Page 20: of Maritime Reporter Magazine (March 1969)

Read this page in Pdf, Flash or Html5 edition of March 1969 Maritime Reporter Magazine

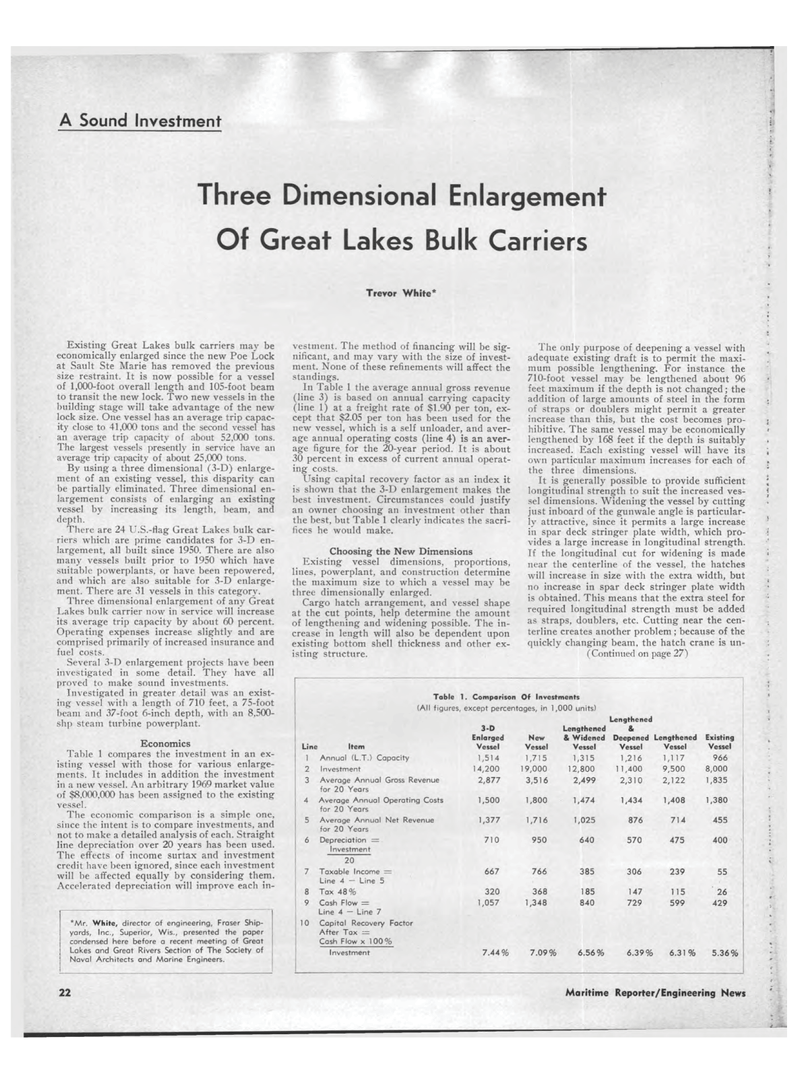

A Sound Investment Three Dimensional Enlargement Of Great Lakes Bulk Carriers Trevor White* Existing Great Lakes bulk carriers may be economically enlarged since the new Poe Lock at Sault Ste Marie has removed the previous size restraint. It is now possible for a vessel of 1,000-foot overall length and 105-foot beam to transit the new lock. Two new vessels in the building stage will take advantage of the new lock size. One vessel has an average trip capac-ity close to 41,000 tons and the second vessel has an average trip capacity of about 52,000 tons. The largest vessels presently in service have an average trip capacity of about 25,000 tons. By using a three dimensional (3-D) enlarge-ment of an existing vessel, this disparity can be partially eliminated. Three dimensional en-largement consists of enlarging an existing vessel by increasing its length, beam, and depth. There are 24 U.S.-flag Great Lakes bulk car-riers which are prime candidates for 3-D en-largement, all built since 1950. There are also many vessels built prior to 1950 which have suitable powerplants, or have been repowered, and which are also suitable for 3-D enlarge-ment. There are 31 vessels in this category. Three dimensional enlargement of any Great Lakes bulk carrier now in service will increase its average trip capacity by about 60 percent. Operating expenses increase slightly and are comprised primarily of increased insurance and fuel costs. Several 3-D enlargement projects have been investigated in some detail. They have all proved to make sound investments. Investigated in greater detail was an exist-ing vessel with a length of 710 feet, a 75-foot beam and 37-foot 6-inch depth, with an 8,500-shp steam turbine powerplant. Economics Table 1 compares the investment in an ex-isting vessel with those for various enlarge-ments. It includes in addition the investment in a new vessel. An arbitrary 1969 market value of $8,000,000 has been assigned to the existing vessel. The economic comparison is a simple one, since the intent is to compare investments, and not to make a detailed analysis of each. Straight line depreciation over 20 years has been used. The effects of income surtax and investment credit have been ignored, since each investment will be affected equally by considering them. Accelerated depreciation will improve each in-*Mr. White, director of engineering, Fraser Ship-yards, Inc., Superior, Wis., presented the paper condensed here before a recent meeting of Great Lakes and Great Rivers Section of The Society of Naval Architects and Marine Engineers. vestment. The method of financing will be sig-nificant, and may vary with the size of invest-ment. None of these refinements will affect the standings. In Table 1 the average annual gross revenue (line 3) is based on annual carrying capacity (line 1) at a freight rate of $1.90 per ton, ex-cept that $2.05 per ton has been used for the new vessel, which is a