Page 39: of Marine Technology Magazine (September 2011)

Ocean Observation

Read this page in Pdf, Flash or Html5 edition of September 2011 Marine Technology Magazine

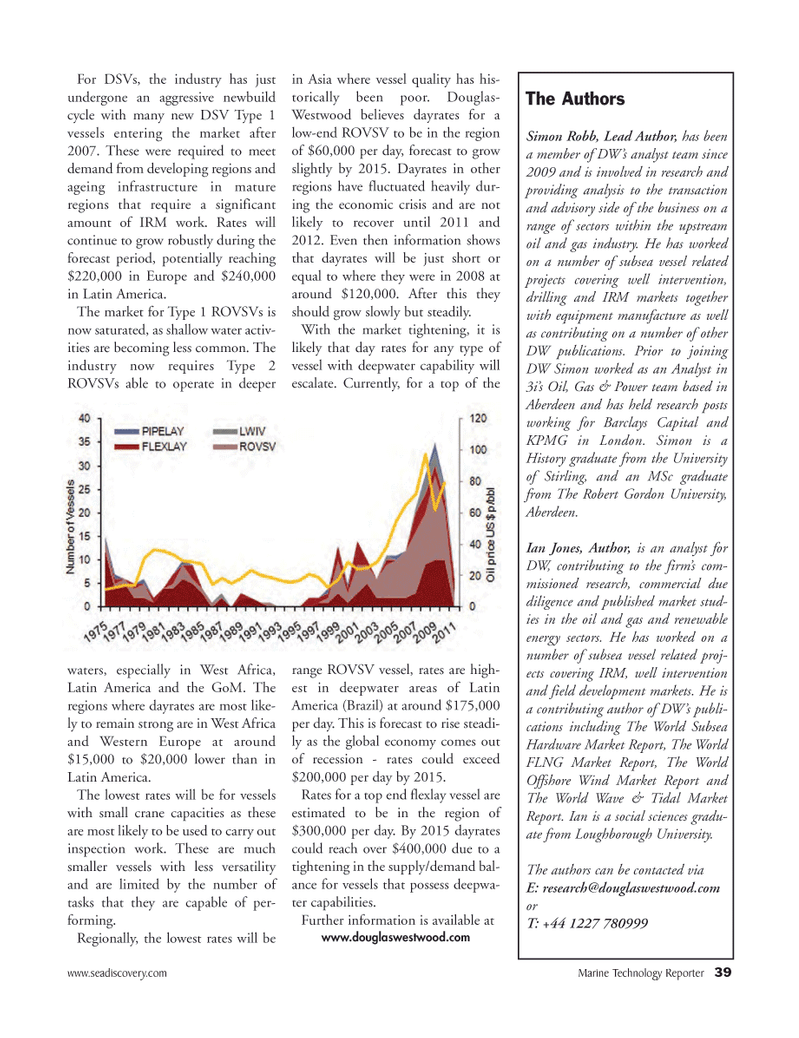

www.seadiscovery.com Marine Technology Reporter 39For DSVs, the industry has just undergone an aggressive newbuild cycle with many new DSV Type 1 vessels entering the market after 2007. These were required to meet demand from developing regions and ageing infrastructure in mature regions that require a significant amount of IRM work. Rates will continue to grow robustly during the forecast period, potentially reaching $220,000 in Europe and $240,000 in Latin America. The market for Type 1 ROVSVs is now saturated, as shallow water activ- ities are becoming less common. The industry now requires Type 2 ROVSVs able to operate in deeper waters, especially in West Africa, Latin America and the GoM. The regions where dayrates are most like- ly to remain strong are in West Africa and Western Europe at around $15,000 to $20,000 lower than in Latin America. The lowest rates will be for vessels with small crane capacities as theseare most likely to be used to carry out inspection work. These are much smaller vessels with less versatility and are limited by the number of tasks that they are capable of per- forming. Regionally, the lowest rates will be in Asia where vessel quality has his- torically been poor. Douglas- Westwood believes dayrates for a low-end ROVSV to be in the region of $60,000 per day, forecast to grow slightly by 2015. Dayrates in other regions have fluctuated heavily dur- ing the economic crisis and are not likely to recover until 2011 and 2012. Even then information shows that dayrates will be just short or equal to where they were in 2008 at around $120,000. After this they should grow slowly but steadily. With the market tightening, it is likely that day rates for any type ofvessel with deepwater capability will escalate. Currently, for a top of the range ROVSV vessel, rates are high- est in deepwater areas of Latin America (Brazil) at around $175,000 per day. This is forecast to rise steadi- ly as the global economy comes outof recession - rates could exceed $200,000 per day by 2015. Rates for a top end flexlay vessel are estimated to be in the region of $300,000 per day. By 2015 dayrates could reach over $400,000 due to a tightening in the supply/demand bal-ance for vessels that possess deepwa- ter capabilities. Further information is available at www.douglaswestwood.com The AuthorsSimon Robb, Lead Author, has beena member of DW?s analyst team since 2009 and is involved in research and providing analysis to the transaction and advisory side of the business on a range of sectors within the upstream oil and gas industry. He has worked on a number of subsea vessel related projects covering well intervention, drilling and IRM markets together with equipment manufacture as well as contributing on a number of otherDW publications. Prior to joining DW Simon worked as an Analyst in 3i?s Oil, Gas & Power team based in Aberdeen and has held research posts working for Barclays Capital and KPMG in London. Simon is a History graduate from the University of Stirling, and an MSc graduate from The Robert Gordon University, Aberdeen. Ian Jones, Author, is an analyst forDW, contributing to the firm?s com- missioned research, commercial due diligence and published market stud- ies in the oil and gas and renewable energy sectors. He has worked on a number of subsea vessel related proj- ects covering IRM, well intervention and field development markets. He is a contributing author of DW?s publi- cations including The World Subsea Hardware Market Report, The World FLNG Market Report, The World Offshore Wind Market Report and The World Wave & Tidal Market Report. Ian is a social sciences gradu- ate from Loughborough University. The authors can be contacted via E: [email protected] or T: +44 1227 780999 MTR#7 (34-48):MTR Layouts 8/29/2011 10:19 AM Page 39

38

38

40

40