Page 7: of Maritime Reporter Magazine (August 15, 1973)

Read this page in Pdf, Flash or Html5 edition of August 15, 1973 Maritime Reporter Magazine

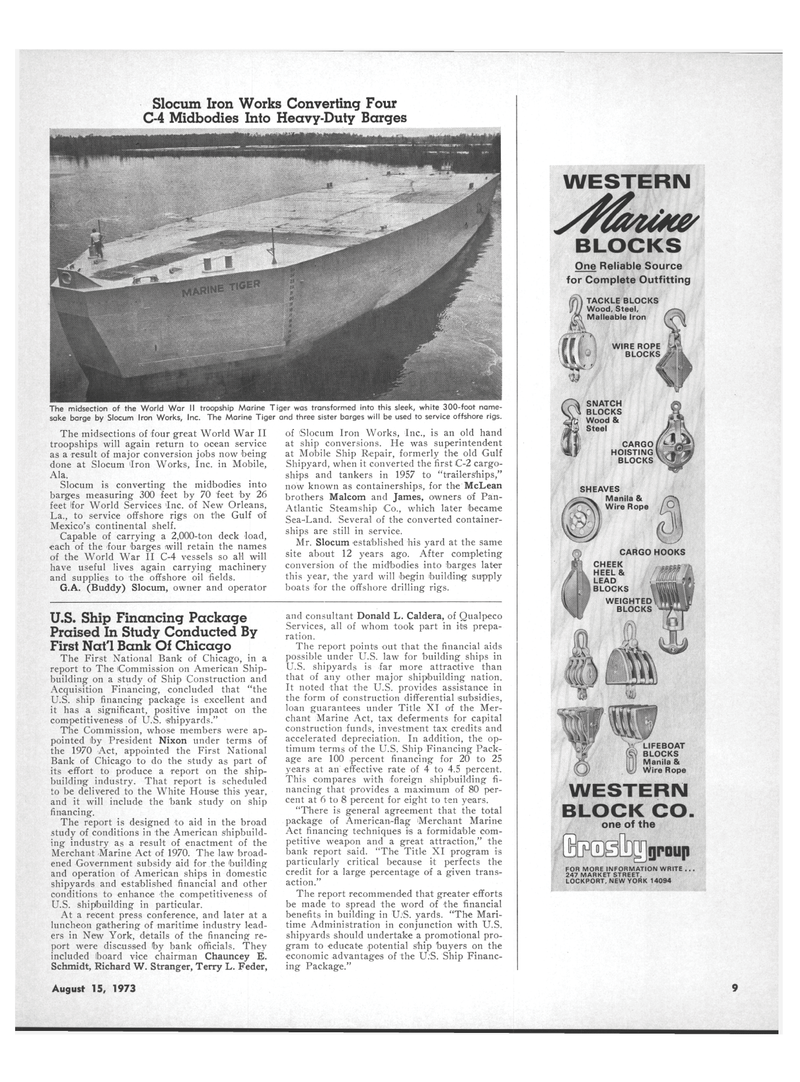

Slocum Iron Works Converting Four

C-4 Midbodies Into Heavy-Duty Barges

The midsection of the World War II troopship Marine Tiger was transformed into this sleek, white 300-foot name- sake barge by Slocum Iron Works, Inc. The Marine Tiger and three sister barges will be used to service offshore rigs.

The midsections of four great World War II troopships will again return to ocean service as a result of major conversion jobs now 'being done at Slocum iron Works, Inc. in Mobile,

Ala.

Slocum is converting the midbodies into barges measuring 300 feet by 70 feet by 26 feet Ifor World Services inc. of New Orleans,

La., to service offshore rigs on the Gulf of

Mexico's continental shelf.

Capable of carrying a 2,000-ton deck load, each of the four barges will retain the names of the World War II C-4 vessels so all will have useful lives again carrying machinery and supplies to the offshore oil fields.

G.A. (Buddy) Slocum, owner and operator of iSlocum Iron Works, Inc., is an old hand at ship conversions. He was superintendent at Mobile Ship Repair, formerly the old Gulf

Shipyard, when it converted the first C-2 cargo- ships and tankers in 1957 to "trailerships," now known as containerships, for the McLean brothers Malcom and James, owners of Pan-

Atlantic Steamship 'Co., which later became

Sea-Land. Several of the converted container- ships are still in service.

Mr. Slocum established his yard at the same site about 12 years ago. After completing conversion of the midbodies into barges later this year, the yard will begin building- supply boats for the offshore drilling rigs.

U.S. Ship Financing Package

Praised In Study Conducted By

First Nat'l Bank Of Chicago

The First National Bank of Chicago, in a report to The Commission on American Ship- building on a study of Ship Construction and

Acquisition Financing, concluded that "the

U.S. ship financing package is excellent and it has a significant, positive impact on the competitiveness of U.S. shipyards."

The Commission, whose members were ap- pointed iby President Nixon under terms of the 1970 Act, appointed the First National

Bank of Chicago to do the study as part of its effort to produce a report on the ship- building industry. That report is scheduled to be delivered to the White House this year, and it will include the bank study on ship financing.

The report is designed to aid in the broad study of conditions in the American shipbuild- ing industry as a result of enactment of the

Merchant -Marine Act of 1970. The law broad- ened Government subsidy aid for the building and operation of American ships in domestic shipyard's and established financial and other conditions to enhance the competitiveness of

U.S. shipbuilding in particular.

At a recent press conference, and later at a luncheon gathering of maritime industry lead- ers in New York, details of the financing re- port were discussed by bank officials. They included board vice chairman Chauncey E.

Schmidt, Richard W. Stranger, Terry L. Feder, and consultant Donald L. Caldera, of Qualpeco

Services, all of whom took part in its prepa- ration.

The report points out that the financial aids possible under U.S. law for building ships in

U.S. shipyards is far more attractive than that of any other major shipbuilding nation.

It noted that the U.S. provides assistance in the form of construction differential subsidies, loan guarantees under Title XI of the Mer- chant Marine Act, tax deferments for capital construction funds, investment tax credits and accelerated depreciation. In addition, the op- timum terms of the U.S. Ship Financing Pack- age are 100 percent financing for 20 to 25 years at an effective rate of 4 to 4.5 percent.

This compares with foreign shipbuilding fi- nancing that provides a maximum of 80 per- cent at 6 to 8 percent for eight to ten years. "There is general agreement that the total package of American-flag Merchant Marine

Act financing techniques is a formidable com- petitive weapon and a great attraction," the bank report said. "The Title XI program is particularly critical because it perfects the credit for a large percentage of a given trans- action."

The report recommended that greater efforts be made to spread the word of the financial benefits in building in U.'S. yards. "The Mari- time Administration in conjunction with U.S. shipyards should undertake a promotional pro- gram to educate potential ship buyers on the economic advantages of the U.S. Ship Financ- ing Package."

One Reliable Source for Complete Outfitting

TACKLE BLOCKS

Wood, Steel,

Malleable Iron

WIRE ROPE y

BLOCKS J/\

SNATCH

BLOCKS

Wood &

Steel

CARGO

HOISTING

BLOCKS

Manila &

Wire Rope

CARGO HOOKS

CHEEK ..TTS •

HEEL&

LEAD . ffiMJ

BLOCKS «

WEIGHTEDIIJHIJ BLOCKS ' LIFEBOAT

BLOCKS

Manila &

Wire Rope

WESTERN

BLOCK CO.

one of the Spssbgoroup

FOR MORE INFORMATION WRITE . . .

247 MARKET STREET,

LOCKPORT. NEW YORK 14094

August 9, 1973

13

6

6

8

8