Page 3: of Maritime Reporter Magazine (December 15, 1973)

Read this page in Pdf, Flash or Html5 edition of December 15, 1973 Maritime Reporter Magazine

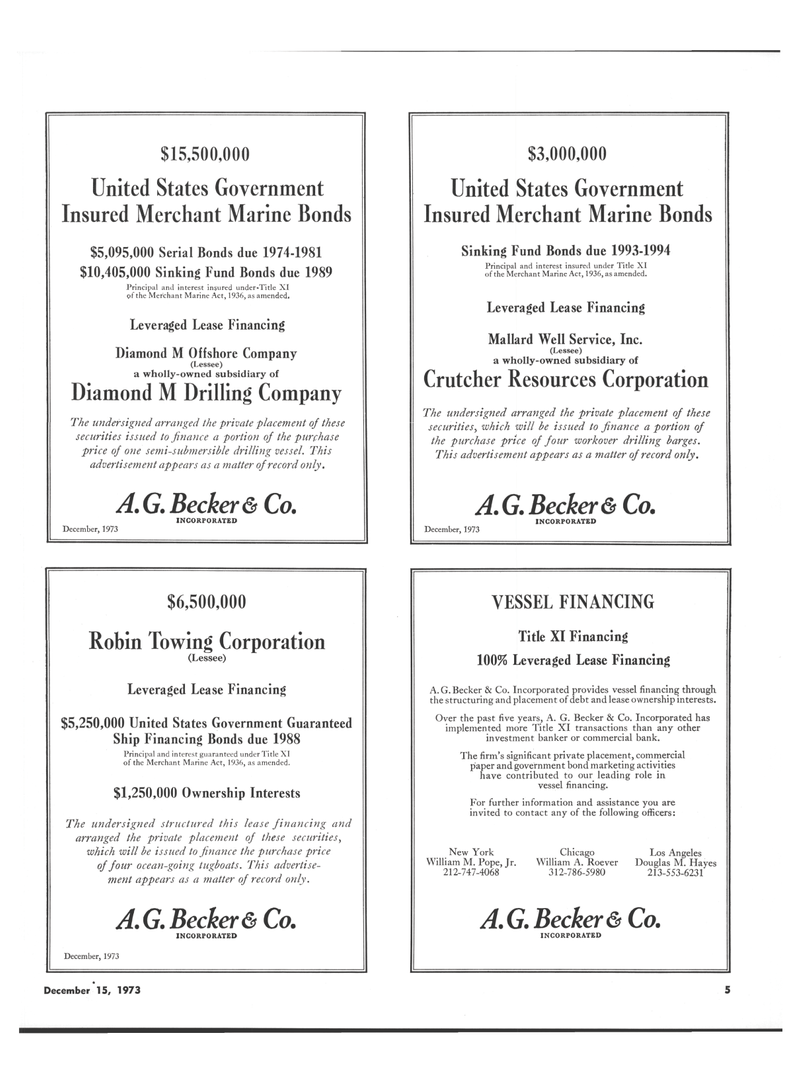

$15,500,000

United States Government

Insured Merchant Marine Bonds $5,095,000 Serial Bonds due 1974-1981 $10,405,000 Sinking Fund Bonds due 1989

Principal and interest insured under-Title XI of the Merchant Marine Act, 1936, as amended.

Leveraged Lease Financing

Diamond M Offshore Company (Lessee) a wholly-owned subsidiary of

Diamond M Drilling Company

The midersigned arranged the private placement of these securities issued to finance a portion of the purchase price of one semi-submersible drilling vessel. This advertisement appears as a matter of record only.

A. G. Becker & Co.

INCORPORATED

December, 1973 $3,000,000

United States Government

Insured Merchant Marine Bonds

Sinking Fund Bonds due 1993-1994

Principal and interest insured under Title XI of the Merchant Marine Act, 1936, as amended.

Leveraged Lease Financing

Mallard Well Service, Inc. (Lessee) a wholly-owned subsidiary of

Crutcher Resources Corporation

The undersigned arranged the private placement of these securitiesy which will be issued to finance a portion of the purchase price of four workover drilling barges.

This advertisement appears as a matter of record only.

A. G. Becker & Co.

INCORPORATED

December, 1973 $6,500,000

Robin Towing Corporation (Lessee)

Leveraged Lease Financing $5,250,000 United States Government Guaranteed

Ship Financing Bonds due 1988

Principal and interest guaranteed under Title XI of the Merchant Marine Act, 1936, as amended. $1,250,000 Ownership Interests

The undersigned structured this lease financing and arranged the private placement of these securities, which will be issued to finance the purchase price of four ocean-going tugboats. This advertise- ment appears as a matter of record only.

A. G. Becker & Co.

INCORPORATED

December, 1973

VESSEL FINANCING

Title XI Financing 100% Leveraged Lease Financing

A.G.Becker & Co. Incorporated provides vessel financing through the structuring and placement of debt and lease ownership interests.

Over the past five years, A. G. Becker & Co. Incorporated has implemented more Title XI transactions than any other investment banker or commercial bank.

The firm's significant private placement, commercial paper and government bond marketing activities have contributed to our leading role in vessel financing.

For further information and assistance you are invited to contact any of the following officers:

New York Chicago Los Angeles

William M. Pope, Jr. William A. Roever Douglas M. Hayes 212-747-4068 312-786-5980 213-553-6231

A. G. Becker & Co.

INCORPORATED

December 15, 1973 5

2

2

4

4