Page 33: of Marine Technology Magazine (April 2016)

Offshore Energy Annual

Read this page in Pdf, Flash or Html5 edition of April 2016 Marine Technology Magazine

concentrated at the end of the forecast period, with the country For platform operators responsible for undertaking decom- being less mature than the UK. As a result it will account for missioning work, the current downturn represents a chance to 32% of all spend over the forecast with 79% of this coming be rid of operating assets that were only commercial at high in the last ten years. However, as a direct result of the low oil oil prices, as well as abandoned platforms that are current li- price there have been a number of Norwegian projects that abilities, requiring extensive maintenance work for no mate- have already been shut in early or are scheduled to be aban- rial return. However, there will be huge costs involved to re- doned in the next year. This includes Det Norske’s Jette ? eld move these assets, causing problems for many companies in which is shutting down production after only three years and the short-term.

ExxonMobil’s Jotun ? eld which has both a ? xed platform and The Pioneering Spirit and other SLVs point towards a new

FPSO. way of operating that could potentially be quicker, cheaper

Though it has a much smaller offshore industry, it is impor- and reduce risk. The proof, however, will be in the success tant to consider the impact Denmark will have on the fore- of early jobs completed by the Pioneering Spirit – if both the cast. Due to its smaller size decommissioning will peak in two Yme and Brent removals are completed with little incident different periods, with no decommissioning activity expected and day rates are competitive, SLVs will be an ideal solution outside of these peaks. The ? rst will be the removal of the Dan for removing the largest platforms in the North Sea. and Halfdan hubs; while in the mid-2030’s DW expects to see decommissioning work start on the Siri and Gorm hubs. The Report

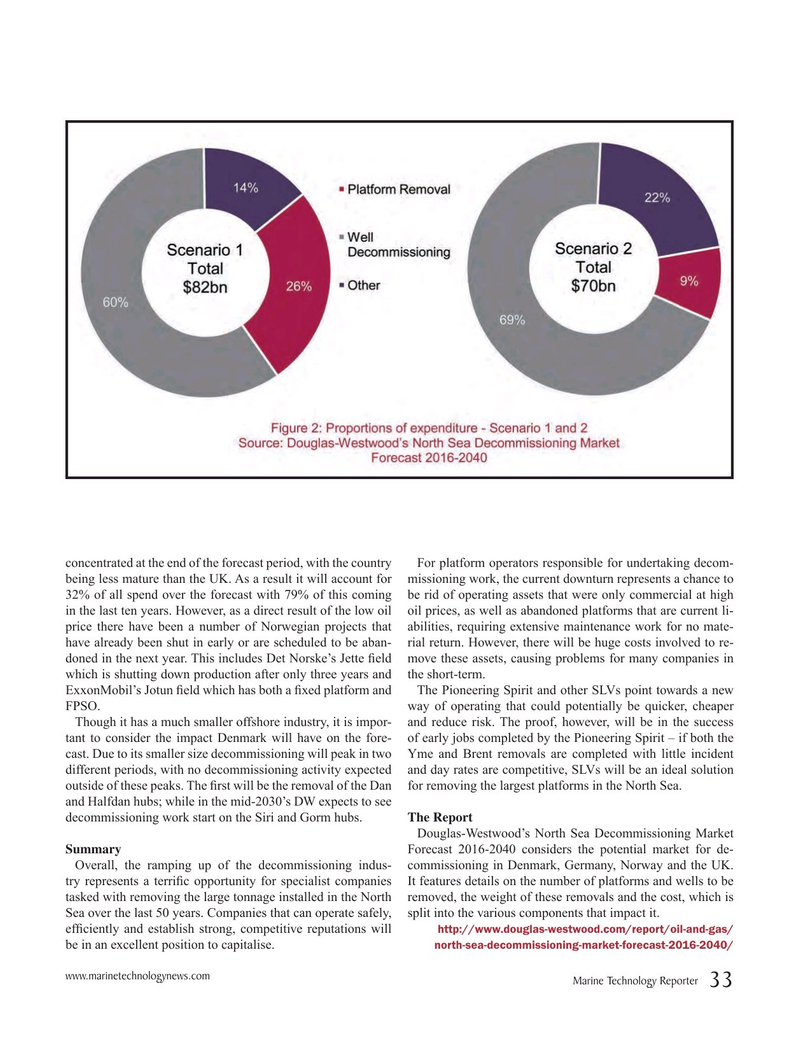

Douglas-Westwood’s North Sea Decommissioning Market

Summary Forecast 2016-2040 considers the potential market for de-

Overall, the ramping up of the decommissioning indus- commissioning in Denmark, Germany, Norway and the UK. try represents a terri? c opportunity for specialist companies It features details on the number of platforms and wells to be tasked with removing the large tonnage installed in the North removed, the weight of these removals and the cost, which is

Sea over the last 50 years. Companies that can operate safely, split into the various components that impact it. ef? ciently and establish strong, competitive reputations will http://www.douglas-westwood.com/report/oil-and-gas/ north-sea-decommissioning-market-forecast-2016-2040/ be in an excellent position to capitalise. www.marinetechnologynews.com

Marine Technology Reporter 33

MTR #3 (18-33).indd 33 4/4/2016 10:01:14 AM

32

32

34

34