Page 22: of Maritime Reporter Magazine (June 15, 1969)

Read this page in Pdf, Flash or Html5 edition of June 15, 1969 Maritime Reporter Magazine

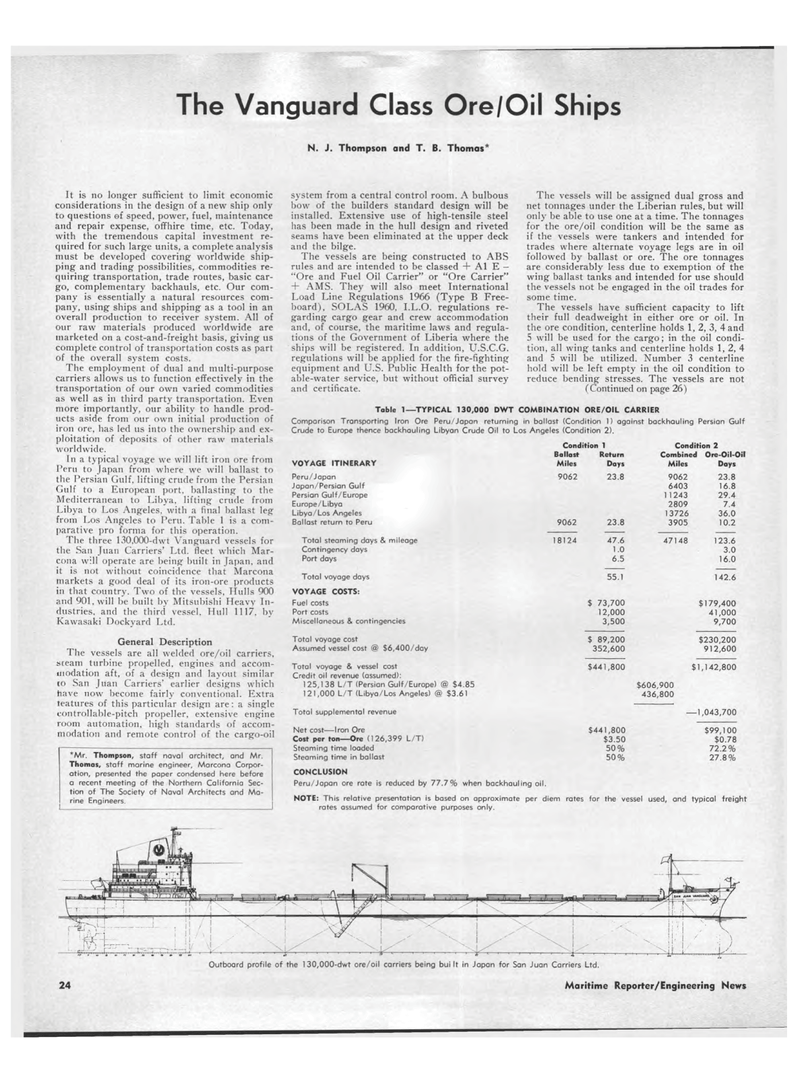

The Vanguard Class Ore/Oil Ships N. J. Thompson and T. B. Thomas* It is no longer sufficient to limit economic considerations in the design of a new ship only to questions of speed, power, fuel, maintenance and repair expense, offhire time, etc. Today, with the tremendous capital investment re-quired for such large units, a complete analysis must be developed covering worldwide ship-ping and trading possibilities, commodities re-quiring transportation, trade routes, basic car-go, complementary backhauls, etc. Our com-pany is essentially a natural resources com-pany, using ships and shipping as a tool in an overall production to receiver system. All of our raw materials produced worldwide are marketed on a cost-and-freight basis, giving us complete control of transportation costs as part of the overall system costs. The employment of dual and multi-purpose carriers allows us to function effectively in the transportation of our own varied commodities as well as in third party transportation. Even more importantly, our ability to handle prod-ucts aside from our own initial production of iron ore, has led us into the ownership and ex-ploitation of deposits of other raw materials worldwide. In a typical voyage we will lift iron ore from Peru to Japan from where we will ballast to the Persian Gulf, lifting crude from the Persian Gulf to a European port, ballasting to the Mediterranean to Libya, lifting crude from Libya to Los Angeles, with a final ballast leg from Los Angeles to Peru. Table 1 is a com-parative pro forma for this operation. The three 130,000-dwt Vanguard vessels for the San Juan Carriers' Ltd. fleet which Mar-cona will operate are being built in Japan, and it is not without coincidence that Marcona markets a good deal of its iron-ore products in that country. Two of the vessels, Hulls 900 and 901, will be built by Mitsubishi Heavy In-dustries, and the third vessel, Hull 1117, by Kawasaki Dockyard Ltd. General Description The vessels are all welded ore/oil carriers, sceam turbine propelled, engines and accom-modation aft, of a design and layout similar to San Juan Carriers' earlier designs which have now become fairly conventional. Extra features of this particular design are: a single controllable-pitch propeller, extensive engine room automation, high standards of accom-modation and remote control of the cargo-oil system from a central control room. A bulbous bow of the builders standard design will be installed. Extensive use of high-tensile steel has been made in the hull design and riveted seams have been eliminated at the upper deck and the bilge. The vessels are being constructed to ABS rules and are intended to be classed + A1 E -"Ore and Fuel Oil Carrier" or "Ore Carrier" + AMS. They will also meet International Load Line Regulations 1966 (Type B Free-board), SOLAS 1960, I.L.O. regulations re-garding