Page 9: of Maritime Reporter Magazine (October 1971)

Read this page in Pdf, Flash or Html5 edition of October 1971 Maritime Reporter Magazine

31000 I)WT TANK IIAKC.K PUSIILl) (+S500.1100 COST) — 31000 DWT TANK BARGL PUSHED (+SI .000.000 COST) (ATRS - FLAT) (HSTN - LOG)

ROUND TRIP DISTANCES 1 1 1650 2050 2450 2850 3250 3650 4050 4450 4850 0 1450 1850 2250 2650 3050 3450 3850 4250 4650

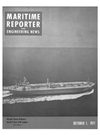

Chart 2—Freight rates ($/LT) versus distance (comparison of pushed versus towed).

Super Barges— (Continued from page 9) ers, consisted of a flat allowance of three percent for all trips.

In Chart 2, Required Freight

Rates were calculated for each vessel unit assuming two levels of increased construction cost; $500,- 000 and then $1.0 million to push with a non-rigid system with cor- responding adjustments made to fixed and voyage costs. The same weather factors were applied to the new speeds used but in all other respects the units were assumed to be the same as investigated with hawser towing.

Chart 3 shows that both conven- tionally towed barges have lower

Required Freight Rates on the cross-Gulf route than the faster tankers of equal size. Based on the assumptions used, the 31,000-dwt barge-tug is overtaken economical- ly by the 30,000-dwt tanker on a round-trip voyage of about 2,250 miles. The smaller and slightly faster 20,000-dwt barge unit, how- ever, maintains its advantage over its counterpart for round-trip voy- ages in excess of 3,000 miles.

This means that on the Tampa 900 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900 2000 2100 2200 2300

DISTANCE BETWEEN PORTS (N .M.)

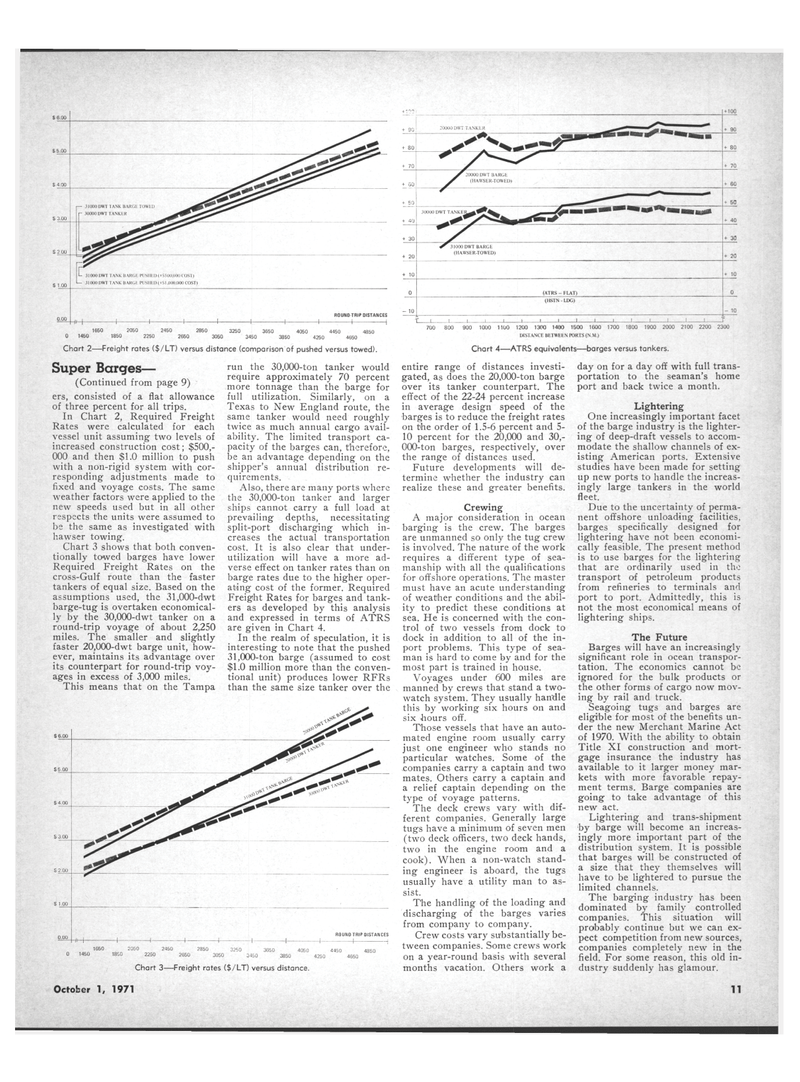

Chart 4—ATRS equivalents—barges versus tankers. run the 30,000-ton tanker would require approximately 70 percent more tonnage than the barge for full utilization. Similarly, on a