self unloader, and aver-age annual operating costs (line 4) is an aver-age figure for the 20-year period. It is about 30 percent in excess of current annual operat-ing costs. Using capital recovery factor as an index it is shown that the 3-D enlargement makes the best investment. Circumstances could justify an owner choosing an investment other than the best, but Table 1 clearly indicates the sacri-fices he would make. Choosing the New Dimensions Existing vessel dimensions, proportions, lines, powerplant, and construction determine the maximum size to which a vessel may be three dimensionally enlarged. Cargo hatch arrangement, and vessel shape at the cut points, help determine the amount of lengthening and widening possible. The in-crease in length will also be dependent upon existing bottom shell thickness and other ex-isting structure. The only purpose of deepening a vessel with adequate existing draft is to permit the maxi-mum possible lengthening. For instance the 710-foot vessel may be lengthened about 96 feet maximum if the depth is not changed; the addition of large amounts of steel in the form of straps or doublers might permit a greater increase than this, but the cost becomes pro-hibitive. The same vessel may be economically lengthened by 168 feet if the depth is suitably increased. Each existing vessel will have its own particular maximum increases for each of the three dimensions. It is generally possible to provide sufficient longitudinal strength to suit the increased ves-sel dimensions. Widening the vessel by cutting just inboard of the gunwale angle is particular-ly attractive, since it permits a large increase in spar deck stringer plate width, which pro-vides a large increase in longitudinal strength. If the longitudinal cut for widening is made near the centerline of the vessel, the hatches will increase in size with the extra width, but no increase in spar deck stringer plate width is obtained. This means that the extra steel for required longitudinal strength must be added as straps, doublers, etc. Cutting near the cen-terline creates another problem ; because of the quickly changing beam, the hatch crane is un-(Continued on page 27) Table 1. Comparison Of Investments (All figures, except percentages, in 1,000 units) Lengthened 3-D Lengthened & Enlarged New & Widened Deepened Lengthened Existing Line Item Vessel Vessel Vessel Vessel Vessel Vessel 1 Annual (L.T.) Capacity 1,514 1,715 1,315 1,216 1,117 966 2 Investment 14,200 19,000 12,800 1 1,400 9,500 8,000 3 Average Annual Gross Revenue for 20 Years 2,877 3,516 2,499 2,310 2,122 1,835 4 Average Annual Operating Costs for 20 Years 1,500 1,800 1,474 1,434 1,408 1,380 5 Average Annual Net Revenue for 20 Years 1,377 1,716 1,025 876 714 455 6 Depreciation = Investment 20 710 950 640 570 475 400 7 Taxable Income = Line 4 ? Line 5 667 766 385 306 239 55 8 Tax 48% 320 368 185 147 115 26 9 Cash Flow = Line 4 ? Line 7 1,057 1,348 840 729 599 429 10 Capital Recovery Factor After Tax = Cash Flow x 100% Investment 7.44% 7.09% 6.56% 6.39% 6.31 % 5.36% 22 Maritime Reporter/Engineering News

19

19

21

21