cargo gear and crew accommodation and, of course, the maritime laws and regula-tions of the Government of Liberia where the ships will be registered. In addition, U.S.C.G. regulations will be applied for the fire-fighting equipment and U.S. Public Health for the pot-able-water service, but without official survey and certificate. The vessels will be assigned dual gross and net tonnages under the Liberian rules, but will only be able to use one at a time. The tonnages for the ore/oil condition will be the same as if the vessels were tankers and intended for trades where alternate voyage legs are in oil followed by ballast or ore. The ore tonnages are considerably less due to exemption of the wing ballast tanks and intended for use should the vessels not be engaged in the oil trades for some time. The vessels have sufficient capacity to lift their full deadweight in either ore or oil. In the ore condition, centerline holds 1, 2, 3, 4 and 5 will be used for the cargo; in the oil condi-tion, all wing tanks and centerline holds 1, 2, 4 and 5 will he utilized. Number 3 centerline hold will be left empty in the oil condition to reduce bending stresses. The vessels are not ( Continued on page 26) *Mr. Thompson, staff naval architect, and Mr. Thomas, staff marine engineer, Marcona Corpor-ation, presented the paper condensed here before a recent meeting of the Northern California Sec-tion of The Society of Naval Architects and Ma-rine Engineers. Table 1?TYPICAL 130,000 DWT COMBINATION ORE/OIL CARRIER Comparison Transporting Iron Ore Peru/Japan returning in ballast (Condition 1) against backhauling Persian Gulf Crude to Europe thence backhauling Libyan Crude Oil to Los Angeles (Condition 2). VOYAGE ITINERARY Peru/Japan Japan/Persian Gulf Persian Gulf/Europe Europe/Libya Libya/Los Angeles Ballast return to Peru Total steaming days & mileage Contingency days Port days Total voyage days VOYAGE COSTS: Fuel costs Port costs Miscellaneous & contingencies Total voyage cost Assumed vessel cost @ $6,400/day Total voyage & vessel cost Credit oil revenue (assumed): 125,138 L/T (Persian Gulf/Europe) @ $4.85 121,000 L/T (Libya/Los Angeles) @ $3.61 Total supplemental revenue Net cost?Iron Ore Cost per ton?Ore (126,399 L/T) Steaming time loaded Steaming time in ballast CONCLUSION Peru/Japan ore rate is reduced by 77.71 Condition 1 Ballast Return Miles Days 9062 23.8 9062 18124 when backhauling oil. Condition 2 Combined Ore-Oil-Oil Miles Days 23.8 47.6 1.0 6.5 55.1 $ 73,700 12,000 3,500 $ 89,200 352,600 $441,800 9062 6403 1 1243 2809 13726 3905 47148 $606,900 436,800 $441,800 $3.50 50% 50% 23.8 16.8 29.4 7.4 36.0 10.2 123.6 3.0 16.0 142.6 $179,400 41,000 9,700 $230,200 912,600 $1,142,800 ? 1,043,700 $99,100 $0.78 72.2% 27.8% NOTE: This relative presentation is based on approximate per diem rates for the vessel used, and typical freight rates assumed for comparative purposes only. Outboard profile of the 130,000-dwt ore/oil carriers being built in Japan for San Juan Carriers Ltd. 24 Maritime Reporter/Engineering News

21

21

23

23