Texas to New England route, the same tanker would need roughly twice as much annual cargo avail- ability. The limited transport ca- pacity of the barges can, therefore, be an advantage depending on the shipper's annual distribution re- quirements.

Also, there are many ports where the 30,000-ton tanker and larger ships cannot carry a full load at prevailing depths, necessitating split-port discharging which in- creases the actual transportation cost. It is also clear that under- utilization will have a more ad- verse effect on tanker rates than on barge rates due to the higher oper- ating cost of the former. Required

Freight Rates for barges and tank- ers as developed by this analysis and expressed in terms of ATRS are given in Chart 4.

In the realm of speculation, it is interesting to note that the pushed 31,000-ton barge (assumed to cost $1.0 million more than the conven- tional unit) produces lower RFRs than the same size tanker over the

Chart 3—Freight rates ($/LT) versus distance. entire range of distances investi- gated, as does the 20,000-ton barge over its tanker counterpart. The effect of the 22-24 percent increase in average design speed of the barges is to reduce the freight rates on the order of 1.5-6 percent and 5- 10 percent for the 20,000 and 30,- 000-ton barges, respectively, over the range of distances used.

Future developments will de- termine whether the industry can realize these and greater benefits.

Crewing

A major consideration in ocean barging is the crew. The barges are unmanned so only the tug crew is involved. The nature of the work requires a different type of sea- manship with all the qualifications for offshore operations. The master must have an acute understanding of weather conditions and the abil- ity to predict these conditions at sea. He is concerned with the con- trol of two vessels from dock to dock in addition to all of the in- port problems. This type of sea- man is hard to come by and for the most part is trained in house.

Voyages under 600 miles are manned by crews that stand a two- watch system. They usually handle this by working six hours on and six hours off.

Those vessels that have an auto- mated engine room usually carry just one engineer who stands no particular watches. Some of the companies carry a captain and two mates. Others carry a captain and a relief captain depending on the type of voyage patterns.

The deck crews vary with dif- ferent companies. Generally large tugs have a minimum of seven men (two deck officers, two deck hands, two in the engine room and a cook). When a non-watch stand- ing engineer is aboard, the tugs usually have a utility man to as- sist.

The handling of the loading and discharging of the barges varies from company to company.

Crew costs vary substantially be- tween companies. Some crews work on a year-round basis with several months vacation. Others work a day on for a day off with full trans- portation to the seaman's home port and back twice a month.

Lightering

One increasingly important facet of the barge industry is the lighter- ing of deep-draft vessels to accom- modate the shallow channels of ex- isting American ports. Extensive studies have been made for setting up new ports to handle the increas- ingly large tankers in the world fleet.

Due to the uncertainty of perma- nent offshore unloading facilities, barges specifically designed for lightering have not been economi- cally feasible. The present method is to use barges for the lightering that are ordinarily used in the transport of petroleum products from refineries to terminals and port to port. Admittedly, this is not the most economical means of lightering ships.

The Future

Barges will have an increasingly significant role in ocean transpor- tation. The economics cannot be ignored for the bulk products or the other forms of cargo now mov- ing by rail and truck.

Seagoing tugs and barges are eligible for most of the benefits un- der the new Merchant Marine Act of 1970. With the ability to obtain

Title XI construction and mort- gage insurance the industry has available to it larger money mar- kets with more favorable repay- ment terms. Barge companies are going to take advantage of this new act.

Lightering and trans-shipment by barge will become an increas- ingly more important part of the distribution system. It is possible that barges will be constructed of a size that they themselves will have to be lightered to pursue the limited channels.

The barging industry has been dominated by family controlled companies. This situation will probably continue but we can ex- pect competition from new sources, companies completely new in the field. For some reason, this old in- dustry suddenly has glamour.

October 1, 1971 11

8

8

10

10