Page 10: of Marine Technology Magazine (January 2022)

Read this page in Pdf, Flash or Html5 edition of January 2022 Marine Technology Magazine

Markets U.S. Offshore Wind

White House initiative released in assessment of a second wind farm, the with the states. Further, the current New

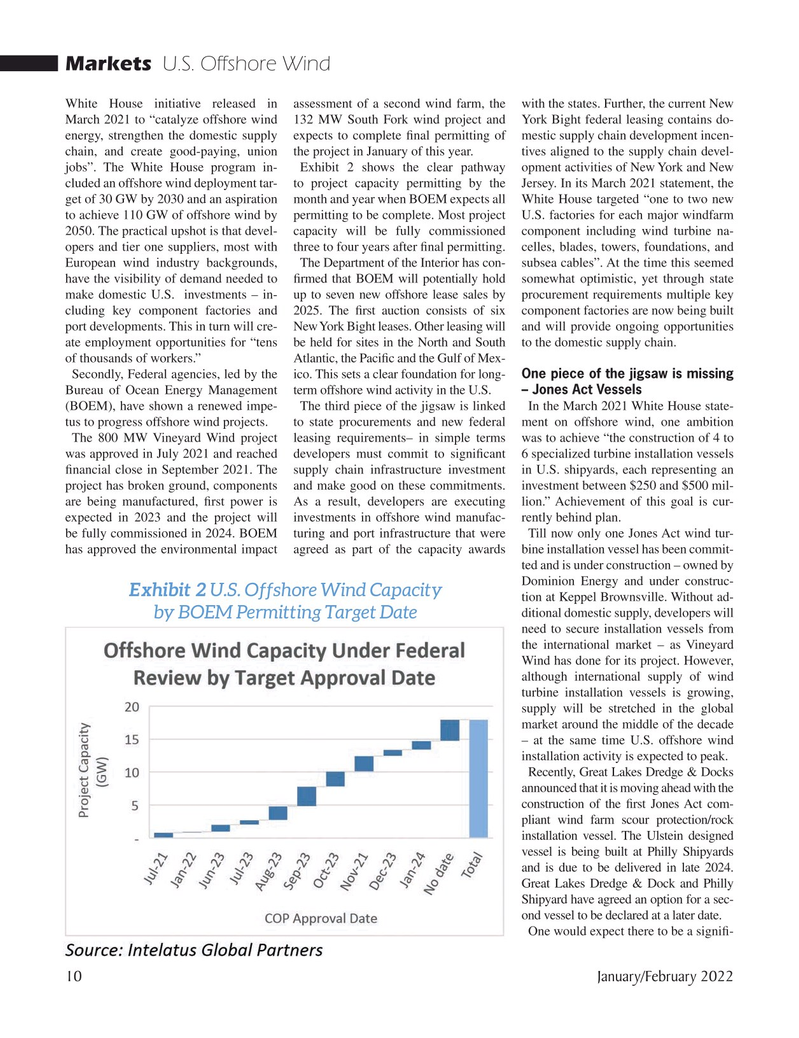

March 2021 to “catalyze offshore wind 132 MW South Fork wind project and York Bight federal leasing contains do- energy, strengthen the domestic supply expects to complete ? nal permitting of mestic supply chain development incen- chain, and create good-paying, union the project in January of this year. tives aligned to the supply chain devel- jobs”. The White House program in- Exhibit 2 shows the clear pathway opment activities of New York and New cluded an offshore wind deployment tar- to project capacity permitting by the Jersey. In its March 2021 statement, the get of 30 GW by 2030 and an aspiration month and year when BOEM expects all White House targeted “one to two new to achieve 110 GW of offshore wind by permitting to be complete. Most project U.S. factories for each major windfarm 2050. The practical upshot is that devel- capacity will be fully commissioned component including wind turbine na- opers and tier one suppliers, most with three to four years after ? nal permitting. celles, blades, towers, foundations, and

European wind industry backgrounds, The Department of the Interior has con- subsea cables”. At the time this seemed have the visibility of demand needed to ? rmed that BOEM will potentially hold somewhat optimistic, yet through state make domestic U.S. investments – in- up to seven new offshore lease sales by procurement requirements multiple key cluding key component factories and 2025. The ? rst auction consists of six component factories are now being built port developments. This in turn will cre- New York Bight leases. Other leasing will and will provide ongoing opportunities ate employment opportunities for “tens be held for sites in the North and South to the domestic supply chain.

of thousands of workers.” Atlantic, the Paci? c and the Gulf of Mex-

Secondly, Federal agencies, led by the ico. This sets a clear foundation for long- One piece of the jigsaw is missing

Bureau of Ocean Energy Management term offshore wind activity in the U.S. – Jones Act Vessels (BOEM), have shown a renewed impe- The third piece of the jigsaw is linked In the March 2021 White House state- tus to progress offshore wind projects. to state procurements and new federal ment on offshore wind, one ambition

The 800 MW Vineyard Wind project leasing requirements– in simple terms was to achieve “the construction of 4 to was approved in July 2021 and reached developers must commit to signi? cant 6 specialized turbine installation vessels ? nancial close in September 2021. The supply chain infrastructure investment in U.S. shipyards, each representing an project has broken ground, components and make good on these commitments. investment between $250 and $500 mil- are being manufactured, ? rst power is As a result, developers are executing lion.” Achievement of this goal is cur- expected in 2023 and the project will investments in offshore wind manufac- rently behind plan.

be fully commissioned in 2024. BOEM turing and port infrastructure that were Till now only one Jones Act wind tur- has approved the environmental impact agreed as part of the capacity awards bine installation vessel has been commit- ted and is under construction – owned by

Dominion Energy and under construc-

Exhibit 2 U.S. Offshore Wind Capacity tion at Keppel Brownsville. Without ad- ditional domestic supply, developers will by BOEM Permitting Target Date need to secure installation vessels from the international market – as Vineyard

Wind has done for its project. However, although international supply of wind turbine installation vessels is growing, supply will be stretched in the global market around the middle of the decade – at the same time U.S. offshore wind installation activity is expected to peak.

Recently, Great Lakes Dredge & Docks announced that it is moving ahead with the construction of the ? rst Jones Act com- pliant wind farm scour protection/rock installation vessel. The Ulstein designed vessel is being built at Philly Shipyards and is due to be delivered in late 2024.

Great Lakes Dredge & Dock and Philly

Shipyard have agreed an option for a sec- ond vessel to be declared at a later date.

One would expect there to be a signi? - 10 January/February 2022

MTR #1 (1-17).indd 10 1/25/2022 10:15:22 AM

9

9

11

11