Page 32: of Marine Technology Magazine (May 2016)

Underwater Defense

Read this page in Pdf, Flash or Html5 edition of May 2016 Marine Technology Magazine

Norway’s Subsea Valley are now known cost-cutters. Building things smaller; scaling Remote controlled operations at Rambøll-built platforms sug- back scope; eliminating duplicate engineering and documents gests “minimum service visits” due to the minimum of equip- or eliminating the use of costly vessels are the newest wave. ment at these facilities. The designs are “standardized” and

Yet in Norway, where offshore ? eet-owners are anxious, trim- those installed in the ‘80’s are still in use. The Rambøll Type 4 ming back vessel use is a treasonous proposition. An idea that design is the simplest and is used in the Gulf of Mexico without generates offshore ? eet use is welcome, and Denmark-based a helideck, accommodations or cranes. It means offshore ship wind turbine and offshore platform jacket designer Rambøll owners’ new, employment-saving “walk-to-work” vessels are appears to have just the ticket: introduce to Norway simple used to ferry in specialists and supplies. There are ? ve simpli- “unmanned, minimum-facility platforms” which are ubiqui- ? ed platform designs, including a Type 2 pig launcher for pipe- tous in neighboring shallow-water oil provinces along with lines with cranes and a Type O for up to 30 wells. For Norway, normally unmanned platforms. The platforms are understood it’s the wind industry’s relatively incident-free, helicopter-free to be considerably less expensive to build and operate than mode of accessing offshore wind turbines that might matter many subsea developments, and some 60-odd European oil- most. Some 91 European discoveries, Juhl says, are less than ? eld projects are scheduled to be subsea tie-ins. Other subsea 50 km from technology-laden infrastructure, where these sim- projects are shelved but would be feasible should Rambøll’s ple surface wellhead platforms could provide 26 to 52 ship vis-

Type O to Type 4 platforms be used. The idea has found major its or up to 3,000 hours of walk-to-work vessel time per-year, traction in Norway, where the Norwegian Petroleum Director- per-platform of up to 12 wells. Some 850 of Rambøll’s 13,500 ate has just disseminated Rambøll’s report on the subject. Just global workforce is committed to offshore oil and gas projects. ? ve percent of Norwegian platforms are unmanned compared Many more work in its wind-energy business. to from 25 percent to 30 percent in the Dutch, Danish and It’s unknown how long the oceangoing supply chain will

U.K. sectors, where water depths are often similar. Operator continue looking at new markets or old ideas to boost busi-

Statoil was convinced enough to order in December 2015 an ness. Rystad’s Martinsen says deferred offshore oil? eld de- unmanned wellhead platform, jack-up drill rig and one dedi- velopments is only adding to “the jackpot waiting to happen” cated support vessel for the Oseberg Vest? anken 2 ? eld devel- when demand for subsea suppliers again strengthens. By that opment. The operator says $122m has been saved by opting time, more offshore service vessels, or OSVs, might be servic- for the concept. ing more Rambøl unmanned platforms, and Blueye might be satiated by the consumer market alone.

“Offshore services need to survive 2016 in order to have a

W2Ws bright future,” says Martinsen, who adds that a slow 2017 will “We’re not trying to end subsea,” says Rambøll administrative usher in the “jackpots” of 2018-2020. We’ll see whose jackpot director for offshore pipelines, subsea and jackets, Henrik Juhl. it’ll be.

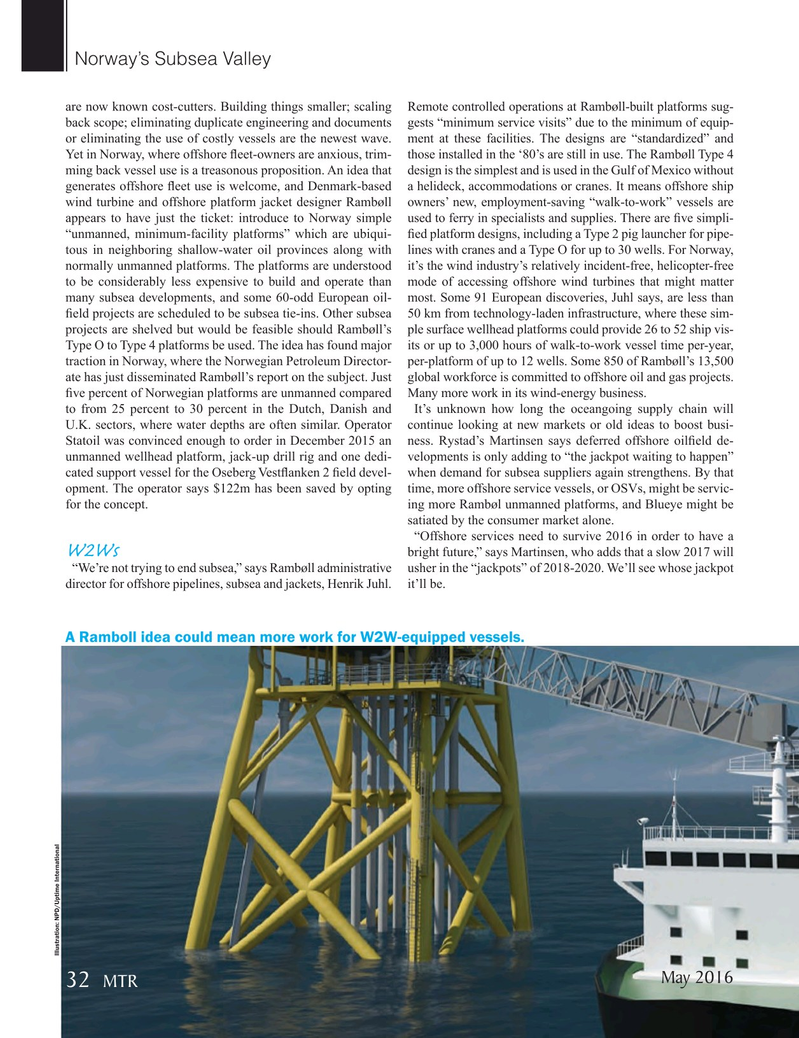

A Ramboll idea could mean more work for W2W-equipped vessels.

Illustration: NPD/Uptime International

May 2016 32 MTR

MTR #4 (18-33).indd 32 4/25/2016 10:43:28 AM

31

31

33

33