Page 17: of Maritime Reporter Magazine (December 1971)

Read this page in Pdf, Flash or Html5 edition of December 1971 Maritime Reporter Magazine

MarAd Announces

Research Program

On LNG Transportation

Plans for a research program to improve the competitiveness of

U.S.-flag vessels in the transporta- tion of liquefied natural gas have ! been initiated by the Maritime Ad- ministration.

The agency, according to Assis- tant Secretary of Commerce for

Maritime Affairs A.E. Gibson, has sent a letter to gas companies, na- val architects, shipbuilders, and other interested groups, requesting their ideas for the specific elements to be included in the effort.

From the responses, Maritime will develop a research program that will be carried out on a joint cost-sharing basis between indus- try and the agency. Maritime, Mr.

Gibson said, has allocated up to $1.2 million as its contribution to the funding. "The marine transportation of natural gas today," Mr. Gibson ex- plained, "is almost totally the out- growth of technology developed in other nations. LNG carriers which will be built and registered in the

U.S. using this technology will be competing with foreign-flag LNGs on their own ground. "Our goal is to develop a new

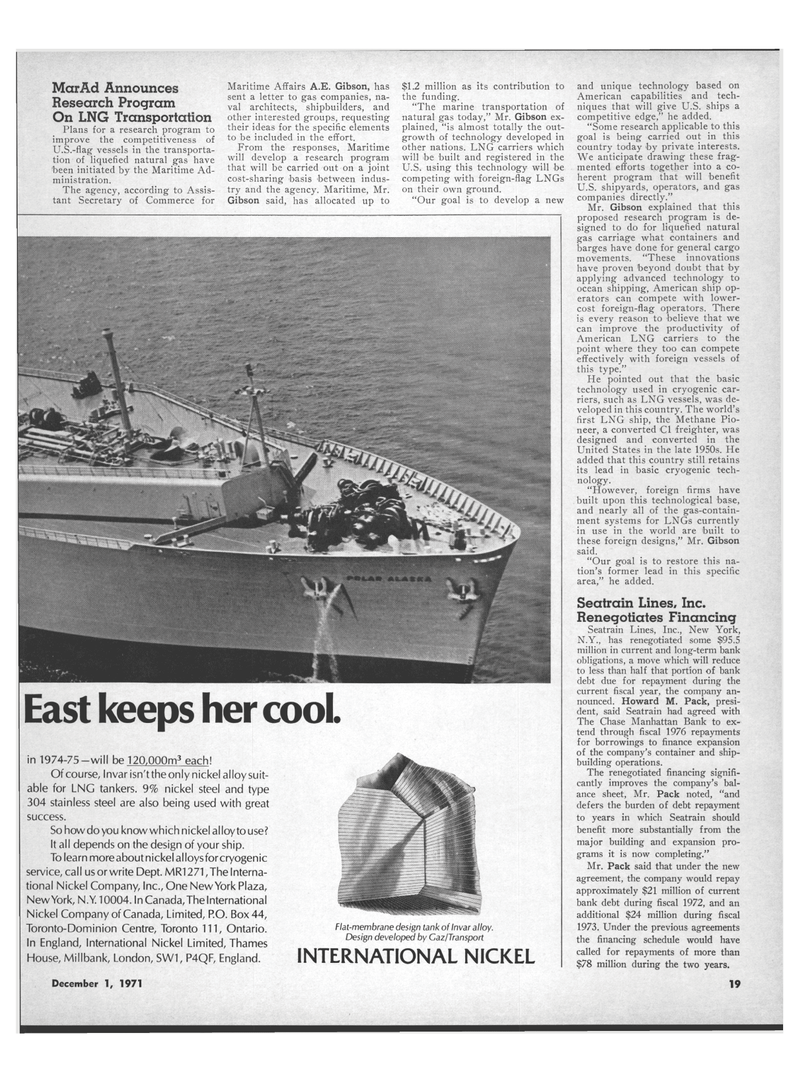

East keeps her cool. in 1974-75-will be 120,000m3 each!

Of course, Invar isn'tthe only nickel alloy suit- able for LNG tankers. 9% nickel steel and type 304 stainless steel are also being used with great success.

So how do you know which nickel alloy to use?

It all depends on the design of your ship.

To learn more about nickel alloys for cryogenic service, call us or write Dept. MR1271,Thelnterna- tional Nickel Company, Inc., One New York Plaza,

New York, N.Y. 10004. In Canada, The International

Nickel Company of Canada, Limited, P.O. Box 44,

Toronto-Dominion Centre, Toronto 111, Ontario.

In England, International Nickel Limited, Thames

House, Millbank, London, SW1, P4QF, England.

Flat-membrane design tank of Invar alloy.

Design developed by Caz/Transport

INTERNATIONAL NICKEL and unique technology based on

American capabilities and tech- niques that will give U.S. ships a competitive edge," he added. "Some research applicable to this goal is being carried out in this country today by private interests.

We anticipate drawing these frag- mented efforts together into a co- herent program that will benefit

U.S. shipyards, operators, and gas companies directly."

Mr. Gibson explained that this proposed research program is de- signed to do for liquefied natural gas carriage what containers and barges have done for general cargo movements. "These innovations have proven beyond doubt that by applying advanced technology to ocean shipping, American ship op- erators can compete with lower- cost foreign-flag operators. There is every reason to believe that we can improve the productivity of

American LNG carriers to the point where they too can compete effectively with foreign vessels of this type."

He pointed out that the basic technology used in cryogenic car- riers, such as LNG vessels, was de- veloped in this country. The world's first LNG ship, the Methane Pio- neer, a converted CI freighter, was designed and converted in the

United States in the late 1950s. He added that this country still retains its lead in basic cryogenic tech- nology. "However, foreign firms have built upon this technological base, and nearly all of the gas-contain- ment systems for LNGs currently in use in the world are built to these foreign designs," Mr. Gibson said. "Our goal is to restore this na- tion's former lead in this specific area," he added.

Seatrain Lines, Inc.

Renegotiates Financing

Seatrain Lines, Inc., New York,

N.Y., has renegotiated some $95.5 million in current and long-term bank obligations, a move which will reduce to less than half that portion of bank debt due for repayment during the current fiscal year, the company an- nounced. Howard M. Pack, presi- dent, said Seatrain had agreed with

The Chase Manhattan Bank to ex- tend through fiscal 1976 repayments for borrowings to finance expansion of the company's container and ship- building operations.

The renegotiated financing signifi- cantly improves the company's bal- ance sheet, Mr. Pack noted, "and defers the burden of debt repayment to years in which Seatrain should benefit more substantially from the major building and expansion pro- grams it is now completing."

Mr. Pack said that under the new agreement, the company would repay approximately $21 million of current bank debt during fiscal 1972, and an additional $24 million during fiscal 1973. Under the previous agreements the financing schedule would have called for repayments of more than $78 million during the two years.

December 1, 1971 19

16

16

18

18