12

- Bringing the Capital Construction Fund Program Ashore page: 18

- Navigating Sustainability: Charting a Way Forward page: 20

- Will the Effort to Reach Zero Emissions Go Nuclear? page: 22

- Workboat Power: Alternatives Join Diesel to Power Current—and Future—Vessels page: 26

- Accelerating US CTV Market Development with Hybrid Solutions page: 32

- US Shipbuilding: Policy and Progress page: 36

- Marine News' Top Vessels of 2023 page: 44

- Inside Wärtsilä’s Sustainable Technology Hub page: 56